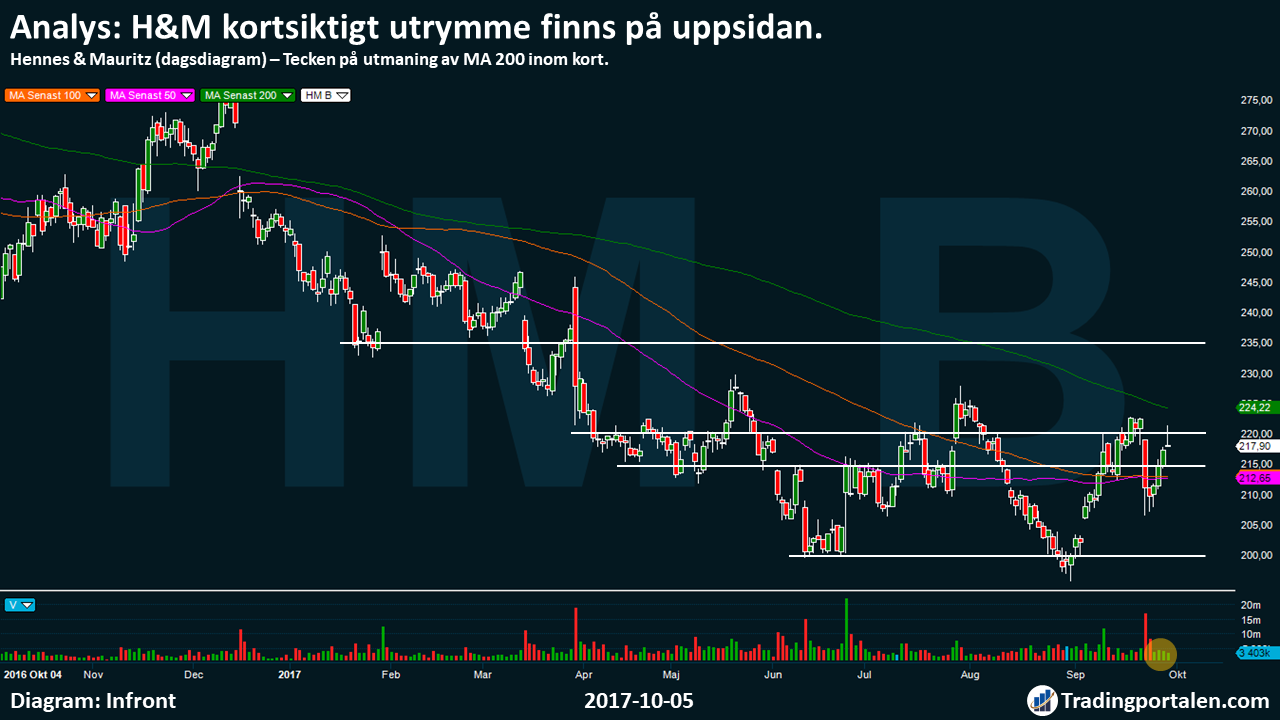

Klädbolaget Hennes & Mauritz launched the month of september in positive progressions. A clear balancing act has been going on in the 215-220 crowns, and underlying momentum is pointing at the outbreak of the further the rise. Short-term space, on the upside, low-risk vs. reward…

Get Minianalys Swedish Shares automatically to your e-mail every day before the stock market opens!

H&M has during the current year had a bitter journey, and declined more than -14% since the end of the year.

The company’s stock has gone from trading around sek 275 the end of 2016, to bounce at around 200 sek the beginning of september.

Everything from sales figures have been under the expectation, that the sales concerned, and more of a sign of strength on the products from the competitors, raises concern among investors.

After the previous short trade below the MA 50 and 100, see it now rather looks as if we charge for the new tag, yet short of such.

If H&M only manage to stuck at around 220 sek, by especially close over this price level, to believe that we can come to have a serious challenging of the 200-day moving average.

A köpläge step forward in such a location at 220 sek, whereupon we see a rise to our målkurs 235 crowns possible. A so-called case of low-risk versus reward.

During the course of the journey we need to succeed, however, take a step above the MA 200, otherwise the risk is that we will bounce back to 220 kronor. In such a situation would further weakness also worry, of which the stop loss suggested can be placed at 215 sek, as the risk then increases significantly for a decline to the support area at around 205-200 crowns.

H&M secretly started up rapportsäsongen the 28 september, by reporting an operating profit of 4.939 million for the third quarter of the split financial year 2016/2017.

Expectations according to analytikerkåren lay on an operating income of approximately 4.901 million, while gross margin that came in at 51.4 per cent were below the expected 51.6 per cent.

In conjunction with the report, it was revealed at the same time that the company seen a “slight slowdown” in sales at the end of september, while the fall collection was a good start after the summer’s “aggressive summer sales”.

The company’s shares are traded on the stockholm stock exchange, under the symbol HM B.

Hennes & Mauritz

Entrance buy

220.00 £

Ticker

HM B

Målkurs

235.00 £

Market

The OMXS Large Cap

Emergency exit

215.00 kr

P/E

19.9

Latest

217.90 £

Direct avk.

4.5%

Click on the link for more information about ”Focus, strategy and ansvarsbeskrivning”

Upcoming course

“Learn to support Yourself on Your Trading – a complete three-day course!” – see the next course!

More about technical analysis:

- Common concepts in technical analysis

- Moving averages – lagging indicator, which filters out the noise

- MACD – technical indicator, which fits well into the trends

- RSI – a classic momentumindikator that is a ”must” in swingtrading