Twilio Inc. (TWLO) shares rose more than 3% during Thursday’s session after KeyBanc reiterated its Overweight rating and raised its price target to a Street high of $248 per share, which implies a 9% premium to Wednesday’s closing price. KeyBanc believes that Twilio’s platform can withstand price competition and moves to the top of the stack in the Contact Center as a Service space. In addition, the analyst believes that Twilio will become a key component of digital acceleration over the next few years.

The movement follows the same target price increases in the last few weeks. Goldman Sachs, Northland, and Piper Sandler raised their price targets to $225, citing increases in the software industry assessments in the middle of the COVID-19 pandemic.

Twilio has also been under the spotlight since the City of New York, announced that he would use the platform to power its contact tracing efforts. With the recent increase of the COVID-19 cases around the nation, other states and municipalities may follow suit.

TrendSpider

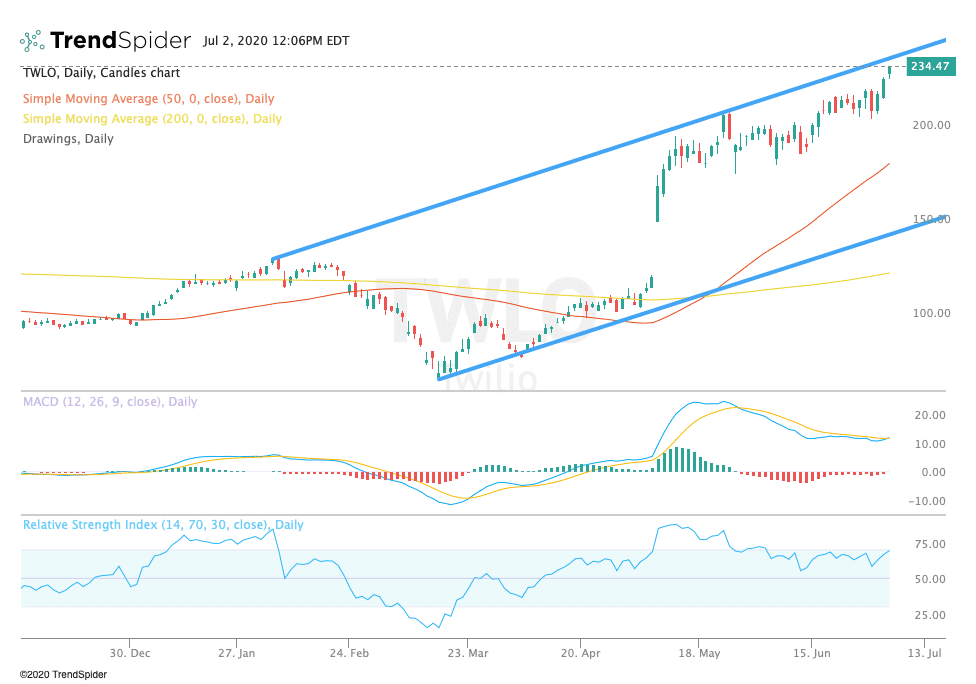

From a technical point of view, the stock broke out to fresh highs during Thursday’s session after a period of sideways trading. The relative strength index (RSI) has been moved near overbought territory with a reading of 69.53, but the moving average convergence divergence (MACD) is neutral. These indicators suggest that the stock could see short-term consolidation before moving higher in the coming sessions.

Traders should watch for consolidation above trend line support in the coming sessions. If the stock breaks down, traders could see a movement to retest the low, or the 50-day moving average at $182.79. A further breakdown could lead to a close of the gap from early May to near the 200-day moving average at $124.62. If the stock continues to breaks, the operators could see a trend to the trend line resistance at around $240.00.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com