U.S. Steel (X) shares jumped higher 27% early trading Monday after it rejected an unsolicited offer from Cleveland-Cliffs (CLF) for around $7.25 billion and said it was considering other “strategic alternatives “.

KEY POINTS

- Shares of U.S. Steel soared in early trading Monday after rejecting a $7.25 billion offer from Cleveland-Cliffs.

- If accepted, the deal would have created the #39;one of the largest steelmakers in the world.

- United States Steel said it was considering other “strategic alternatives” of selling some to all of its assets.

Century-old industry icon U.S. Steel called Cleveland-Cliffs' offer 'unreasonable'. and said strategic alternatives being considered could range from selling some of its assets to buying out the entire business.

U.S. Steel posted a profit of $477 million in the second quarter of this year, less than half of the $978 million in the same period a year ago, as steel prices fell and that demand has slowed. Net sales fell to $5.01 billion from $6.29 billion last year.

Cleveland-Cliffs' $35 per share offer for U.S. Steel shares represented a 43% premium to their closing price on Friday and, if accepted, would have created one of the biggest steelmakers in the world with ownership of 100% of the country's national iron ore reserves.

Cleveland-Cliffs has made several acquisitions in recent years, including AK Steel Holding Corp in 2020, as well as the US operations of steelmaker ArcelorMittal.

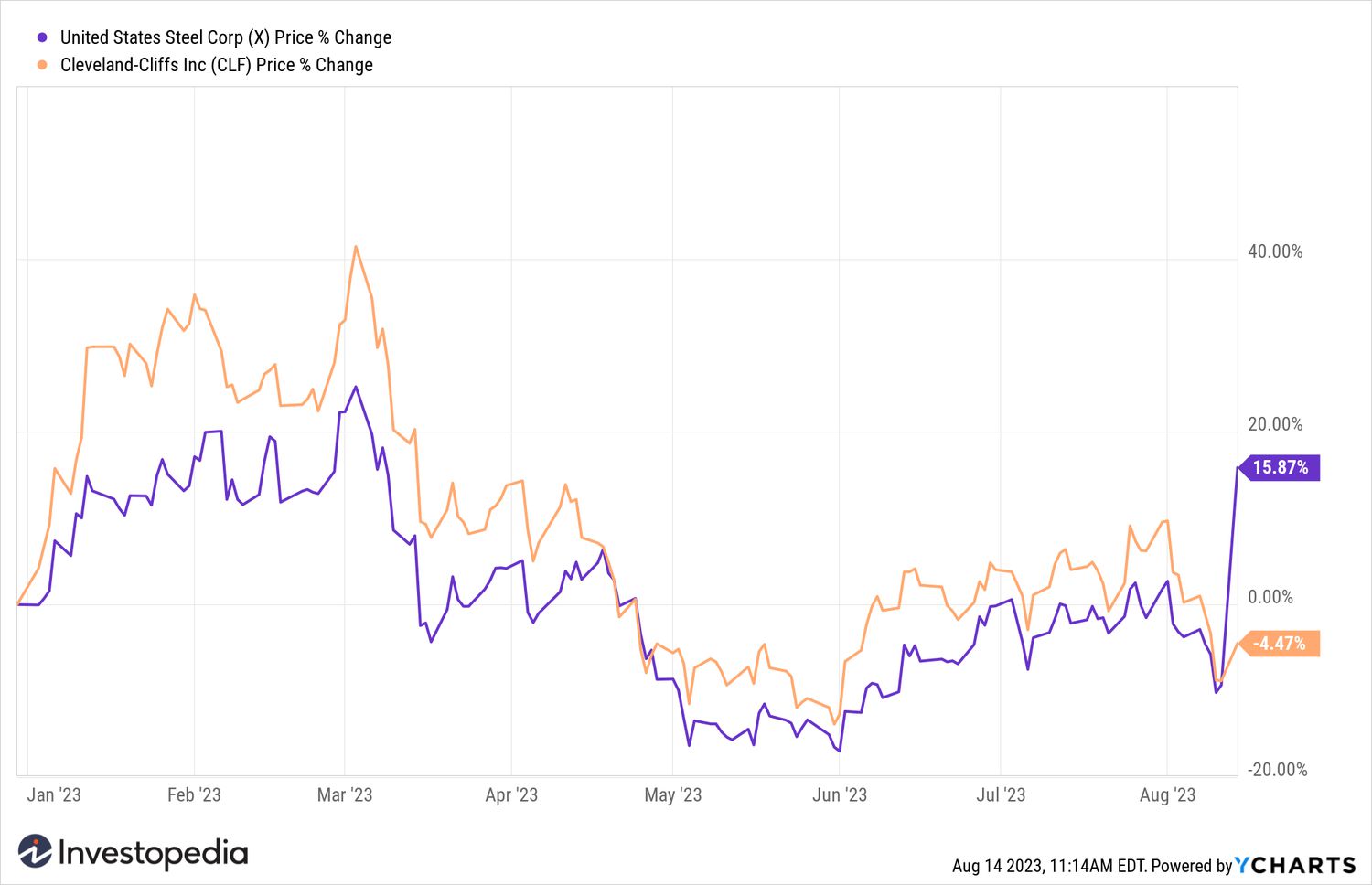

U.S. Steel shares are up about 16% year-to-date, while Cleveland-Cliffs shares are down about 4.5% over the same period.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com