Key takeaways

- Walgreens shares fell on Tuesday after the drugstore chain cut its full-year profit forecast.

- The company blamed lower consumer spending and slowing demand of COVID-19 products and services.

- Third fiscal quarter earnings missed estimates, while sales beat expectations.

Walgreens Boots Alliance (WBA) was the worst Dow Jones and S&P 500 stocks performed well on Tuesday morning as stocks fell 9% after America's largest drugstore chain slashed its full-year forecast as consumer spending and demand for pharmacies that had been driven by the COVID-19 pandemic declined.

The company now expects earnings per share (EPS ) for fiscal year 2023 from $4 to $4.05, down from the previous $4.45 to $4.65. Walgreens blamed “consumer and category conditions, a lower contribution to COVID-19, and a more cautious macroeconomic view” for the shift.

Walgreens said it would take ” immediate action to drive sustainable adjusted operating income growth in fiscal 2024.” Chief Financial Officer Rosalind Brewer said the company will step up its cost-cutting efforts and focus on increasing profitability in its healthcare segment.

For the third quarter, Walgreens posted earnings of $1 per share, below forecasts. He pointed to a 19.5% headwind due to “significantly lower COVID-19 vaccine and testing volumes.” Revenue rose 8.6% to $35.42 billion, better than expected.

Brewer added that customers of Walgreens are being hit by higher inflation and interest rates, reduced federal food benefits for the poor, lower tax refunds and an uncertain economic outlook.

