No tree grows to the sky and no apple tree hangs fruit forever. Apple stock has thrived well since lågpunkten in may last year and although the seasons are easier to assess in real life than on the stock exchange, it feels increasingly as the temperature has begun to fall in a suspicious way. Time to put teeth into the Apple in the cards?

Get Minianalys Shares Global automatically to your e-mail every week!

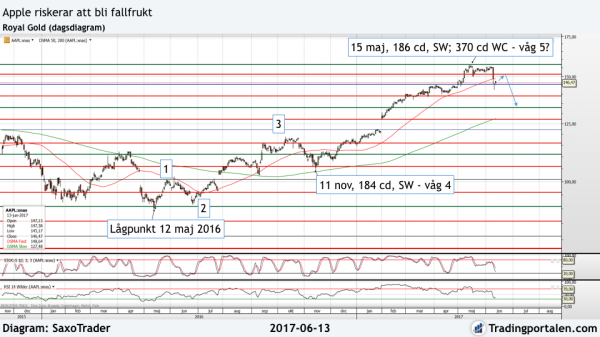

Apple took note of a lågpunkt 12 may 2016, before the shares took off and began to rise. Now, retrospectively, we can conclude that it is likely to have been the case if an impulsive rise in Apple shares since the bottom. And as we know, so moving a positive trend in five waves, three up and two recoils between the three uppvågorna. From lågpunkten in may, it gives us two scenarios. A which indicates that the positive trend is to single and the one that tells us that it probably is time for a little more recoil, even if the larger trend would appear to remain positive.

In the picture below you can see the negative scenario, which also fits into our tidscykler in the top 15 may in the year. The fact is that it is more or less perfect based on a negative interpretation.

When it comes to the price, Apple began to rise from the 90 dollar level, the top 15 may in the year came in at close to 157 u.s. dollars or 180 degrees on the Gann wheel. Overall, this gives pretty clear signals of a clearly elevated risk to owning Apple at the moment, in any case, in the medium term.

We are looking at the daily oscillators in the Apple gave the powerful negative disparities before the release came in last week.

Apple (daily chart)

There is nothing positive to say? In a positive interpretation, has the Apple share price recently completed a third wave on the upside, a phase that should be followed by a rebound that should take some time to work out. The day Apple closes above 157 dollars, we can take a view against 183 dollars, which will be the next time-stamp. However, this has not happened, and next this signal is in place or we get other positive indications of a turnaround so, Apple should be regarded with suspicion.

Before rushing, go, and sell the cards you should keep an eye on the 30-day rule. This rule says that a negative trend needs to be confirmed with a lower peak of a calendar month or more after the last top. This time zone is active from today, tomorrow and the day after tomorrow. So a little hesitant strength and a new break of our Gann support at 146 dollars is the signal to short Apple with a price target in the first place 133 dollars. Stops can be placed at 150 dollars.

The more aggressive the shopkeeper can of course take their chances already on the current strength, ideally the turn in this case, Apple is down from the $ 150 level. You can customize then stops. In the matrix below, we have specified milestones for the more conservative way to act.

Apple – an overview

Entrance sell

$146.00

Ticker

AAPL

Målkurs

$133.00

Market

The Nasdaq

Emergency exit

$150.00

P/E (est 2017)

16.2

Latest

$146.43

Direct avk. (est 2017)

1.7 %