Glu Mobile Inc. (GLUU) stock opened about 2% lower during the Monday session as traders took profits off the table following last week, the benefit of the race at the beginning of the trading session.

Morgan Stanley downgraded Glu Mobile stock to Equal Weight, from Overweight, but raised its price target from $8.00 to $10.50 per share. Analyst Matthew Cost is of the opinion that the market has fully appreciated the momentum that the company acquired in the course of the pandemic and sees significant margin expansion included in the share price, which has doubled in the last few weeks.

Revenues increased 11.9% to $107.3 million during the first quarter, beating expectations of $10.55 million, while the net loss to $0.06 per share, which was one cent per share, worse than expectations. Bookings have increased a lot-better-than-expected 15% during the quarter, and the company believes that it could reach $ 500 million by the end of the year.

TrendSpider

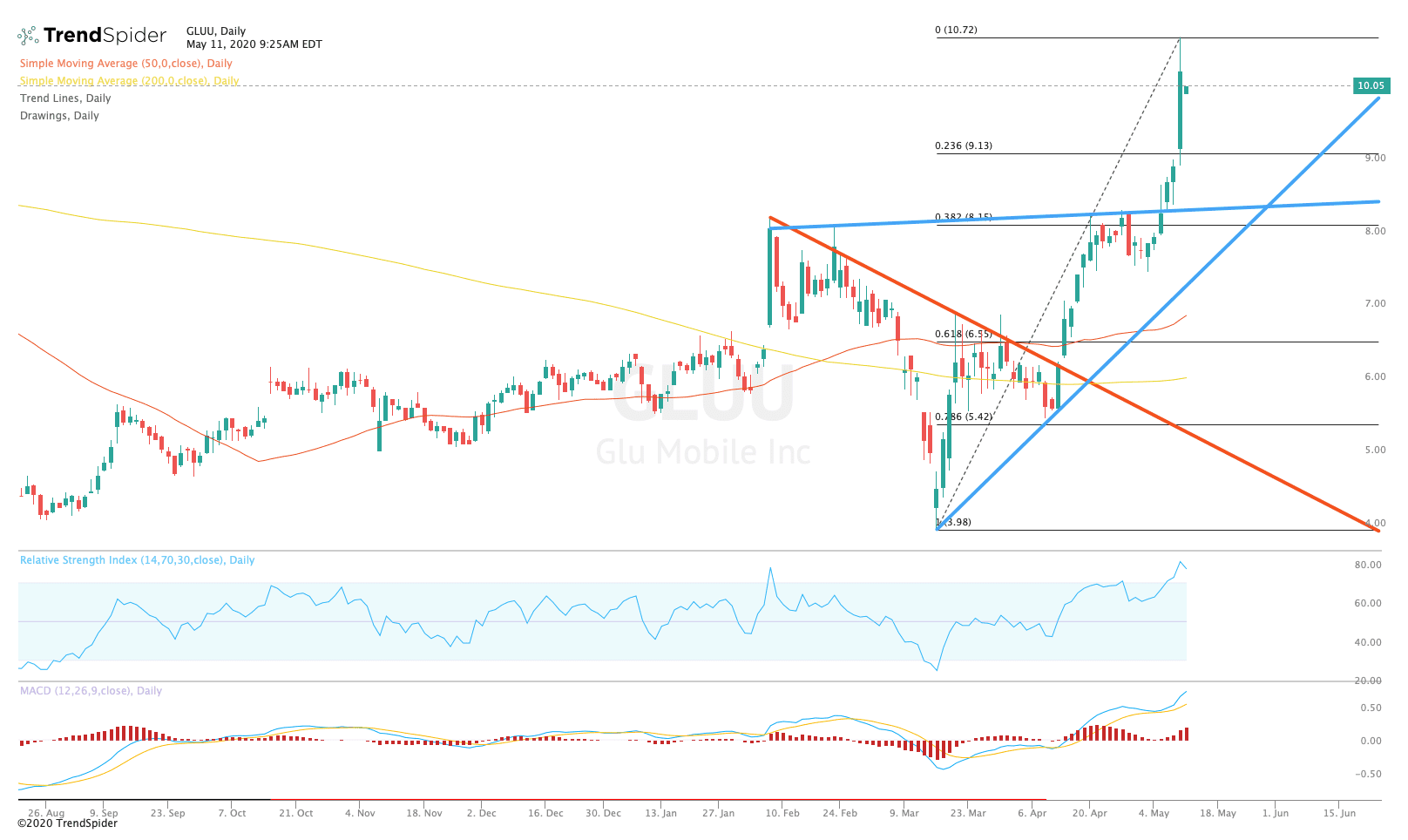

From a technical point of view, Glu Mobile stock has broken out of prior highs and trendline resistance at the beginning of this month and extended the next meeting of its financial results for the first quarter on Friday. The relative strength index (RSI) moved into overbought territory with a reading of 80.95, but the moving average convergence divergence (MACD) remains in a bullish trend. These indicators suggest that the stock could see some consolidation.

Traders should watch for a period of consolidation above Fibonacci support at $9.13 to a trendline support at about $8.40 on the medium-term. If the stock breaks down from these levels, traders could see a move towards the 200-day moving average at around $7.00, but this scenario seems unlikely given the bullish momentum. If the stock rebounds more, traders should watch for a move past $10.70 to new highs.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com