Taiwan Semiconductor Manufacturing Company (TSM), or TSMC for short, shares fell more than 4% in early trading Thursday after reporting lower profits for the first time in four years amid falling demand for electronics.

TSMC

- TSMC reported net profit of 181.8 billion New Taiwan dollars ($5.85 billion) for the second quarter, down 23.3% from the same period a year ago.

- It was the first drop in profit for the Apple vendor since 2019, as sales of devices using its chips fell.

- The company expects revenue to be between $16.7 billion and $17.5 billion in the third quarter.

Taking a hit from macroeconomic headwinds

TSMC reported net profit of 181.8 billion New Taiwan dollars ($5.85 billion) for the second quarter, down 23.3% from the same period ago is a year old and the first drop for the Apple supplier since 201 9 as sales of smartphones and other devices using its chips fell.

"Our business in the second quarter was impacted by general global economic conditions, which dampened end market demand and drove customers" continuous inventory adjustment," TSMC Chief Financial Officer Wendell Huang said in a statement.

Apple, TSMC's biggest customer, reported its second consecutive decline in overall electronics sales in the quarter ending April 1, and blamed the “difficult macroeconomic environment”.

Apple was not alone. The global smartphone market fell 11% in the second quarter from a year ago, according to figures from research firm Canalys.

However, this trend may be starting to change.

“The smartphone market is sending early signals of recovery after six consecutive quarters of decline since 2022,” wrote Canalys analyst Le Xuan Chiew. “Smartphone inventory has started to thin out as smartphone vendors have prioritized reducing inventory of older models to make room for new launches.”

Third Quarter Forecast

TSMC expects third quarter revenue to be between $16.7 billion and $17.5 billion, with a gross profit margin between 51.5% and 53.5%.

“As we approach the third quarter of 2023, we expect our business to be supported by the strong ramp-up of our 3-nanometer technologies, partially offset by the continued adjustment of our customers' inventories”," Huang said.

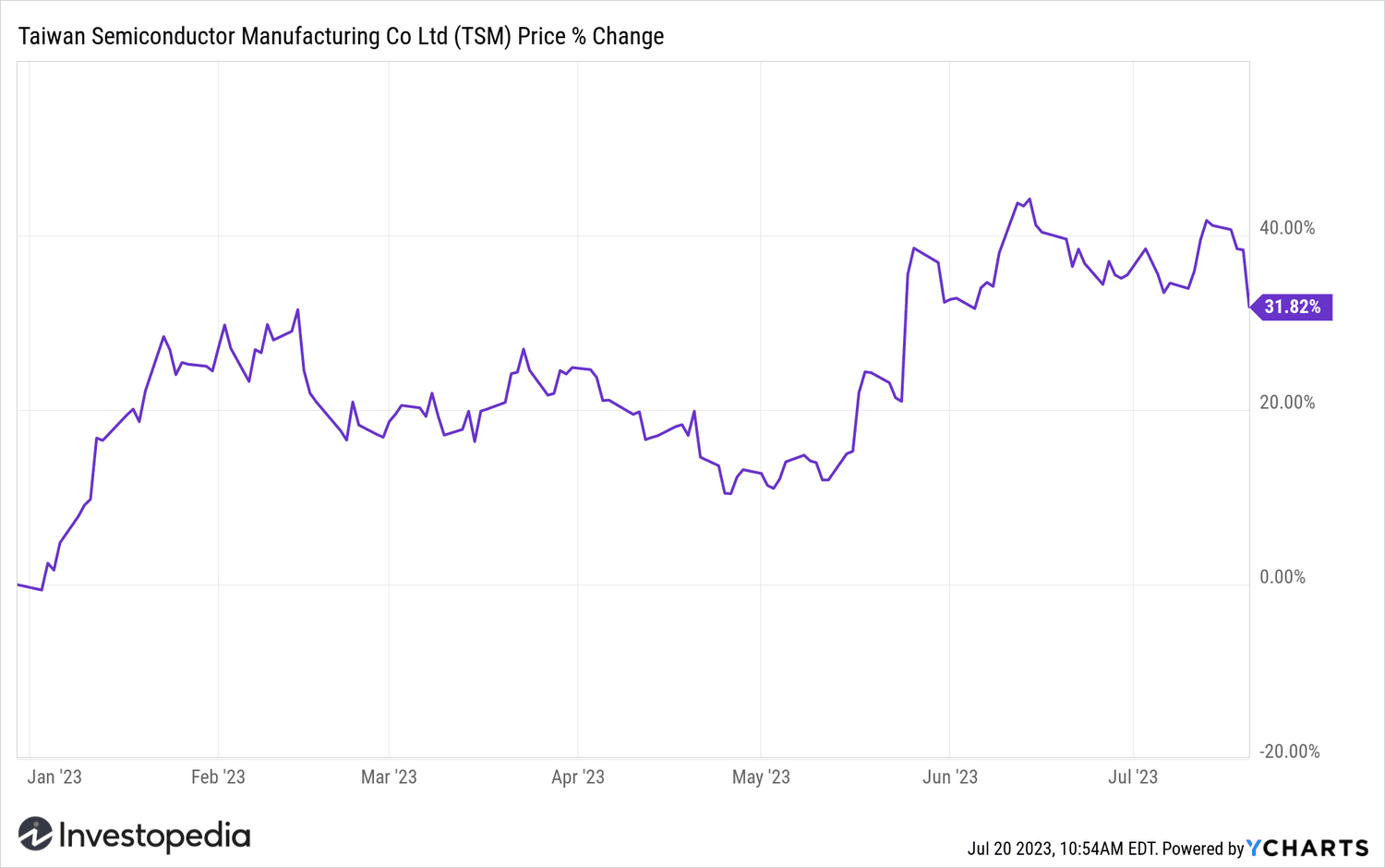

Despite Thursday's decline, TSMC shares are up more than 30% year-to-date.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com