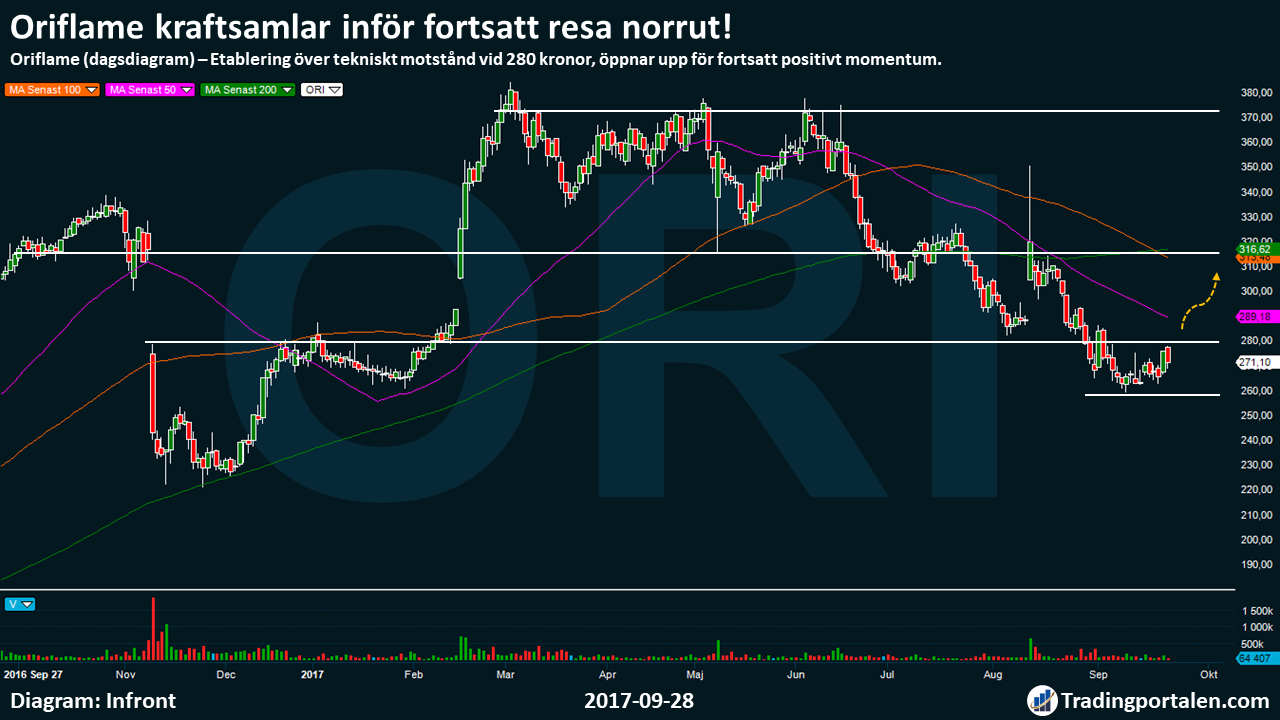

Oriflame has, since the year high at 380 crowns gone properly on the setback. The company’s share has painted a negative image, which bottomed out in september. The underlying positivity is experienced in the current focus, and we are now on the road to challenge the new heavy technical resistance, which points to a further trip to the north…

Get Minianalys Swedish Shares automatically to your e-mail every day before the stock market opens!

After a sharp decline since the year high in march, is now trading Oriflame around the same price level since the end of the year.

It was with the strong tag at the end of the first quarter We managed to step up to the 380 sek. Thereafter, continued consolidation within the 340 – 370 sek, and the majority of occasions were unable to find momentum enough for the outbreak.

A clear bottom has now formed around 260 sek, after the large decline since the summer, and the stock is now trading around sek 271.

We seem to experience the underlying positive attitude, we have sought us out higher up. Moreover, it looks like we will get a challenging of the heavy technical resistance at 280, which points to a further trip to the north, if we get a closing above that.

We still have a negative ‘ vapour, but despite this köpstyrka looked forward all the more, which further is considered to be a positive piece of the puzzle in the build-up, which now is experienced.

A köpläge is thus seen around 280 or, alternatively, a small initial position today.

Målkursen lands at the technical resistance at sek 315, whereupon a smaller resistance can be experienced already at 300 sek. If an initial position is already in the current situation, it might be worth folded down around this price level.

In a case in which the parameter occurs again, we limit such a decline, we tentatively place a stop loss already at 270 sek, alternatively to sek 260, if an initial position is taken already today.

On 20 september, Oriflame an extra boost from the challenging of technical support at 260 crowns, in conjunction with the Business community highlighted that the share ”suffered a large decline from the high for the year. Too much…”.

The stock is traded on the stockholm stock exchange, under the symbol ORI.

Oriflame Holding

Entrance buy

280.00 kr

Ticker

ORI

Målkurs

315.00 £

Market

The OMXS Mid Cap

Emergency exit

270.00 kr

P/E

18.9

Latest

271.10 usd

Direct avk.

5.1%

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about technical analysis:

- Common concepts in technical analysis

- Moving averages – lagging indicator, which filters out the noise

- MACD – technical indicator, which fits well into the trends

- RSI – a classic momentumindikator that is a ”must” in swingtrading