Twitter Inc. (TWTR), the social media of the company, is faced with two opposing trends, like the COVID-19 pandemic forces millions of people in the world sheltered the house, the closure of a large part of the UNITED states and the global economy. For Twitter, millions of home, consumers have led to a welcome spike in the social media of the company of the movement. But the economic judgments have also begun to lead to a reduction in the advertising, Twitter depends on for most of its revenues and profits.

Investors will see how these two forces that affect Twitter when it reports earnings on July 23 for FISCAL Q2 2020. The news is likely to be mixed. Analysts expect the company to report its first net loss in at least 14 quarters in the middle of dive revenue as well as corporate users, traffic posts largest quarterly year-on-year (yoy) growth in the last three years. Twitter management this spring was also uncertain about the prospects of the company, in consideration of the pandemic, which has not provided earnings guidance for Q2.

A metric that investors will look especially near Twitter in the measurement of traffic of the primary user of the platform: Monetizable daily Active Users (mDAU). Analysts expect a 24.7% gain year-on-year.

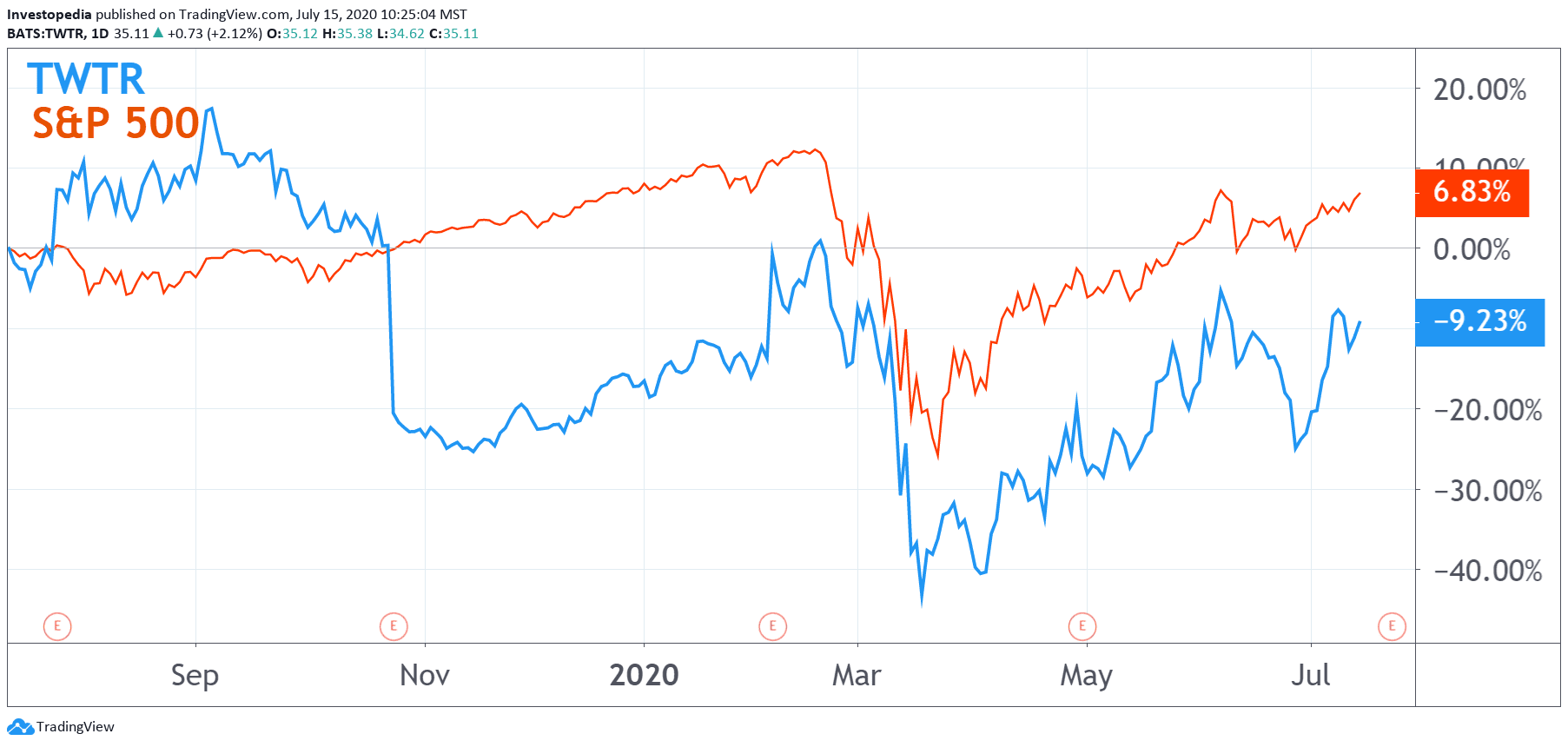

In the last 12 months, the company has under-performed the broader stock market, posting a total return of -9.2% compared to 6.8% for the S&P 500. This is in line with the company’s historical performance, with Twitter constantly lagging behind the S&P 500 index over the past five years.

Source: TradingView.

In spite of these difficulties, the company managed to beat earnings expectations in FISCAL Q1 2020 at the end of March, providing an adjusted earnings per share (EPS) of$ 0.11, compared to a consensus estimate of$ 0.10. Twitter numbers have revealed that there are significant warnings signs. Despite the pace, the adjusted earnings per share was down 69.8% year-on-year in the middle of the weakness in revenue growth of 2.6%. Twitter in stock sold by about 10% in the short term, in the days of his AF Q1 2020 for the publication of the results, the 30 April, but rallied to a stock market, fueled by hopes of an economic recovery.

