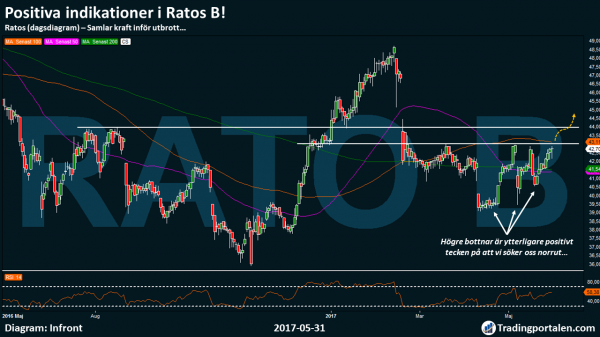

Ratos has after the big drop mid-February this year, experienced persistent attempts at recovery and the outbreak of heavy resistance level. There is, however, positive progressions, with three significant challenging in your back pocket just during the month of may. It looks now like we’re loading before the outbreak further north…

Get Minianalys Swedish Shares automatically to your e-mail every day before the stock market opens!

Ratos whose primary orientation is towards active and long-term holdings in unlisted companies, have started sending positive signals since the beginning of may.

Earlier in February, a little larger cases, in connection with that the company reduced the dividend. The dividend was reduced to 2 crowns evenly, from the previous 3.25 sek, and it was implemented as a result of helårsförlust according to the company’s ceo.

”The dividend policy says that the dividend should reflect the earnings in the Ratos, and on the full year, we do a negative result,” said the company’s ceo Magnus Agervald, who took office on 14 november 2016.

Ratos fell at the moment from sek 47 down to around 42 dollars a day. Then, we got a slightly further movement to the south after the consolidation.

Since the middle of april, however, sentiment shifted, and we have, in less than two months gained the majority of challenging of the heavy resistance level at 43 dollars.

We note also during this time that we got higher and higher bottoms, which in itself sends additional positivity. Also, the clear establishment that occurred over both the MA 50 and 200 broadcasting to further support the positive noises we are experiencing.

Ratos thus sending out signals that we now stands and concentrates, before the outbreak of the resistance level at 43 dollars. An outbreak over here, open not only up for a further rise, but we estimate that we will receive further fuel and substantially momentum when the resistance at the 44 kronor knocked out.

At just 44 sek awaiting the resistance, but at the same time, a rise to this level, mean that we managed to pass the MA 100, which is further expected to increase signal strength.

Preferably, a initial position is opened already at the establishment of the resistance level 43), which then increased with the establishment of the next resistance level at 44 kronor.

After the first trigger and the buy signal is triggered at 43.25 crowns, after the establishment of the resistance level 43 sek, followed by the 44 kronor, this opens up a rise to our målkurs 46.25 crowns. The emergency exit is placed, preferably already at 42.25 crowns.

On the basis of a longer-term perspective, there is scope for the rise to 48 bucks, but here we see an increased probability that the strength gains from the sales staff.

Shares traded just below the 100 day moving average, at the same time as a clear establishment recently revealed over both the short-term MA 50, but also long-term partner with the MA 200. On the basis of a much longer-term perspective, see also share out to find the land over the 12-month moving average.

Since the beginning of may, it has, inter alia, stated that the company disposes of a subsidiary Nebula to Telia for 165 million euro, with a exitvinst of sek 500 million. The deal requires the approval of the competition authorities, and is expected to be completed during the third quarter of this year.

Even Ratos subsidiary of Sophion Holding in a previous press release at the beginning of may indicated that it sells Sophion Bioscience to Sapphire Bioscience, a newly formed förvärvsbolag controlled by the Thais Johansen, president of Sophion Bioscience. The divestment is expected, however, not give any significant exiteffekt.

The stock is traded on the stockholm stock exchange, under the symbol RATO B.

Ratos

Entrance buy

43.25 kr

Ticker

RATO B

Målkurs

46.25 kr

Market

The OMXS Large Cap

Emergency exit

42.25 kr

P/E

NEG

Latest

42.70 kr

Direct avk.

4.7%