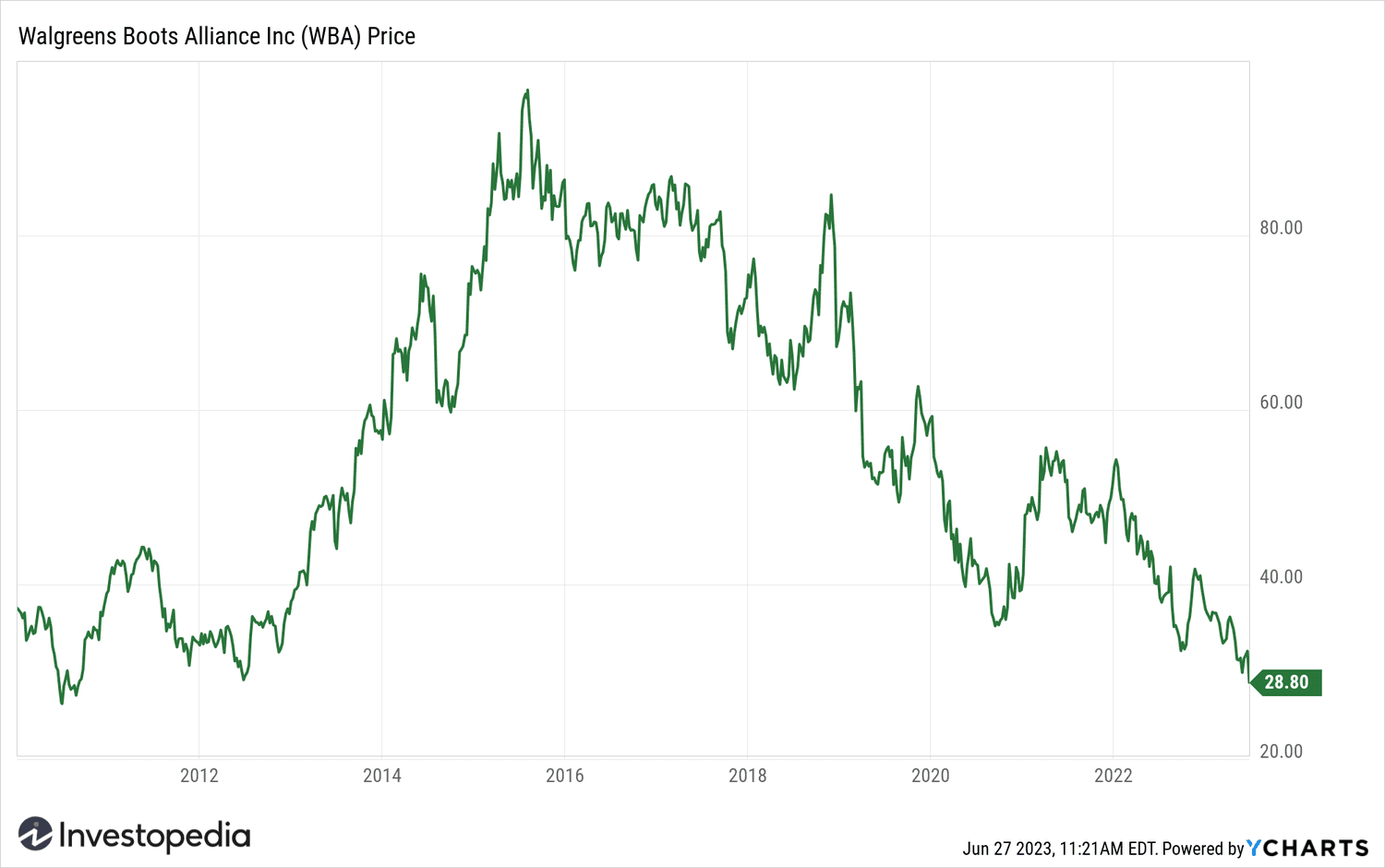

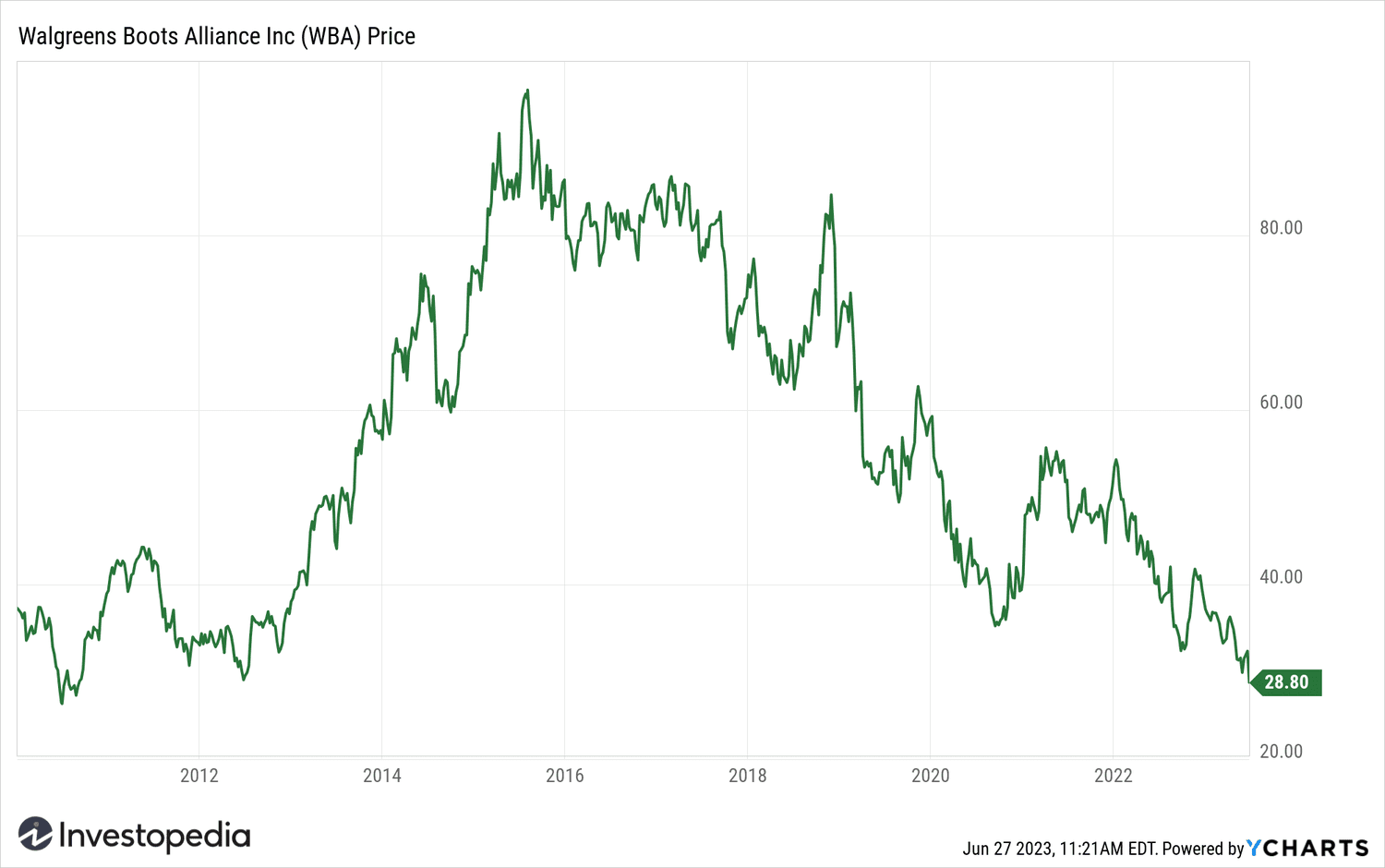

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com