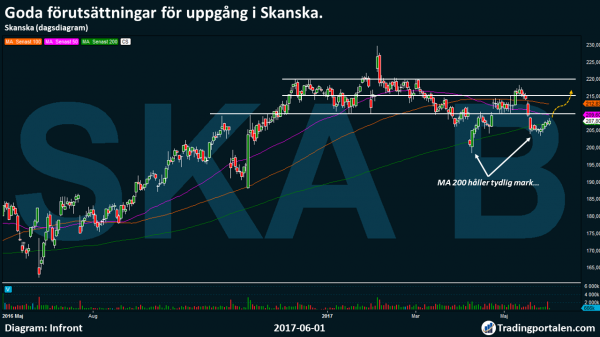

Construction company, Skanska will continue to search for themselves slowly but surely to the north. Share will also continue to be balanced at the 200 day moving average since may 18. After the fall from the year high in the beginning of February, we note now also that the sales force does not find the real momentum in the last few weeks, which is sending good signals for the upswing in the future…

Get Minianalys Swedish Shares automatically to your e-mail every day before the stock market opens!

The Swedish construction company Skanska has since the decline from the high for the year at 230 kronor in the beginning of February of this year, slowly but surely moved to the south.

After we reached the year low on april 6, at 198.50 crowns, we have, however, found köpstyrka that brought us back to a positive path to the north.

Clear balanspunkter with the historical high volume, has meant that we have moved any cyclist the north as we found the establishment of the technical key levels.

We now since 18 may experienced a significant balancing at the 200-day moving average, in conjunction with the sales force also not found momentum in recent weeks bodes well for the future.

Sure, we got a brief jolt to the downside earlier in may. It, however, we see that a brief anomaly in the context of the political turmoil prevailing in the united states, which are to a certain base that we now see an attractive köpläge.

We see a köpläge already today, in tune with the underlying positivity that prevails. However, you have to keep an eye on 210 crowns, which we take every closer step received.

Although we expect a certain amount of resistance at 210 crowns, we look primarily to heavier resistance levels at 215 followed by heavy 220 sek, which listed the highest volume last year, will give more impression.

Målkursen lands on 220 kronor, just under the high for the year.

Would weakness, however, come to light, we keep an extra eye on if we get a negative divergence from the MA 200. Possibly would a trigger be able to be to the previously announced investments in the infrastructure in the united states from the Trump not succeed. However, we see that this in such a case should come later in the time horizon, and not affect the current underlying positivity.

The shares are also traded just below the slightly shorter medeltalsvärde as MA 50 and 100, which looks to provide an indication to now start pointing northwards, similar to the long-term MA 200 do at present.

From the news feed, the end of may, we note, among other things, Skanska received an order in Helsinki hosts about 360 million to build 189 apartments.

Skanska also go out and invest 440 million in the first phase of the office complex Brama Miasta in Lods, Poland, according to a press release.

In a press release on 24 may, it was also to Skanska’s former head of Skanska USA Civil, Rich Cavallaro is ceo of the business, thus leaving his current responsibilities for the us construction. Thus he is replacing current chief Mike Cobelli, who instead go into a senior rådgivarroll instead, to support the work of strengthening profitability in the united states Civil.

The stock is traded on the stockholm stock exchange, under the symbol TO B.

Skanska

Entrance buy

207.80 kr

Ticker

SHOULD B

Målkurs

220.00 £

Market

The OMXS Large Cap

Emergency exit

204.00 kr

P/E

12.3

Latest

207.80 kr

Direct avk.

4.0%