Walmart Inc. (WMT) shares rose more than 1% during Monday session after UBS upgraded the stock to Buy with a $135 price target, reflecting a 13% premium to Friday’s close. UBS analyst Michael Lasser is bullish on the retailer is the improvement of the productivity of the loop, the increase of e-commerce at scale, and accelerating the deployment of technologies. He is also optimistic about the Walmart health care ambitions, the advertising traction, and success in key emerging markets such as India.

Guggenheim analyst Robert Drbul also raised its price target from $140 to$ 145, while reiterating its Buy rating. The analyst remains comfortable with an above-consensus EPS estimate of six bi-monthly surveys. In addition, it is estimated that Walmart’s omni-channel strategy will produce strong growth.

Walmart shares have outperformed the S&P 500 since the beginning of the pandemic, serving as a refuge of sorts when investor anxiety is on the rise. While it has not benefited as much as Amazon.com, Inc. (AMZN), or other online-only retailers, the pandemic has boosted Walmart’s online presence to go forward.

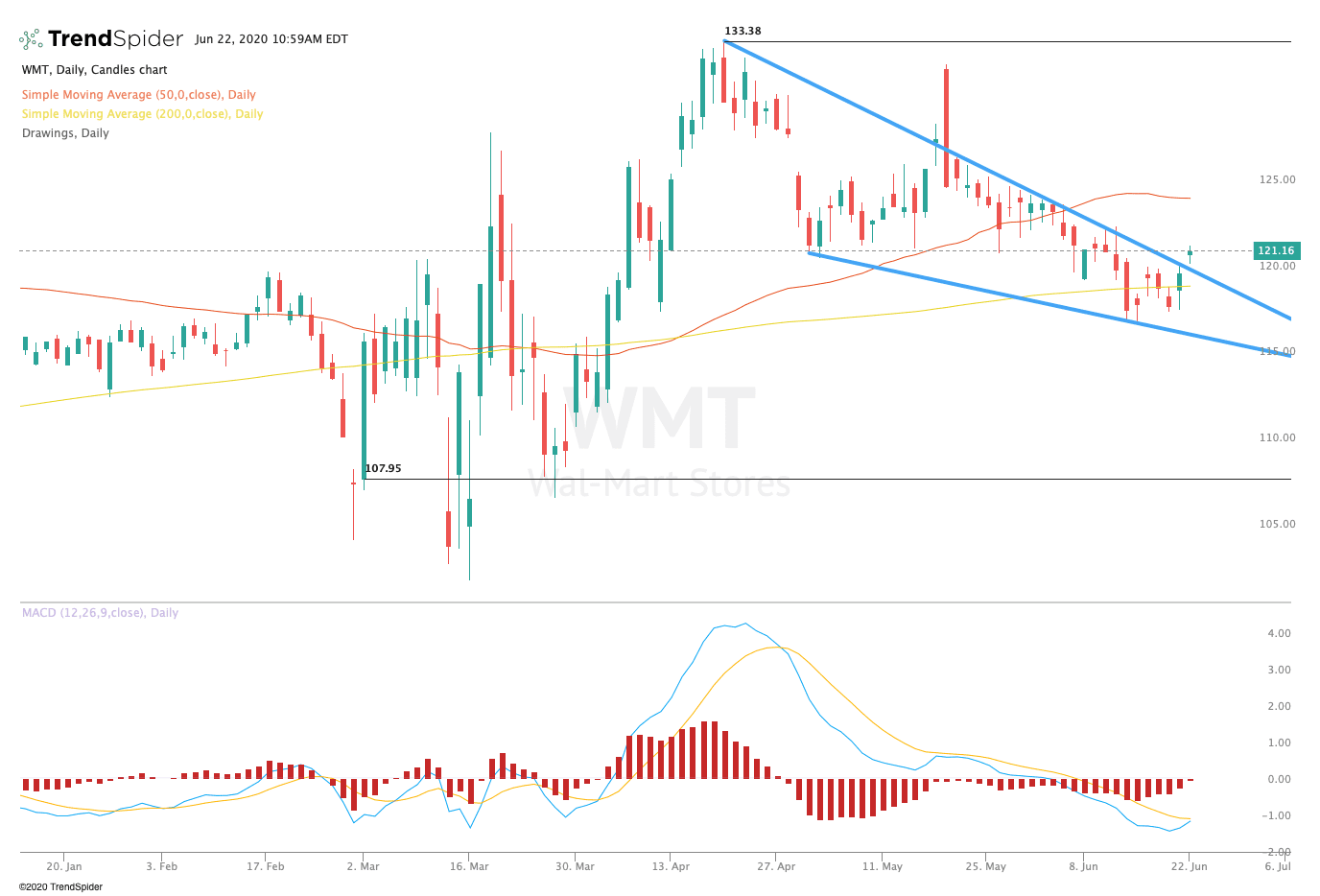

TrendSpider

From a technical point of view, the stock has rebounded from its 200-day moving average at $118.18 to its 50-day moving average at $124.03. The relative strength index (RSI) has been moved to neutral levels of 48.69, while the moving average convergence divergence (MACD) could see short-term bullish crossover. These indicators suggest that the stock could have more room to run in the coming sessions.

Traders should look to switch to the 50-day moving average at $124.03 in the coming sessions, with support at the 200-day moving average at $118.18. If the stock breaks out, traders could see a move towards the prior highs around $132.50. If the stock breaks down, operators could see a trend in the reaction lows of near $107.50, although this seems less likely to occur given the bullish sentiment.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com