Tyson Foods, Inc. (TSN) stock is trading lower by nearly 9% in Monday’s pre-market after missing the second quarter of 2020 the top and bottom line consensus estimates. The company recorded an earnings per share (EPS) of $0.77 in the quarter, just half of analyst estimates, while $10.89 billion in revenues fell below $11.01 billion expectations. The stock has fallen 40% discount on the all-time high posted on Jan. 13, in spite of its participation in the hot-running staple of the industry.

More than a dozen meat processing plants have been closed due to the sars coronavirus pandemic, taking a toll on the income and the country of the food chain. In response, the President, Donald Trump has invoked the Law on the Production of Defense, which authorizes the executive office to send workers to their positions. Tyson noted the headwinds in its earnings release, advise “these challenges are expected to increase our operating costs and negatively impact our volumes for the remainder of fiscal year 2020.”

Other U.S. meat producers are facing the same problems, with Smithfield Foods recently stop pork plants in Illinois, Wisconsin, Missouri, and South Dakota. The workers of these industries are forced to stand “shoulder to shoulder”, without protective equipment, while saying that they have had to face disciplinary action when coughing or sneezing, because it slows down the production. Smithfield is owned by WH Group Limited (WHGRF), a publicly traded meat and food processor headquartered in Hong Kong.

The shutdowns have raised fears of empty supermarket shelves and a national meat shortage will lead to higher costs and inflation. The addition of consequences, beef, and pork farmers are reporting large surpluses, because they can’t get their cattle to the slaughterhouses, requiring them to increase the capacity or reduce the size of the herds. These barriers are having a ripple effect on the futures markets, with pigs and cattle contracts near multi-year lows.

