Swiss banking giant UBS (UBS) on Monday agreed to pay about $1.4 billion to settle a lawsuit over its handling of residential mortgage-backed securities (MBS) in the years leading up to the 2008 financial crisis.

Key Points to Remember

- UBS has entered into an agreement with the Department of Justice to pay $1.435 billion in a case involving the bank's handling of residential mortgage-backed securities (MBS).

- The settlement concluded the latest lawsuit brought by the DOJ to investigate the conduct of large banks and financial firms in the aftermath of the 2008 financial crisis.

- Credit Suisse, which UBS has acquired in March, settled with the DOJ for $5.3 billion in 2017 to resolve a similar lawsuit related to the bank's MBS practices.

The settlement ends a civil action brought by the Department of Justice in November 2018, which alleged that the Swiss banking giant defrauded investors in the sale of 40 residential mortgage-backed securities in 2006 and 2007. The lawsuit alleged that UBS had misled investors by claiming that the securities were safer than they were and did not correctly indicate the degree of risk of the loans backing them.

'With this resolution, UBS will pay for its conduct related to its underwriting and issuance of residential mortgage-backed securities,' Breon Peace, U.S. Attorney for the Eastern District of New York, said in a statement. “The substantial civil penalty, in this case, serves as a warning to other financial market participants who seek to illegally profit from the fraud that we will hold them accountable no matter how long it takes.”

UBS has committed to challenge the prosecution of the DOJ when it aired nearly five years ago. The bank attempted to dismiss the lawsuit in 2019, but a federal judge in Brooklyn overturned it on the grounds that the DOJ complaint “alleged strong circumstantial evidence of willful misconduct or recklessness.”

