Takeaways

- United Natural Foods reported a loss in the fourth quarter of fiscal 2023 and cautioned about its outlook for the full year.

- The company said that Even though sales were increasing, profitability had been affected by lower inflation-related supply gains and increased shrinkage.

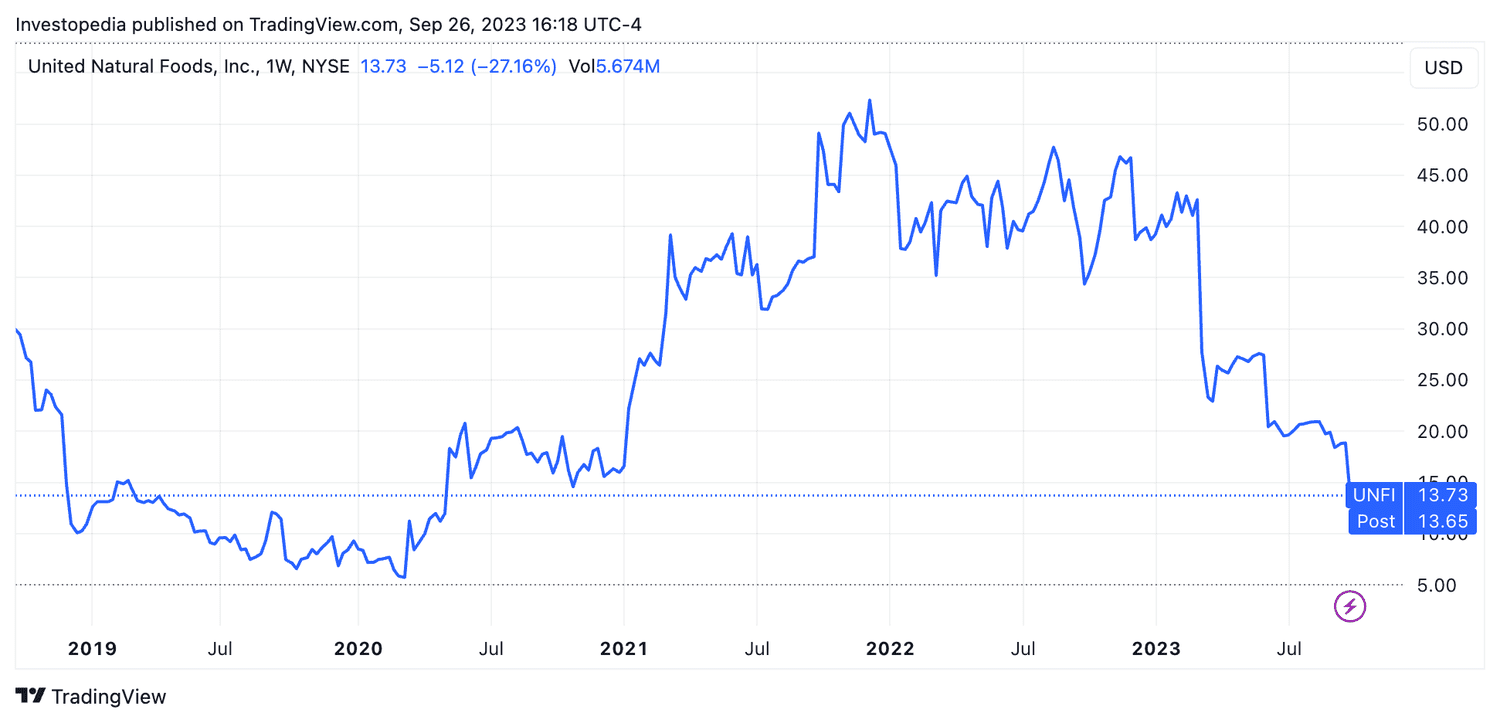

- The report sent shares of United Natural Foods to their lowest level in more than three years.

Shares of United Natural Foods (UNFI) plunged more than 27% Tuesday to their lowest level in more than three years following the natural and organic foods market. The retailer posted a quarterly loss and gave a full-year outlook well below forecasts.

United Natural Foods reported a loss of $1.15 per share in the fourth quarter of fiscal 2023, after posting a profit of $1.27 per share a year ago. Revenue rose 2% to $7.42 billion. Gross margin fell 8.3% to $1.0 billion, and excluding charges, the gross margin rate was 13.5% of net sales, down from 15.2% of net sales 2022.

Even though sales increased across all of the company's customer channels, “profitability declined primarily due to lower inflation-related sourcing gains and significant markdowns,” the company said. CEO Sandy Douglas. He warned that United Natural Foods expects “further headwinds as we continue to generate high inflationary earnings in the first half of fiscal 2024.”

The company plans to Full-year earnings per share (EPS) ranged from a loss of $0.88 to a profit of $0.38. Analysts expected EPS of $1.94.

Shares of United Natural Foods were lost a quarter of their value on Tuesday following the news, and fell to levels not seen since May 2020.

TradingView

Do you have a news tip for news journalists 39;Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com