Key Points

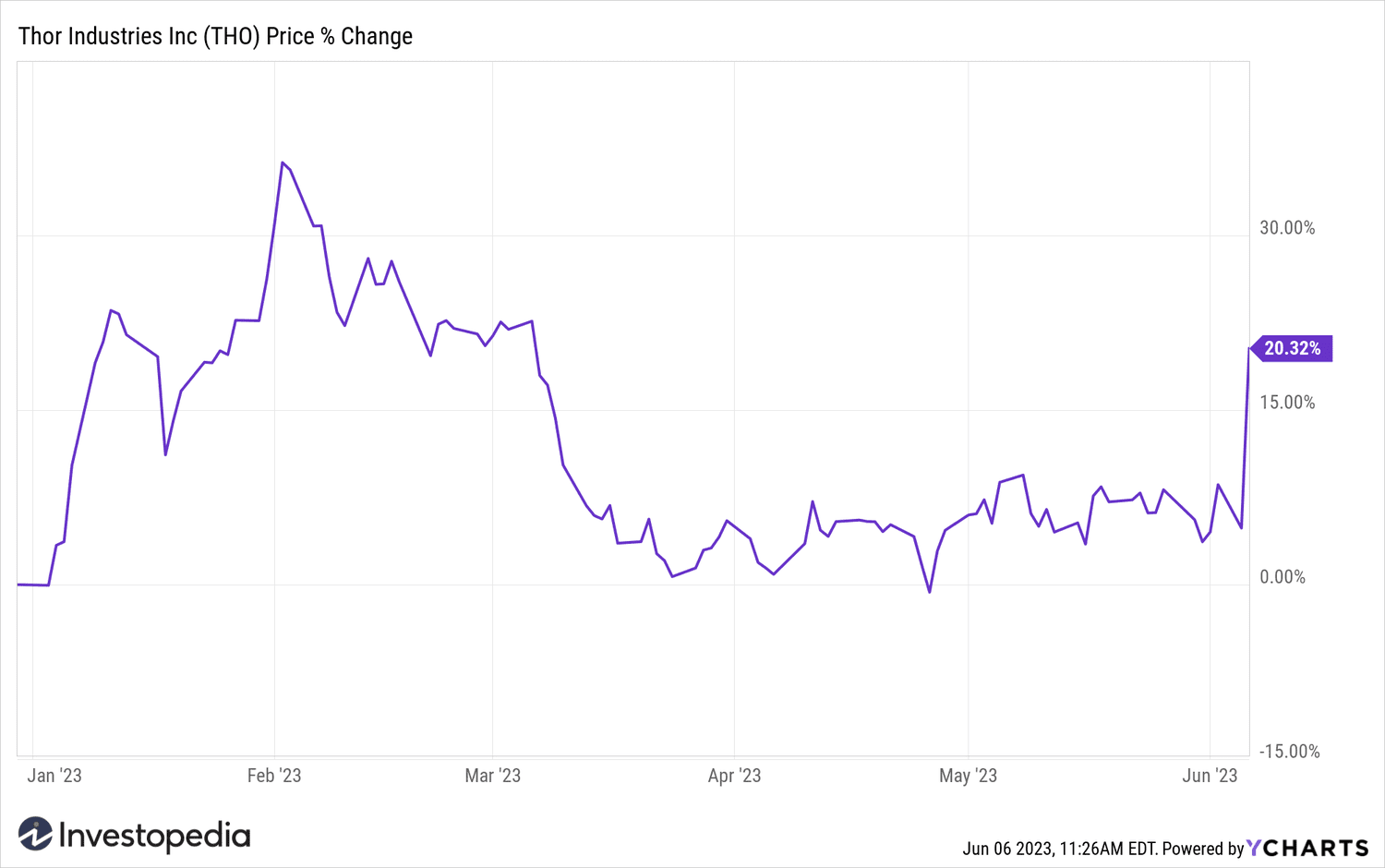

- THOR Shares of Industries surged after third-quarter earnings and sales beat estimates.

- The RV maker still sees 'macro challenges'; to continue in the near term.

- THOR has reduced its full year guidance.

THOR Industries (THOR) shares surged as the recreational vehicle (RV) maker posted better-than-ever results foreseen.

Maker of Airstream, Jayco, and other towable and motorized recreational vehicles reported earnings per share (EPS) of $2.24 per share in the third quarter of fiscal 2023, higher than double analysts' estimates. Revenue fell 37.1% to $2.93 billion, but still beat expectations.

The company has reported that it had reduced inventory, “product offerings based on customer preferences and contained costs.

CEO Bob Martin explained that “market conditions continue to be challenging” as dealers and consumers face “increasing pressures from the macro environment”. However, it said sales in North America drove increased production and foot traffic from the second quarter, while its European division benefited from higher prices, strong demand, operational initiatives and improved availability of RV chassis.

Always, because Expecting macroeconomic challenges to continue in the near term and reduced production before the rollout of 2024 models, THOR has tightened its full-year guidance. The company now expects sales of $10.5-11.0 billion, down from $10.5-11.5 billion previously. He sees EPS of $5.80 to $6.50 from the previous $5.50 to $6.50.

THOR Industries shares have increased by 14% on Tuesdays at 11:30 a.m. ET.

YCharts

Source: investopedia.com