[Article published at 7: 50 and updated at 12pm]

Resistant. Despite historically low interest rates since march 2016, the Agricultural Credit has recorded strong results in the second quarter, above expectations, including in its business of retail banking, the most affected by this interest-rate environment, which clamp its interest margins. The publicly listed entity, Credit Agricole sa (CASA), has achieved a net profit of € 1.3 billion, up 17%. Excluding exceptional items, including the gain of 176 million euros on the sale of securities Eurazeo in June (family Decaux for 790,5 million euros), the increase in the result of “underlying” is the same of 43.4%, to 1.17 billion euros, “thanks to good growth in revenues and especially, a good control of costs,” stresses the bank in its press release.

“This is the best quarter of Credit Agricole sa since 2011, knowing that at the time the income included 25% of the income of the regional banks”, pointed out Philippe Brassac, the general director of CASA, during a conference call.

The Crédit Agricole group has conducted in the last year in a major reorganization of its capital : the 39 regional banks have bought back the 25% that CASA had in their capital, in a transaction to 18 billion euros.

[Revenue and net income, group share of Crédit Agricole S. A. by a pole in the first half of 2017. Local bank = LCL]

“Good harvest”

The green Bank welcomes a “strong commercial momentum in all business and distribution networks of Credit Agricole sa and the regional banks”, which reflects “a better economic activity in the european markets.” That said, the net banking income (NBI) of the funds shows a decrease of 4.1% underlying, reflecting the lower interest margins.

“Good harvest despite challenging weather conditions” sum up the analysts from broker Jefferies on Thursday in a note to clients.

On the other hand, the LCL seems to be handed aplomb : the retail banking increased 1% to its revenue of 912 million euros, thanks to higher commissions, and 40% of its net profit to 186 million euros in the quarter. Outstanding real estate loans grew by 10.6% in one year, those credits at the pros and companies of 11.9%.

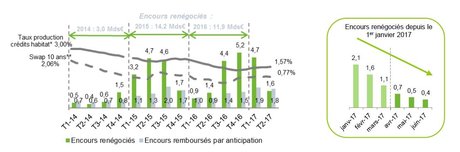

“The wave of early repayment of the loans, which is very important in 2015 and 2016, largely calmed down and has returned to near normal, with a rate of 400 million per month,” pointed out Jérôme Grivet deputy director-general of Casa, in charge of finance.

The group announced that the COMPANY was in exclusive negotiations (with potential buyers undisclosed) in order to assign the Bank Thémis, specialized in banking services for companies in difficulty, procedures or collective agreements.

Loans jumbo and funding “green”

Farm credit wishes to the contrary still achieve the acquisition of three small regional banks in Italy, where its subsidiary, Cariparma has witnessed “a significant growth of its revenues and its results”. The cluster of retail bank international, however, has been penalized by the devaluation of the egyptian pound.

The business hub of markets (“Major clients”), and the second in terms of contribution to the profit after the management of savings and insurance, has had a good quarter, particularly in the fields of interest rate, exchange rate and credit, “in spite of the customer flow down in a market in a wait-and-see, and a volatility low,” as had been the highlight of the Société Générale Wednesday, compared to second quarter 2016 very strong. A base effect that has also affected the activity on the equity markets, a decrease of 11%. Credit Agricole welcomes, however, a “good performance of the advisory activities of the investment bank” where he ranks fourth advice, mergers & acquisitions in France, with 24 transactions.

While some of the european banks, british, swiss or German, give ground, after having reduced the scope, the context is favourable to market share gains. Thus, the subsidiary CACIB was “on the quarter, world no. 2 emission jumbo in all currencies”, these bonds of over a billion, with a market share increase of 1.6 percentage points to 9.1%, and # 4 global syndicated loans in the Europe-Middle East-Africa. The green Bank also boasts to be “no. 1 in the world all currencies in financing green”, as a bookkeeper emissions of “green bonds”, with 23 transactions, according to Thomson Financial.

Action Credit Agricole sa lost, however, over 1.5% this morning (Thursday) in the early exchanges. 12h, it erased its losses and is stable. The title has earned more than 94% in one year.