Key takeaways

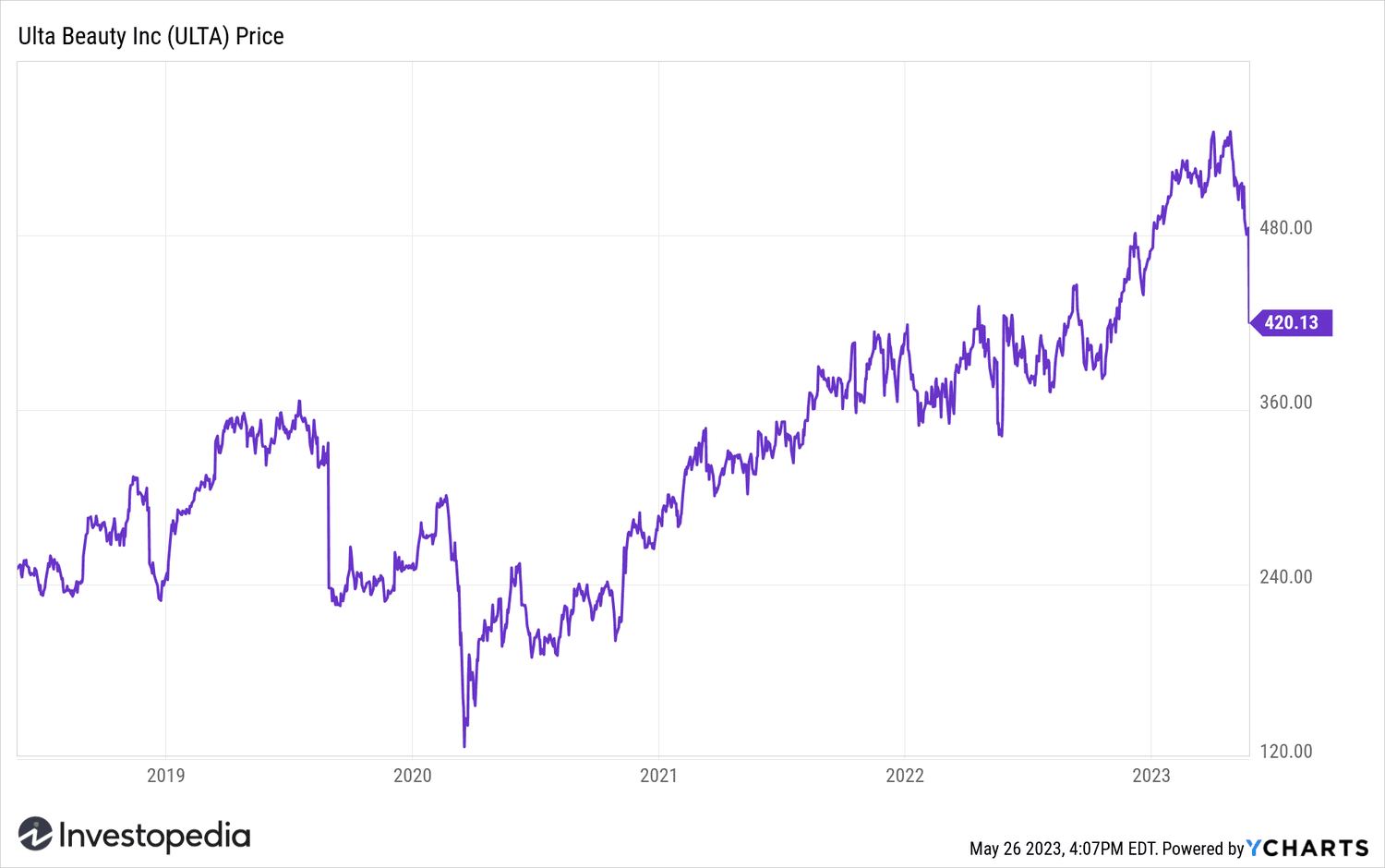

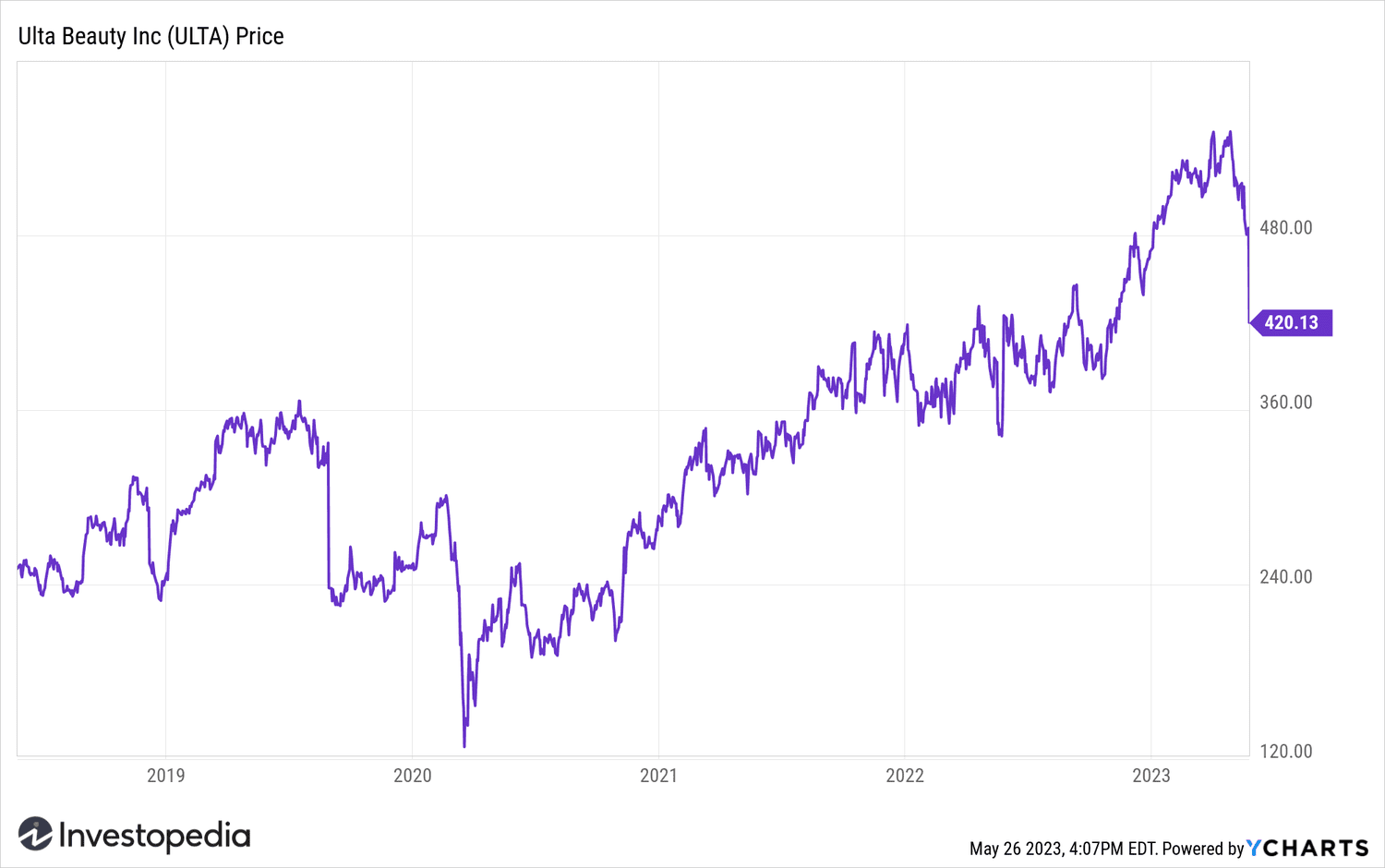

- Ulta Beauty shares fell as it warned of slowing growth.

- The company cut its operating margin outlook for the entire ;year.

- Its stock was the worst performer in the S&P 500 on Friday as shares fell 13.4%.

Ulta Beauty (ULTA) was the worst performing stock in the S&P 500 on Friday, as shares fell 13.4% after the beauty supply chain cut its operating margin forecast for the full year and warned that its recent growth boom would moderate.

Ulta Beauty reported first-quarter fiscal 2023 earnings of $6.88 per share, with revenue up 12.3% to $2.63 billion. Both were slightly above forecast. Same-store sales, which include online shopping, rose 9.3%, just below estimates. The average ticket fell 1.5%.

CEO David Kimbell reported that during the quarter, “store traffic remained healthy, member growth showed continued strength, we achieved growth in key categories and we strengthened the commitment with the Ulta Beauty brand”.

However, he explained that even if the importance of skincare and general wellness were to continue, “the high level of growth that the company has experienced over the past two years will moderate and eventually return to the peak of the historical average”.

Ulta Beauty now projects a slight full-year sales increase from its previous guidance, but it sees an operating margin of 14.5% to 14.8% from the previous 14.7% to 15%.

YCharts

Source: investopedia.com