Virgin Galactic Holdings, Inc. (SPCE) shares rose more than 15% during Thursday’s session after the company appointed Michael Colglazier as head of the directorate and reassigned George Whitesides, the head of the space officer.

Colglazier brings over three decades of experience in the development and growth of the consumption-oriented multi-billion dollar companies, including The Walt Disney Company (DIS). During this time, Whitesides will focus on the development of new business opportunities, including point-to-point hypersonic travel, and the orbital space travel, and president of the company’s Space Advisory Board.

Earlier this week, the Alembic Global Advisors initiated coverage of Virgin Galactic stock with an Overweight rating and a target price of $23.00 per share. The analyst Peter Skibitski said that the company’s mid-term financial projections could be one of the most attractive business models in its coverage of the universe. The EBITDA margins of more than 46% by 2023, would be the highest in the group by a long shot.

In June, Virgin Galactic has also signed an agreement with the Johnson space Center to foster commercial participation in orbital spaceflight to the International Space Station while enabling the development of a robust economy in Low Earth Orbit.

TrendSpider

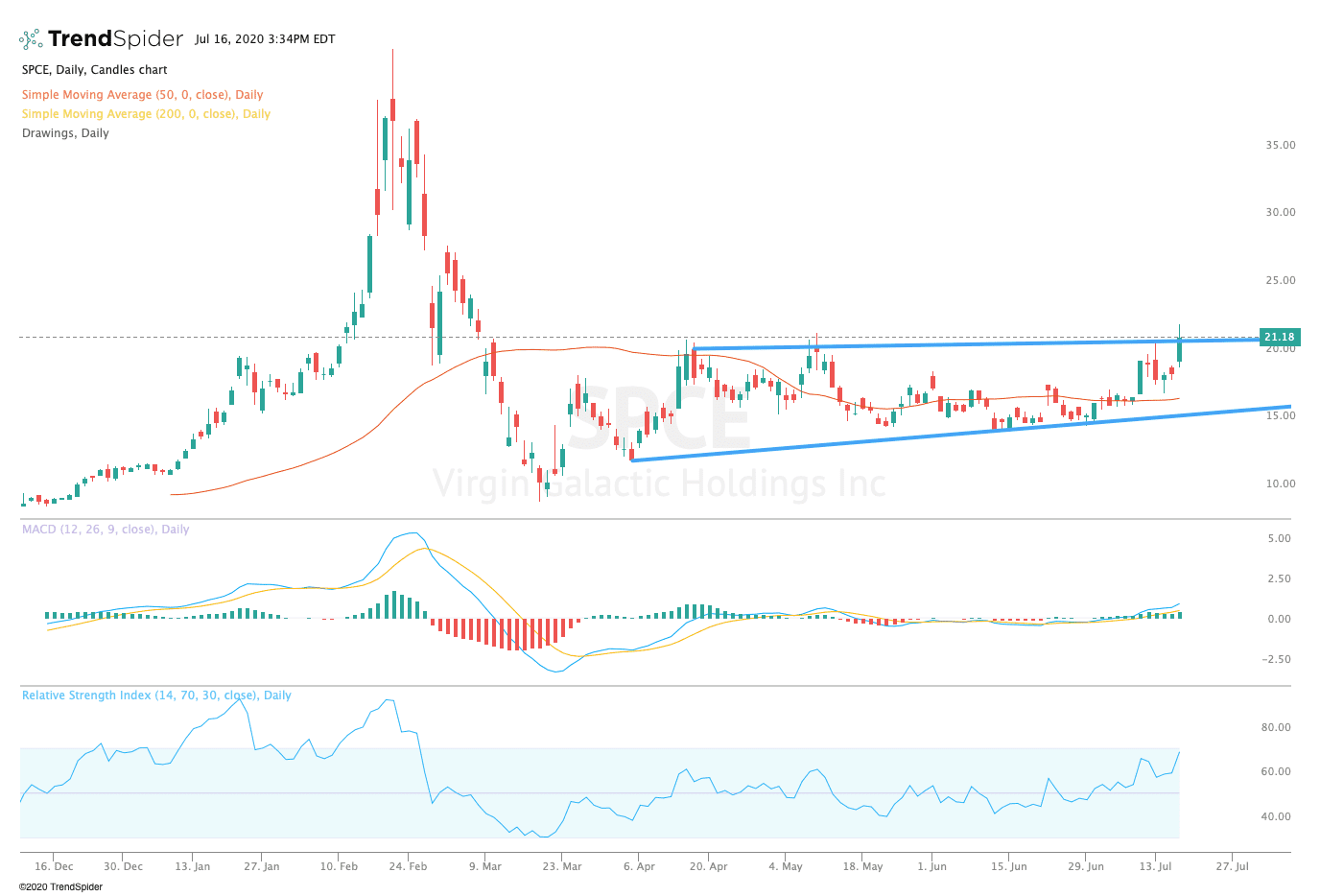

From a technical point of view, Virgin Galactic shares briefly broke out of trend line resistance of their prior highs. The relative strength index (RSI) moved into overbought levels of 68.83, but the moving average convergence divergence (MACD) is neutral. These indicators suggest that the stock could see a consolidation before any significant short-term upward movement.

Traders should watch for a move above trendline resistance at $21.00 in the short term. After the stock consolidates at these levels, traders could see a move to retest prior highs of nearly $42.49 on the medium or long term. If the stock moves lower, traders could see a move to retest of the 50-day moving average at $16.70 or trendline support at $15.50.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com