Key Points

- Shares RV maker Winnebago tumbled on Wednesday as sales beat estimates on weak demand and price cuts.

- The RV market was hit by rising interest rates interest and inflation.

- CEO Michael Happe said the company faced “challenging market conditions”.

Winnebago Industries (WGO) shares fell 2% in early trading Wednesday, as the recreational vehicle (RV) maker reported weaker demand and price cuts that hurt sales.

Winnebago reported third quarter revenue from fiscal 2023 plunged 38.2% to $900.8 million, well below analyst estimates. Earnings fell nearly in half to $2.13, although that beat expectations.

The company said it had lower unit sales “related to RV retail market conditions and higher rebates and allowances compared to the prior year.”

Revenues from its recreational vehicles towables fell by 52.3%, while those for motorhomes fell by 27.5%. Winnebago's marine segment recorded a 1.9% increase in sales.

Demand for VR has dropped because of rising interest rates and high inflation. CEO Michael Happe said the company was facing “challenging market conditions”. He added that Winnebago has benefited from its highly variable cost structure and the way it proactively manages selling, general and administrative (SG&A) expenses.

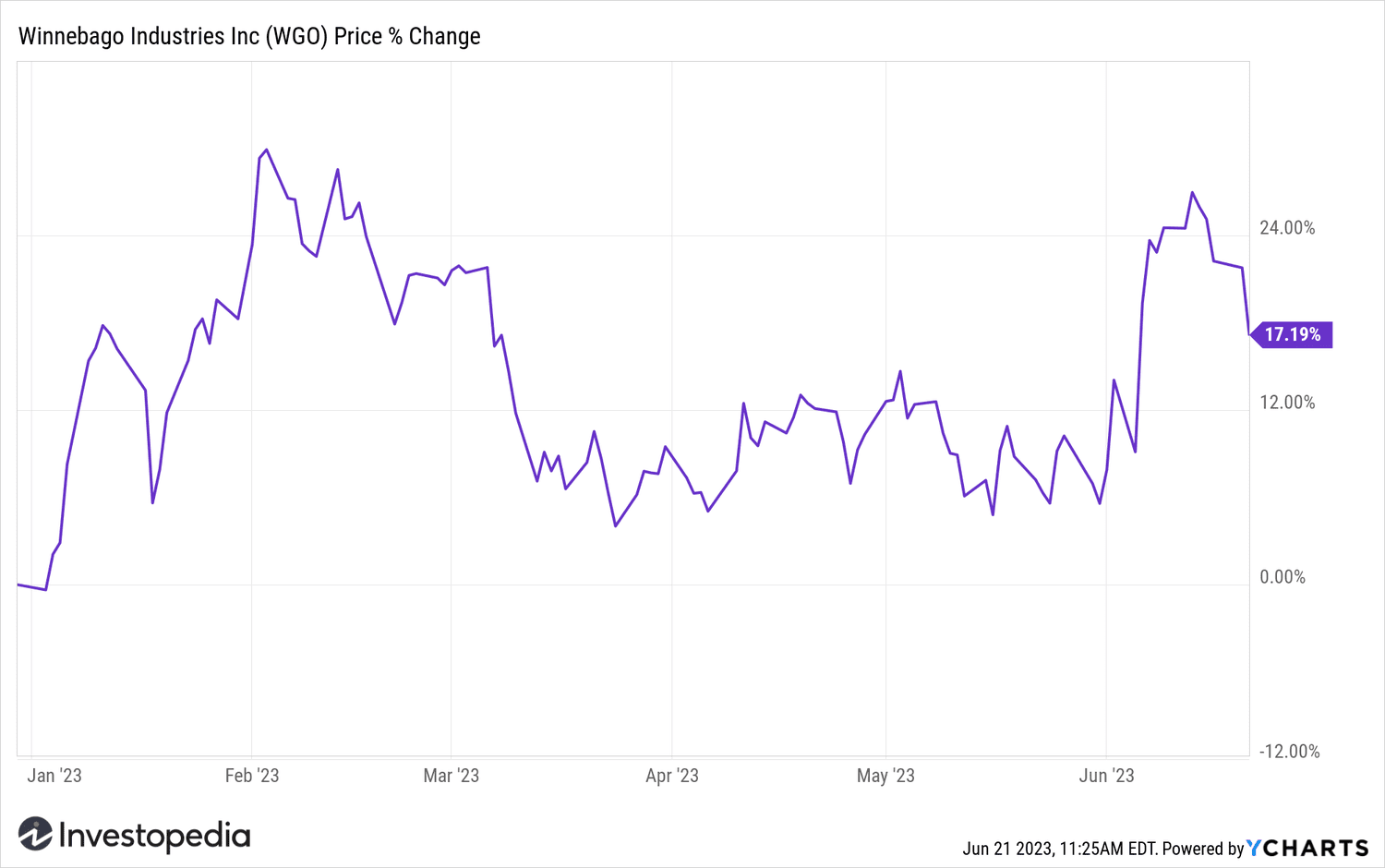

Winnebago Industries shares have slipped to their lowest level in more than two weeks following the news.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com