Trending Videos

Takeaways

- Choice Hotels International Inc. has launched a hostile takeover bid for Wyndham Hotels & Resorts Inc. after Wyndham turned down Choice's previous offer.

- Choice Hotels said the deal would give Wyndham shareholders $49.50 in cash plus common stock of Choice and other financial incentives for each share they held. .

- Wyndham's board previously rejected the proposal, arguing it was a “step backwards.”

After its friendly offers were rebuffed, Choice Hotels International Inc. (CHH ) launched a hostile takeover bid for Wyndham Hotels & Resorts Inc. (WH).

The operator of the Comfort Inn, Radisson and other hotels announced Tuesday that it would submit its “compelling proposal directly to Wyndham shareholders.”

What choice does Wyndham

Choice Hotels said it is offering investors $49.50 in cash and 0.324 shares of Choice common stock for each Wyndham share they own. Based on the closing price of Choice Hotels stock when the company first proposed the purchase on October 16, this would equate to a total of approximately $90 per share, or a 30% premium over the price of $69.10 that Wyndham stock commanded then.

Additionally, the proposal includes a regulatory “ticking fee” to compensate for bid delays of 45 cents per Wyndham share per month, or the equivalent of $38 million per month, 39; accumulating daily starting one year after the majority of Wyndham's shares were tendered to the offering. With these figures, analysts estimate the value of the transaction at around $7.8 billion.

Choice also disclosed that it owns 1.5 million shares of Wyndham valued at approximately $110 million.

Choice Hotels does not is this not ? t Accept no for answer

Choice Hotels said that on November 14, it proposed exactly the same deal, in addition to offering Wyndham two seats on the combined company's board of directors. A week later, Wyndham's board rejected it, calling the proposal a “step backwards” and not in the best interests of shareholders.

Patrick Pacious, CEO of Choice Hotels, said the company would have preferred to reach a negotiated agreement, but “the Wyndham board's refusal to explore a transaction left us with no options.” other choice than to present our proposal directly to Wyndham shareholders.”

If approved, the #39;merged company would have more than 16,000 properties worldwide. Choice Hotels said the offer will expire on March 8, 2024, unless extended or terminated.

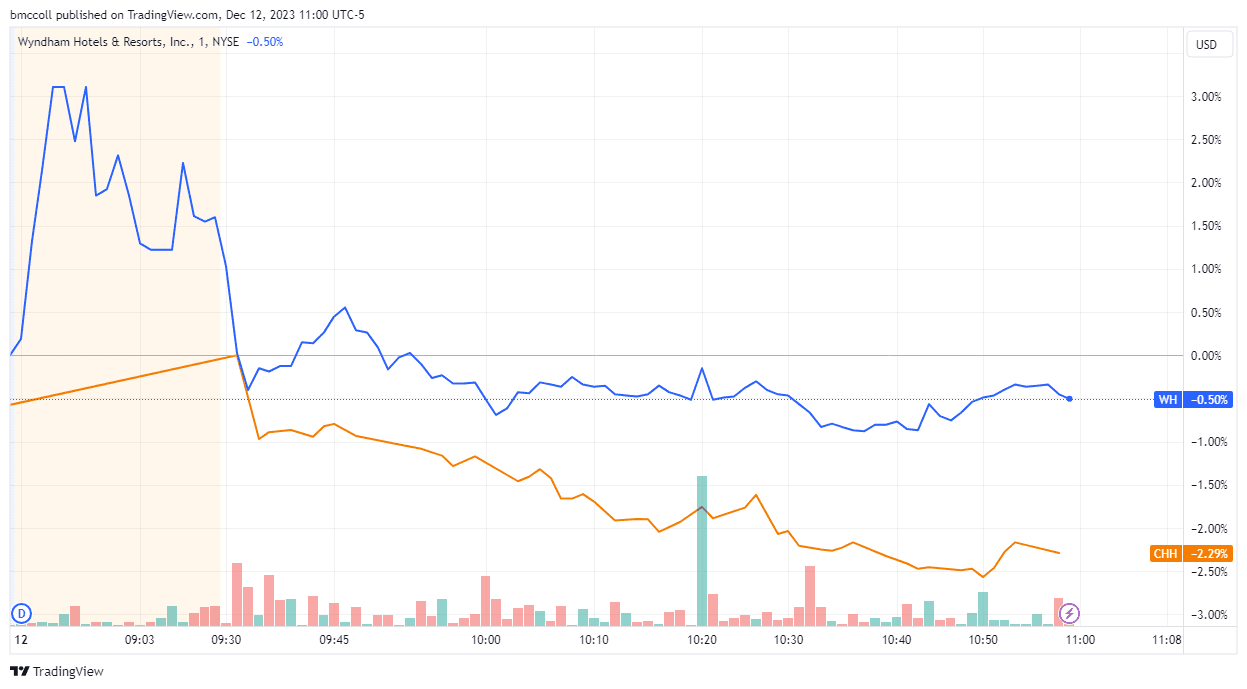

Shares of the two Wyndham hotels and ; Resorts and Choice Hotels International fell Tuesday after the offering was announced.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com