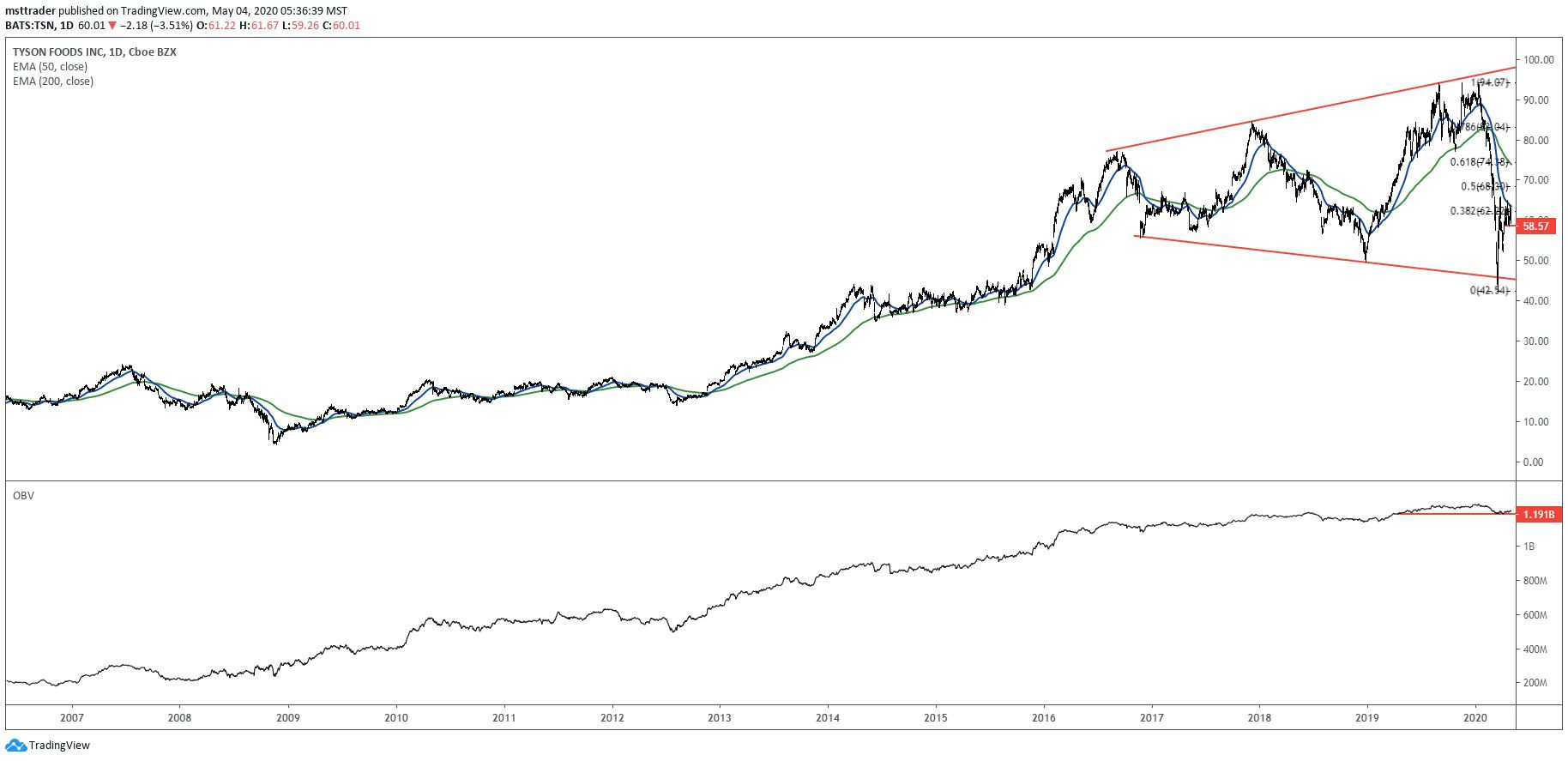

TSN Long-Term Chart (2007 – 2020)

TradingView.com

A multi-year uptrend stuck at just below ten years of resistance in the middle of$20 in July 2007, leaving the place to an orderly decline of two years of support, followed by an explanation to a 10-year low during the economic collapse of 2008. The subsequent reversal of the wave, finally completed a round-trip in the front in 2013, the immediate sale of derivation that has stalled in the middle of$40 in the first quarter of 2015.

Bullish price action cleared this barrier, in November 2015, the generation of a stable slight increase in September 2016 high at $77.05, ahead of a strong slide that ended at nine-month low in the mid – $60s, after the presidential election. The stock has posted the two highest and an equal number of lower levels unprecedented in the past three years, carving the outline of a downward movement of the expansion of the training, which is also known as a megaphone pattern.

The last rally of the wave, climbed above the December 2017 peak of 84.65 in August 2019, which gives a quick advance of $94.07. Failed escape attempts, in November and in January 2020 completed a triple top that broke down in February, the establishment of new resistance in the middle of$70. At the other end of the first quarter dropped to cut through the December 2018 down to $49.77 before hitting a four-year low, while the rebound has rebounded as the floor of the exchange.

TSN in the Short-Term Chart (2018 – 2020)

TradingView.com

The short-term increase of the standoff in the middle of$60, March 25, while the two April breakout attempts have failed to clear the obstacle. This morning’s decline reinforces resistance at that level and the 50-day exponential moving average (EMA), which has contained the price action since the January break. The stock lost a full year of interest from buyers in the first quarter, the abandonment of the on-balance volume (OBV), the accumulation-distribution indicator to the lowest since April of 2019.

The pre-market sell-off has also broken support near $58.50, exposing immediately to the decline in the bottom of $50. More importantly, the bearing raises the chances for a critical test in the month of March low and a voice of support in the $40. Traders should watch OBV if this occurs because a breakdown through the red line of the forward price predicts that the stock will soon follow, confirming a downward trend that could reach the low-to mid – $30.

The Bottom Line

Tyson Foods stock is sold off after a weak quarter, warning that the meat processing shares could drop to five or six years, the down in the months to come.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com