WW International, Inc. (WW) the stock has increased by more than 10% during Wednesday’s session after Jefferies upgraded the stock to Buy with a $32.00 per share price of the target. Analyst Stephanie Wissink estimated that the COVID-19 epidemic has unlocked a “sustainable trend” as consumers prioritize the well-being. It believes that established brands with modern platforms and resources to cultivate the relationship to customers are best placed to take advantage of these trends.

At the end of April, WW International reported a narrower than expected first quarter loss and a 9% increase in the number of subscribers. The company reported a negative impact on the recruitment and studio closures as of mid-March, but reiterated its strong liquidity position and a new $ 100 million cost savings initiative.

Oppenheimer’s Brian Nagel has noted that the retention has remained strong and continues to follow more than 10 months after the financial results for the first quarter. Nagel believes that weight Watchers is planning a marketing campaign more aggressive over the next few weeks, to the address of COVID-19 environment.

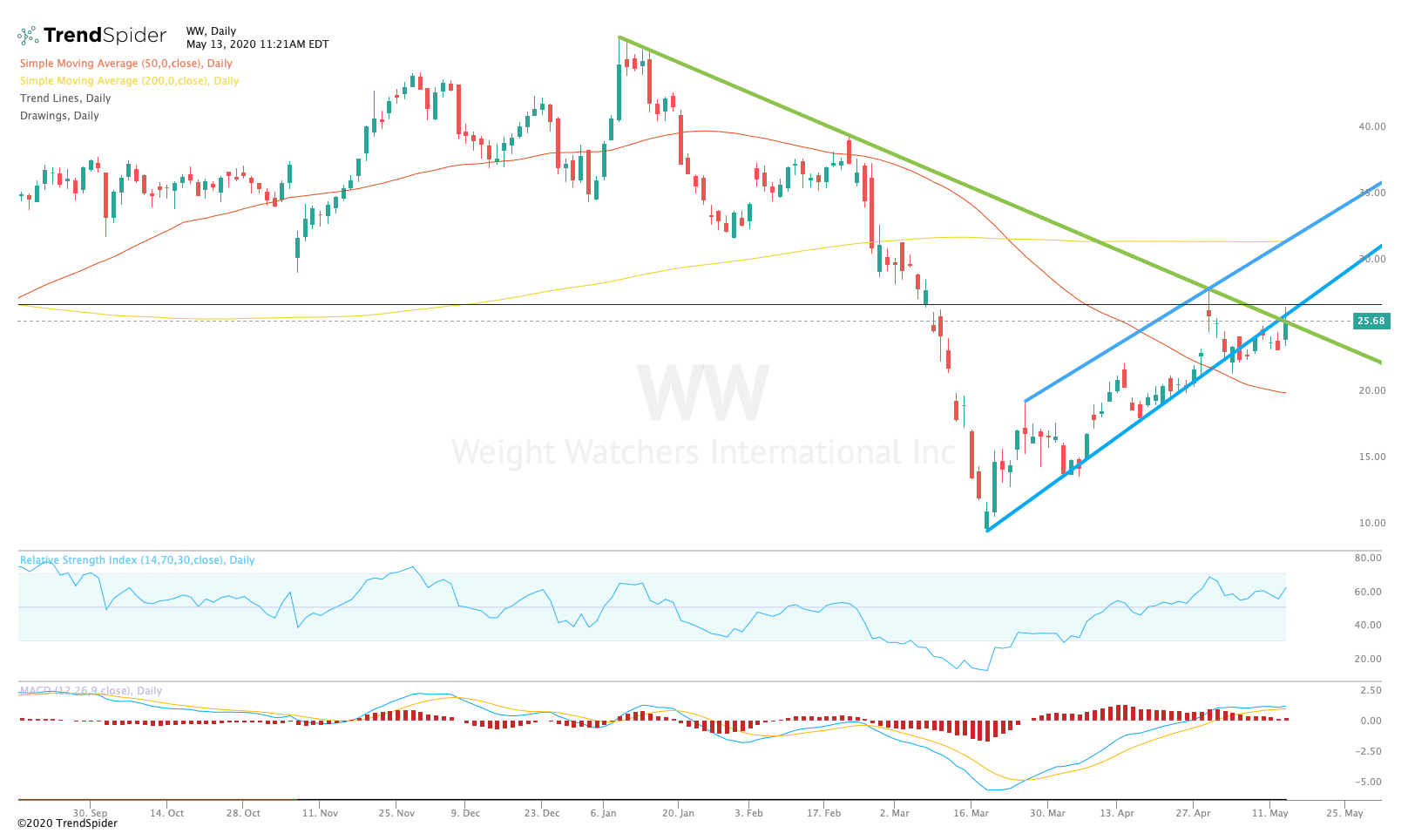

TrendSpider

From a technical point of view, the stock has climbed since mid-March and rapidly approaching the reaction highs of near $28.00. The relative strength index (RSI) is moving towards the overbought territory with a reading of 63.08, but the moving average convergence divergence remains strong. These indicators suggest that the stock still has room to run.

Traders should watch for a breakout of the reaction highs of near $28.00 towards the 200-day moving average of $31.72 during the next sessions. If the stock breaks out from these levels, it could retest reaction highs of near $40.00. If the stock breaks down, traders could see a move towards the 50-day moving average of $20.23 on the medium-term.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com