Key Takeaways

- Analysts estimate EPS of $1.02 vs. $1.37 in Q3 of FISCAL year 2019.

- Payments Volume is expected to fall sharply.

- COVID-19 will bring year-on-year declines in revenue and profits.

Visa Inc. (V) the financial payment giant, has posted gains in quarterly revenue and adjusted EPS during each quarter for the past three years. The uniformity of the growth is largely due to the Visa gains quarterly global volume of payments, which was $ 2.4 trillion in the most recent quarter. Now, it is very uncertain that the Visa can maintain this growth, as millions of credit card holders on a global scale to stay at home and limit spending as a result of the COVID-19 health crisis.

Investors are looking for clear answers to this question when Visa reports earnings after the market close on 28 July for the Q3 of FISCAL 2020. Visa fiscal year ends in September. For the quarter, analysts estimate Visa report considerable year-to-year the (yoy) declines in revenue, and EPS.

Investors will also watch another key indicator for measuring how Visa is navigating the coronavirus fallout: the overall growth in volumes of payments in constant currency. The extent of Visa growth at constant exchange rates to smooth the fluctuations of the exchange rates and gives investors a clearer picture of this metric. For the Q3 of FISCAL 2020, analysts estimate volume of payments will fall.

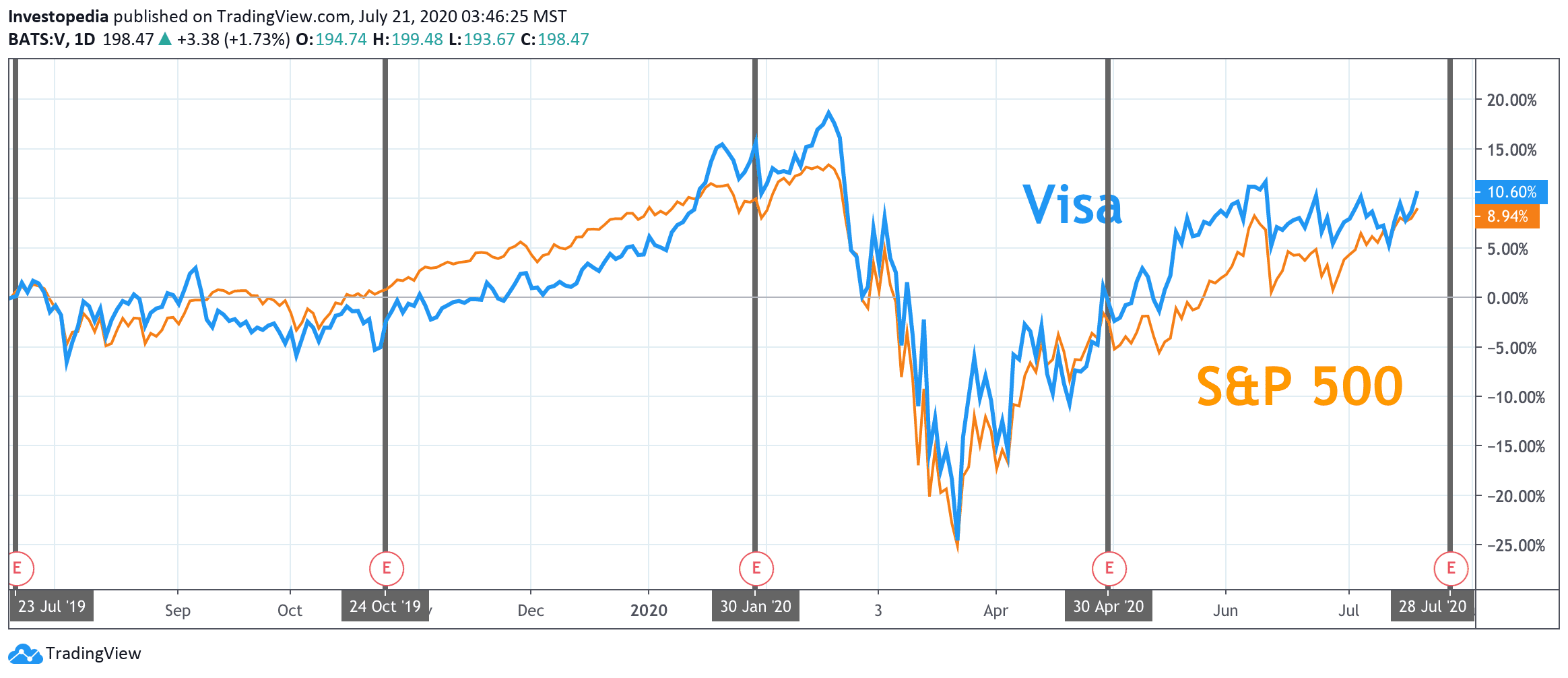

These concerns may be the reason for which the Visa has barely outperformed the broader market in the last 12 months, with a total return of 10.6% compared to 8.9% for the S&P 500.

Source: TradingView.

Visa’s revenue has grown steadily year-on-year in the last fiscal Q3 periods, from $ 4.6 billion in Q3 of FISCAL 2017 to $ 5.2 billion in Q3 of FISCAL year 2018, to reach $ 5.8 billion in Q3 of FISCAL year 2019. Analysts predict that the next report will mark a sharp reversal of this trend, as revenue decreases in the amount estimated to be 17.3% in year-on-year to $4.8 billion in Q3 of FISCAL 2020. This will mark the first year-over-year quarterly revenue decline in more than three years. However, the revenue growth has already been slowing in recent quarters, growth of 10.0% yoy in the 1st quarter of the FISCAL year 2020 and 6.6% in Q2 of FISCAL year 2020.

Quarterly EPS growth has also been strong in recent years, with increases in 13 of the last 14 quarters. The Consensus estimates of $1.02 for the Q3 of the YEAR 2020 would mark a departure from the trend. That would be, for an amount estimated to be 25.2% decrease year-on-year, the first decline since the 2nd quarter of FISCAL year 2017. The difference in revenue, Visa’s quarterly EPS growth has been more volatile in recent quarters, from 6.0% yoy in the 2nd quarter of the YEAR 2020 all the way to 523.7% yoy in the 2nd quarter of FISCAL year 2018.

V Key Measures

Estimate of Q3 FY2020

Real for T3 FY2019

Real for T3 FY2018

The Earnings Per Share

$1.02

$1.37

$1.00

Turnover (in billions of dollars)

$4.8

$5.8

$5.2

Payments Volume Growth (Constant Exchange Rate)

-10.6%

8.7%

11.6%

Source: Visible Alpha

As COVID-19 disrupts global consumer and business markets, the key metric of Visa, investors can focus on the annual rate of increase in the volume of payments in constant currency, which measures the total value of payments through the financial platforms. Investors are turning to this gauge of Visa of performance because it reflects the total volume of business that the company can monetize either by taxes or by interest.

Visa’s quarterly volume of payments has increased, year on year, each quarter, for the past three years, a sign of stability for the investors. Despite this, the quarterly year-on-year rate of growth in payments has slowed in recent quarters. The payments of the growth has decelerated from 11.6% in Q3 of FISCAL 2018 to 8.7% in the 3rd quarter of FISCAL year 2019. In the 2nd quarter of the YEAR 2020, it has been 4.6%, the lowest in two years. Analysts predict that performance will worsen. They believe Visa will show a decline in year-on-year in payments volume for the Q3 of FISCAL 2020 is 10.6%, which represents a significant change in this metric. This metric is the slowdown in the rate of growth is reflected in the society of the deceleration of the profit and revenue growth.

Source: investopedia.com