Dow component UnitedHealth Group Incorporated (UNH) has made a return trip in February to the top and could get out in the next few weeks, clearing 2018 the resistance and the head on a support. The movement would be the track bullish action in other insurance companies, including Humana Inc. (HUM, HUM) and Anthem, Inc. (ANTM), the exposure of the hidden benefit of the coronavirus pandemic to this often maligned industry.

The government’s controversial response to the epidemic has set back the single payer movement for at least a generation, with politicians attacking the medical professionals for doing their job during an election year. The same thing could happen if the private health care is dismantled and the government takes over the reins of the company, threatening the health and well-being of millions of Americans. Market players have picked up on this change of paradigm, in raising these stocks at higher prices.

The crisis is also taking private insurance companies out of the campaign agenda, with the industry to respond quickly and with compassion and the expansion of coverage. The absence of criticism against the group is also bodes well for the premium increases in the years to come, because it will be impossible to argue about the consequences of the pandemic of the carrier costs that they emphasize on several occasions during the negotiation of group plans with employers.

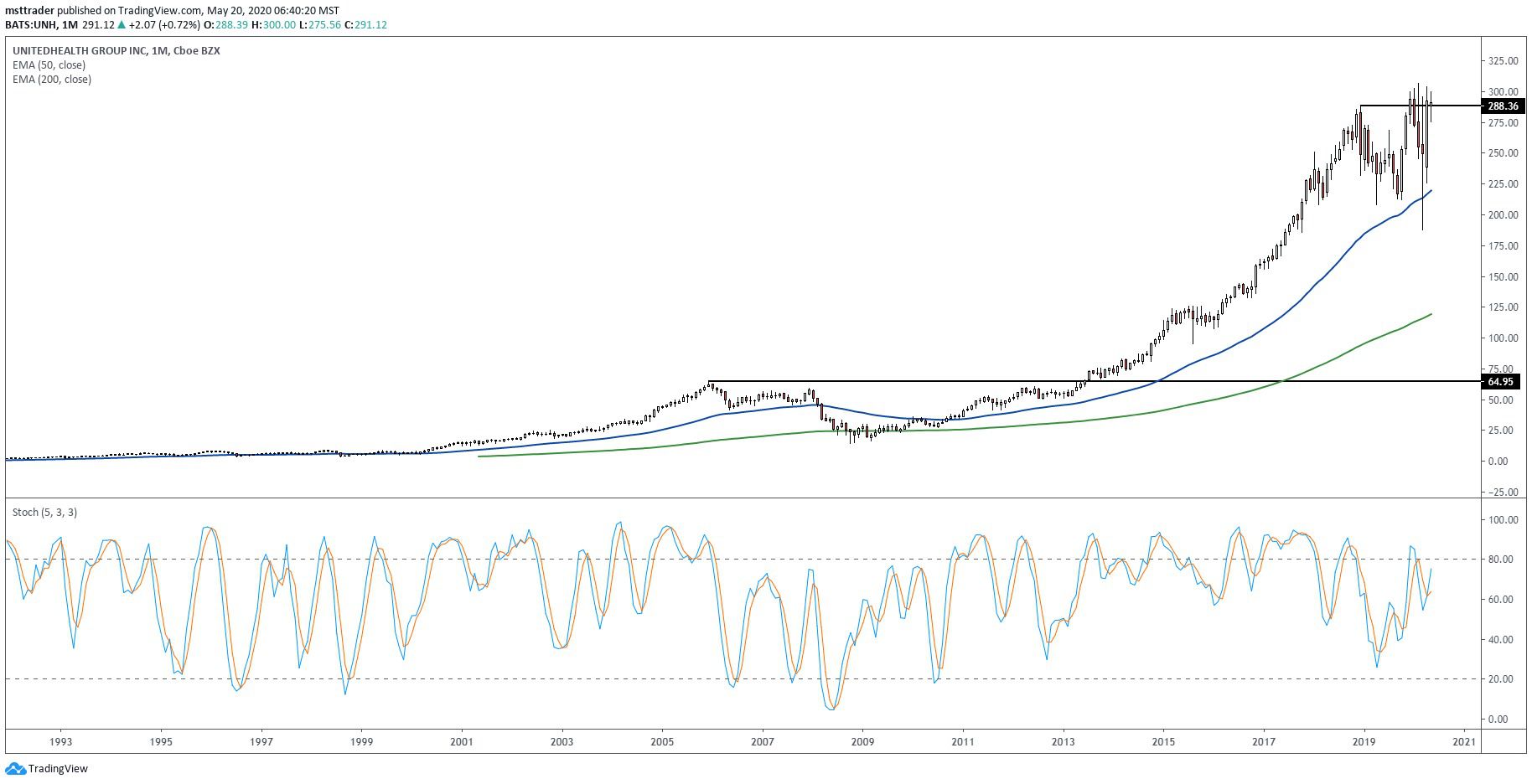

UNH’s Long-Term Chart (1990 – 2020)

TradingView.com

A constant increase was in 1986 at the top in 1991, which gives an escape that has attracted a constant interest in 1996 by the top a split-adjusted 8.63. In 1998, in an escape attempt has failed, before 2000 advanced eased up channel pattern in 2001. The stock held within these limits in 2005, the trim in the middle of$60 at the beginning of 2006. That marked the highest for the next seven years, before a double top pattern that broke down in January 2008.

The sell-off accelerated during the economic collapse, reaching a seven-year low in the mid-teens in October. Pass the tests in November and in March 2009 a triple bottom, before a resumption of the wave that has made a return trip in 2006 in 2013. The subsequent uptrend is entered in the second increase of the canal of the century, a few months later, after a 2014 canal de derivation added to gains in the second quarter of 2015, when the rally stalled in the $120s.

2016 breakout eased in a third channel after the presidential election, finally topping out at $288 in December 2018. The price action since that time has been two-sided and extremely volatile, with a rating of single payer is gaining ground in the run-up to the 2020 campaign. UnitedHealth stock initially hit a low of $208 in April 2009, and tested this level successfully in October, before the final assault which has posted a record of just 18 points over the 2018 peak in February 2020.

UNH in the Short-Term Chart (2017 – 2020)

TradingView.com

The first quarter of the slide cut until 2019, support before dropping back to a two-year low, while the subsequent rebound, carved in the shape of a V pattern that the impasse at only two points in the month of February tip on April 17. The price action in the last five weeks has been constructive, with the stock of a sculpture of a small rectangular trading range on top of 50 and 200 days exponential moving averages (EMAs). A rally above $304 would have triggered buy signals in this configuration, the increase in the odds for a cup and handle breakout.

The balance volume (OBV), the accumulation-distribution indicator topped out ahead of price in November 2018 and has entered a phase distribution which led to an 18-month low in April 2019. Subsequent buying power has failed to clear the resistance in January 2020, setting the stage for a downdraft, which held well above OBV 2018 low. He is now back in the 2020 high with prices and is perfectly placed to post new highs in the course of an escape.

The Bottom Line

UnitedHealth stock looks ready to clear 2018 resistance in an uptrend that could eventually reach$500.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com