Twitter has recorded a strong revenue and earnings growth in Q2 periods in fiscal 2018 and 2019. The company has boosted revenue by 23.8% in Q2 of FISCAL 2018 and 18.4% in Q2 of FISCAL year 2019, and adjusted earnings per share increased by 127.1% and 810%, respectively.

On the other hand, the analysts expect Q2 to the YEAR 2020 show a dramatic deterioration. Analysts expect adjusted earnings per share to swing to a loss of$0.02 to $1.58 in Q2 of FISCAL year 2019. It could get worse, for all of the YEAR 2020. The analysts expect Twitter’s adjusted EPS to dive 83.3% to 4.4% drop in sales.

Twitter Key Metrics

Estimate of the Q2 2020 (AF)

Real for the 2nd quarter of 2019 (FY)

Real for the 2nd quarter of 2018 (AF)

Adjusted Earnings Per Share ($)

-0.02

1.58

0.17

Revenue ($M)

695.7

841.4

710.5

Monetizable Daily Active Users (M)

173.3

139.0

122.0

Source: Visible Alpha

As indicated, a key measure to look at Twitter’s Monetizable daily Active Users (mDAU). This non-GAAP measure is intended to capture the “validated” users of the platform, after filtering out illegitimate users, such as fake accounts, bots, accounts that are linked to spam, multiple accounts linked to the same user, and so on. Twitter is mDAUs are followed closely by advertisers, since they serve as a proxy of the size of the audience that their advertisements can reach through the platform. Although mDAU may provide a more accurate picture of the company’s user base, it also becomes difficult to compare Twitter to the performance of competitors.

The rebound of Twitter stock in recent months may be due, in part, that mDAUs have increased 23.9% in FISCAL Q1 2020 compared to a year earlier, an increase of 32 million users. The analysts expect strong mDAU continued growth in FISCAL Q2 2020, up from 24.7% to 173.3 million from $ 139.0 million in Q2 2019. Twitter has shown an acceleration in the rate of mDAU growth in each of its last seven quarters. The big question is whether the increase in mDAUs will be able to offset the decline of advertising in the future.

Source: investopedia.com