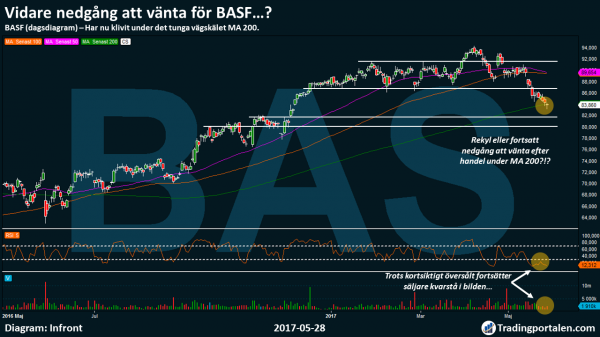

German chemicals group BASF, which is one of the world’s largest kemikalietillverkare, stepped on Friday during the heavy fork 200 day moving average. In the short term, the stock is oversold then a few days back, but the question is whether this is enough for a rebound, or if further decline is to be expected…

Get Minianalys Swedish Shares automatically to your e-mail every day before the stock market opens!

The German chemical company BASF was founded in 1865 and has its headquarters just to the south of Frankfurt in the German city of Ludwigshafen. With over 100 000 employees worldwide, is the company one of the world’s largest kemikalietillverkare.

Like the majority of the shares on the stock exchange in 2016, a year that was a clear trip to the north. For BASF, it meant a trip to the north with over 50% of the rise.

The first quarter of the current year was hardly any exciting movement, with a clear sideways trading. However, we got a jolt just at the end of the first quarter which meant that we stepped over the resistance level at eur 92. Subsequently, the achieved share price year high at 94.50 euro, only 3 euro from an all-time high.

Then have we got a trip to the south, which has meant that we not only ruled out a technical nyckelnivån at 92 euros, then 87 million which was a form of the bottom of the sideways trading that we have experienced. After Friday’s trading, the share price closed even during the long-term fork in the road as the 200-day moving average.

We closed below the MA 200 now opens up for a potential trip in the south, initially for a challenging of the support level at 82 euros, then await the next support level at 80 euros.

We note, however, that we are in a short term oversold position purely technical, where sellers had the upper hand in the last three trading days. In the short term this can open up for a possible rebound, back above the MA 200 which is currently quoted at € 84.

Sellers have not only had the upper hand during the last three trading days, but the stock has also closed on the minus the past three weeks.

However, we note a slightly lower sales force during the previous week as a whole than in the past two weeks, which in itself could be a possible positive signal for a rebound.

On the basis of a longer-term perspective, we note also that the share closed the previous week in the a little more long-term 40-week moving average for the first time since soon one year back, at the same time as the share is only traded 2 million from the really heavy long-term partner 12 month moving average.

BASF

Ticker

BASE

Latest

€83.86

Market

Xetra

P/E est. 2017

15.84

Direct avk. est. 2017

3.72%

Our conclusion is that we wait and see if a clear establishment under MA 200 is, in order to possibly get to see a challenging of the support level at 82 euros, which would be able to open up for a potentially challenging the next level of support and sentimental heltalsnivå at 80 euros.

In the short term would a rebound back, and the establishment of the MA 200, open up to new positive attitude, which very well may mean a challenging of the resistance level at 87 euros in the long term.

The shares are traded on Xetra, in symbol BASE.