Uber Technologies Inc. (UBER), the one of the world's largest ridesharing companies, will likely post a narrow net loss in the first quarter on strong revenue gains driven by a robust take rate or the percentage of each passenger's fare it retains.

Key Points to Remember

- Uber is expected to report a net loss of $178.1 million, or 9 cents per share, compared to a much larger loss of $5.93 billion in the same quarter last year.

- Revenue growth slowed from the previous two years, when the easing of pandemic-related restrictions led to an increase in travel demand, but remained robust.

- Total revenue was likely up 27% year-on-year to $8.71 billion, boosted by a -record attendance rate of 27.7%.

Uber will likely post a net loss of $178.1 million, or nine cents per share, compared to a much larger loss of $5.93 billion in the same quarter last year, according to estimates compiled by Visible Alpha . Revenue is expected to have risen 27% year over year to $8.71 billion, a slowdown from recent quarters. The company's turnout likely held steady at 27.7%, which helped boost revenue. Uber releases its first quarter results on Tuesday, May 2 before markets open.

Revenue gains from Uber's core transit business have likely slowed from the blistering pace of the previous two years, when the lifting of pandemic restrictions and stay-at-home orders prompted an increase travel demand. Ride's revenue growth peaked at a 195% annual pace in Q1 2022, after contracting 67% year-over-year in Q2 2020, at its peak pandemic closures.

Uber Key Figures Q1 FY 2023 (projected) Q1 FY 2022 Q1 FY 2021 Revenue ($M) 8,710 6,854 2,903 Earnings per share ($) (0.09) (3.03 ) (0.06) Participation rate (%) 27.68 25.91 14.8 6

Helping to boost Uber's ride-sharing revenue was a high take-up rate, or the percentage of the fare the company earns as commission. Uber's turnout was likely 27.7% in the first quarter, just below the all-time high of 28.7% two quarters ago. A high turnout indicates that the company earns a greater share of each rider's payout, which increases revenue and profit margins.

Total Uber trips in Q1 likely exceeded 2.1 billion, little change from the previous quarter but 22.8% more than a year ago, the largest annual increase in three quarters.

Revenue from Uber Eats, the company's food delivery service, also moderated in the first quarter. It was probably up 20.8% year-over-year, compared to 44.3% growth in the same quarter last year. Unlike ridesharing, Uber Eats revenue has soared during the pandemic as online food orders have surged amid shutdowns. Segment revenue growth peaked at 224% YoY in Q4 2020.

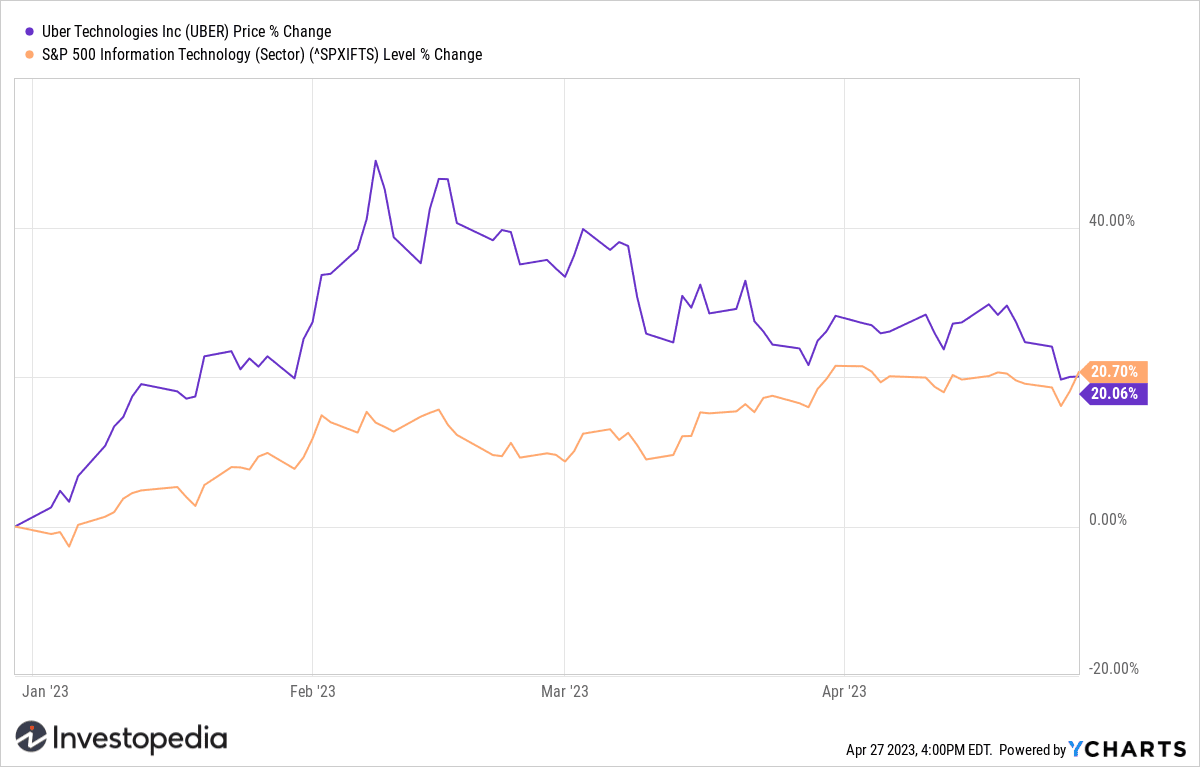

Uber shares are up 20% year-to-date, roughly matching the performance of the IT sector of the S&P 500 over the same period.

Y Graphics

Source: investopedia.com