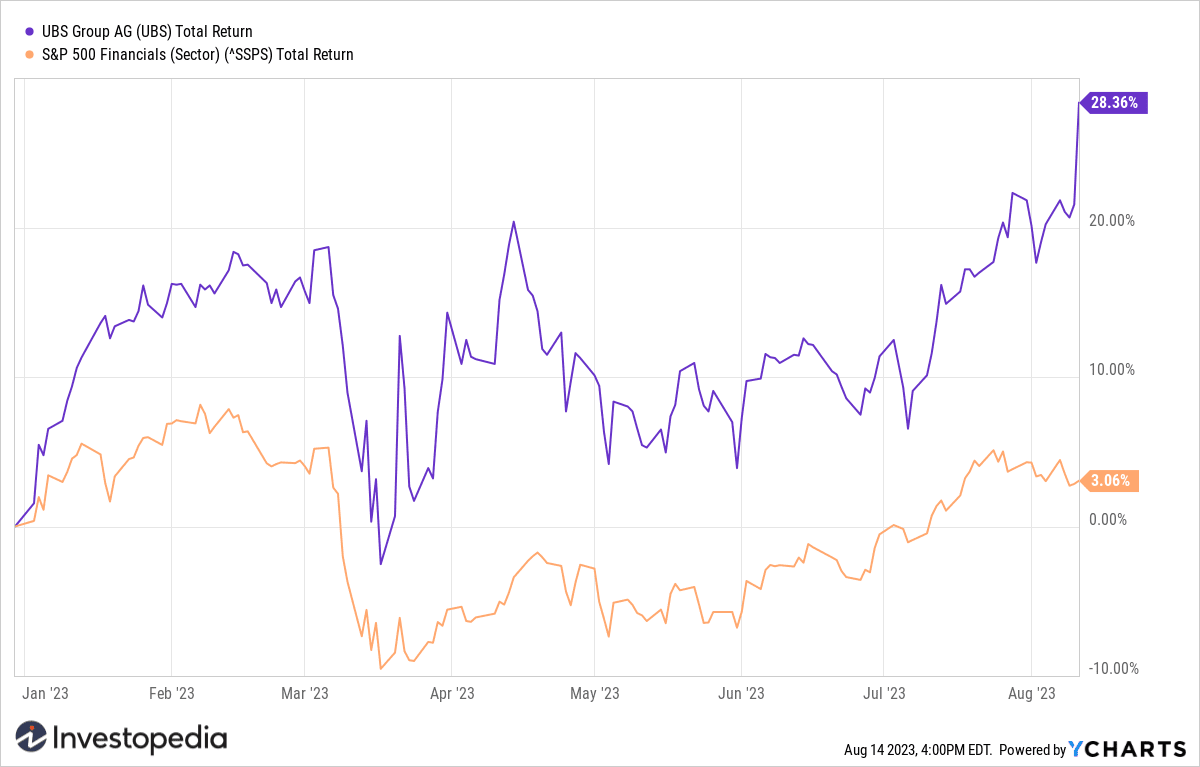

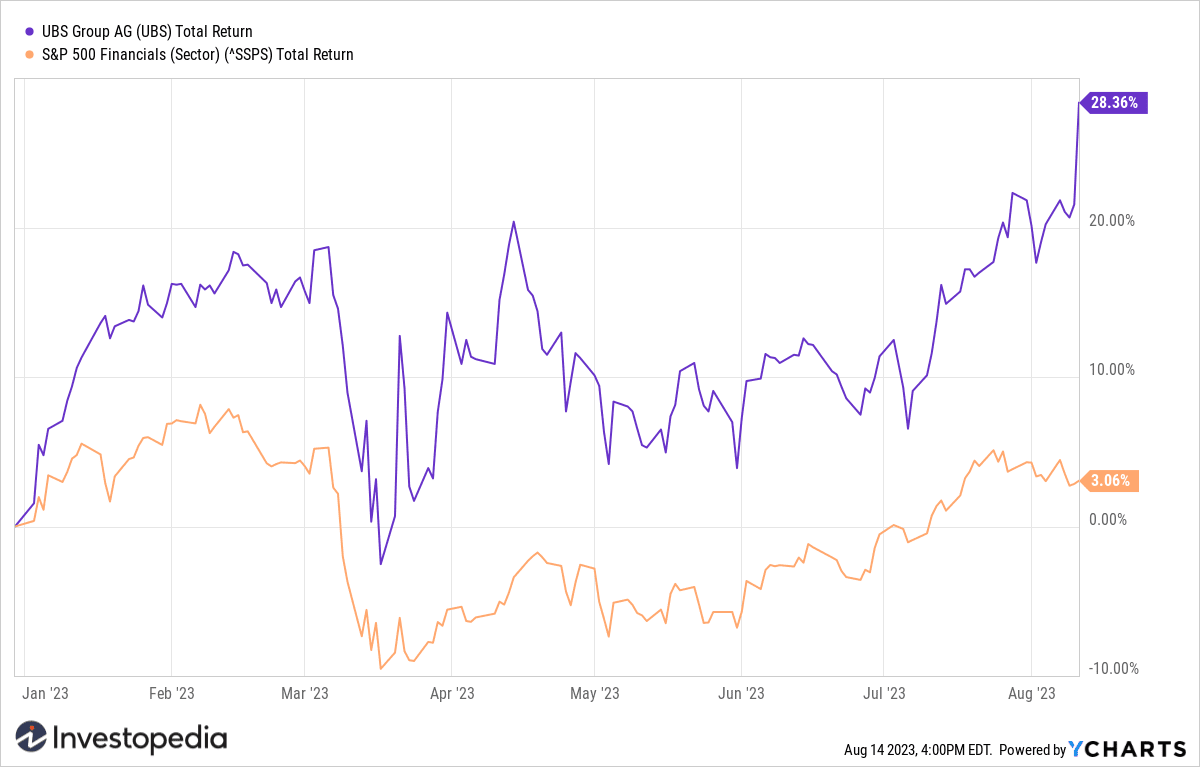

UBS shares rose 1% on Monday. They are up 28% this year, outperforming a 3% gain for the broader S&P 500 financials sector over that period.

ChartsY

The last of the surveys on the big banks in the Crisis of 2008

Monday's settlement concluded the latest lawsuit brought by the DOJ to investigate the conduct of major banks and financial firms whose actions may have played a role in triggering and worsening the 2008 financial crisis. The Department of Justice has reached an agreement with 18 other financial firms, including JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Wells Fargo (WFC) and Goldman Sachs (GS) regarding their MBS practices.

Credit Suisse, the troubled Swiss lender that was taken over by UBS in a government-brokered deal in March, also settled with the DOJ in 2017 to resolve a similar lawsuit over the bank's MBS practices. . He was forced to pay around $5.3 billion, nearly four times the UBS settlement.

Debt-backed securities mortgages played a crucial role in the 2008 financial crisis. In the years leading up to the crisis, Wall Street lenders pooled subprime mortgages (those of low credit quality given to borrowers who could not repay ) and sold them to institutional investors. The MBS were grouped into tranches and given credit ratings that greatly underestimated the true risk of default. When borrowers began to default en masse on their mortgages, the underlying securities quickly deteriorated and threatened to bring down the entire banking system.

Do you have any advice? news for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com