The reluctance of workers to return to the office is The checkerboard financial track record and sizable losses led flexible workspace provider WeWork (WE) to express in a regulatory filing on Tuesday “substantial doubt” about its ability to stay in business. Shares of the company fell 26% in early trading on Wednesday.

KEY POINTS

- WeWork has raised concerns about its ability to remain in business in an SEC filing.

- The company posted net losses of $0.7 billion in the first six months of the year, with negative cash flow from operating activities of $0.5 billion. /li>

- Stocks fell 26% in early trading on Wednesday.

Lights out for WeWork?

WeWork suffered losses of 0.7 billion dollars and negative cash flow from operating activities of $0.5 billion for the first six months of the year.

Its annual net losses were $2.3 billion, $4.6 billion, and $3.8 billion in 2022, 2021, and 2020, respectively, and its corresponding negative cash flow from operating activities were $0.7 billion, $1.9 billion, and $0.9 billion, respectively, for the same periods.

In 2019, WeWork's first publicly announced offering (IPO) plans were upended as it had already posted net losses of over $900 million for the first six months of 2019 on revenues of 1. $54 billion. But its members had also jumped 90% from the previous year to 527,000.

In its latest financial statements, the company admitted its membership this year had been less than expected. Its ability to stay in business largely depends on whether membership agreements are renewed or not.

While the company still has many large commercial buildings around the world, the increase in remote working due to the pandemic and economic weakness has increased WeWork's debt while limiting cash flow.

Other than increasing revenue through membership, WeWork could remain a going concern by limiting capital expenditures and seeking capital through debt or equity issuance.

Once A Wall Street Darling

Disrupting the rigid office real estate market by providing flexibility, WeWork was once valued at $47 billion by Japan's SoftBank in 2018.

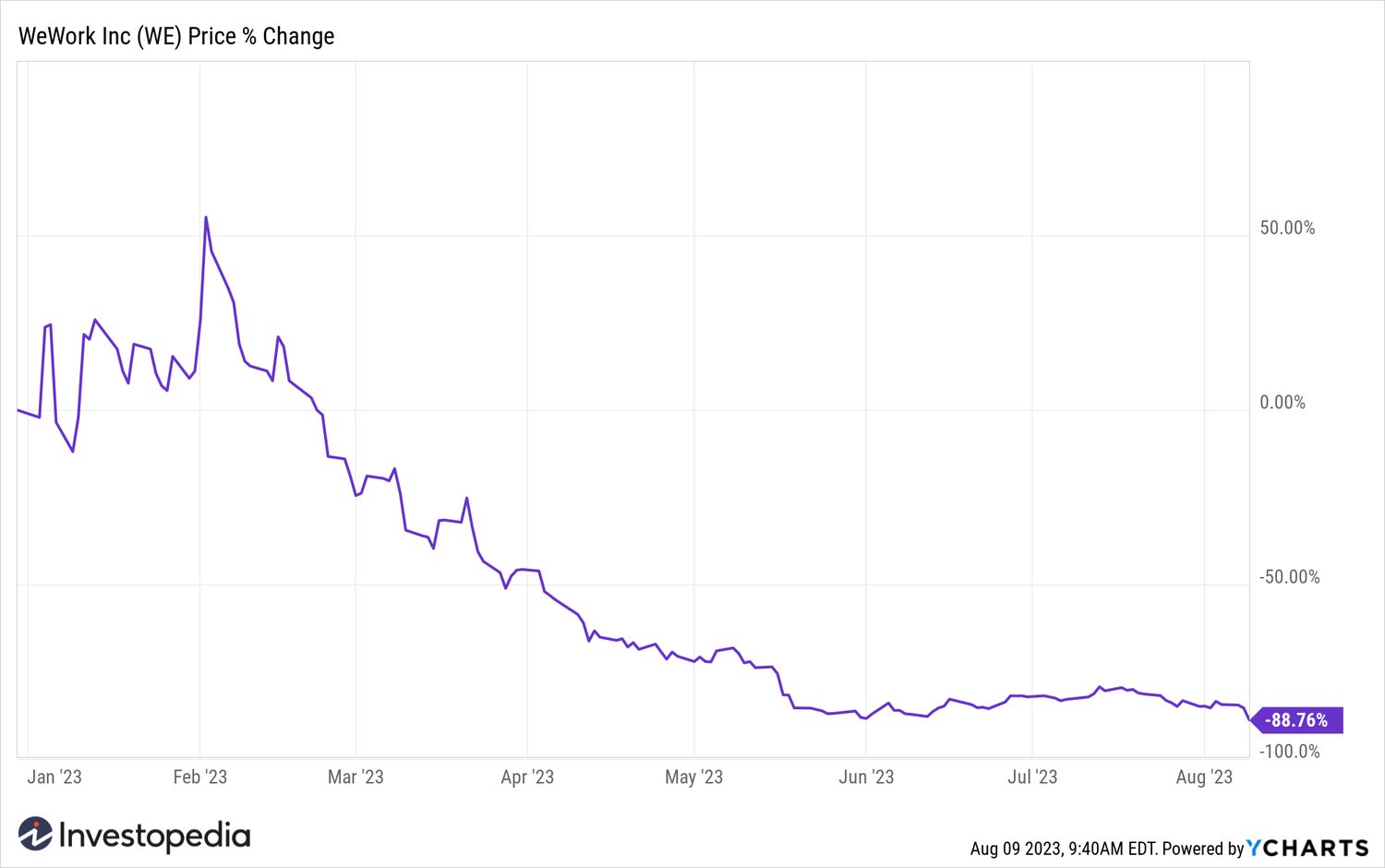

The company has had a humbling journey, from a Wall Street darling to the edge of the #39;collapse. Even though its 2019 IPO was put on hold, WeWork went public via a merger with a Special Purpose Acquisition Company (SPAC) in October 2021, with its shares reaching an all-time high of $14.97. . WeWork shares are currently trading at around 15 cents per share and have lost more than 88% of their value since the start of the year.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com