Key Takeaways

- An increase in trading has led to more shutdowns at several large online brokers

- Schwab making TD Ameritrade received a key approval

- thinkorswim launches a web version of its powerful trading and analytical platform

- Two brokers offer discounts for transactions on their platforms

- A new exchange for the merchants future opens

- The Baby-boomers approaching retirement and can use a new application to estimate income and lower expenses

While bullish traders retail has continued to online transactions at a record pace, in the middle of a historic rally for stocks, the online brokers and the fintech developers are rolling out new products and features. Early statistics for the trading Can see continued trading surge compared with the same month in 2019, but they are flat compared to April.

More Breakdowns on the Great trading Days

An increase in the negotiation, on the morning of June 5, has caused a number of problems for trading platforms online, with a peak around 9:30 eastern time. Downdetector reported problems at Charles Schwab, E*TRADE, Fidelity, Merrill, Robinhood, and TD Ameritrade. On Twitter, customers of M1, Finance, and thinkorswim complained. Customers who have complained to their dealers on Twitter were invited to call support lines.

It is strange to see that so many brokers are suffering at a time when the market circuit breakers have not been tripped. These brokers do not share of compensation of companies; most are self-clearing. A M1 spokesperson told us on Twitter, “We had a great and unusual burst of traffic this morning, which may have caused problems for some people. We are currently in the process of working with someone who has been affected.” A TD Ameritrade spokesman reports by e-mail, “e-mail volume. We have had delays for about 4 minutes of commands that have been executed, but the messages were slow.” Of Schwab, we were told, “Due to a technical problem, we have experienced a delay in the reporting of the transactions to a small number of customers this morning. It was a declaration of delays (no negotiation), and we worked quickly to remedy the situation.”

Thinkorswim for the Web Launched.

At the end of May, TD Ameritrade has launched a simplified version of its downloadable platform, thinkorswim (TOS), which runs in a web browser. This version has been in development for nearly two years and supports at the time of trading in the live and papermoney, a simulator of trading. The web version of TOS is connected to all the same sources of data and trading engine as the desktop version and includes the same watch lists, including the dynamic lists update automatically as the stocks move filters.

Harrison Napper, senior product manager for thinkorswim TD Ameritrade said, “We want people to be able to use TOS for any device.” Napper notes that TOS web works on phones, tablets or desktop computers and that the TOS is itself a large ecosystem. Napper said, “we focused on the way transactional, and built our process to adapt to feedback quickly. We are to receive the bones to the customers and ask them to help us evolve according to their needs.” As customers demand additional functionality, including studies for the technical mapping package, Napper said that these items can be added.

“One of the reasons why it took some time to bring this has been the challenge of managing data,” Napper said. When you refresh the page, it reloads the entire application. The team has done a lot of work on the reduction of the data payload and the weight of the application itself. The technical team had to invent a technology to attach all of the front face, the flow of data and the trading engine. During a brief hands-on test, we found the web platform, very responsive and suitable for a rapid negotiation of tasks and control over the balances. The analysis of the power of the desktop platform is still the place for a lengthy analysis and negotiation sessions.

Schwab’s acquisition of control of TD Ameritrade Clears the Obstacles.

On June 4, 2020, the shareholders of Charles Schwab has approved the proposed acquisition of TD Ameritrade. In a separate meeting the same day, the shareholders of TD Ameritrade has approved the acquisition. The two groups of shareholders, offers very little resistance to the fusion, with less than 1% at all meetings of voting in the opposition.

Earlier in the day, the Ministry of Justice has given Charles Schwab antitrust approval of the acquisition. There were concerns about the concentration of investment advisor managed since the merger would result in more than a third of the registered investment advisor of the guard from market under one roof. All that remains to proceed to the resumption of regulatory approvals. The repurchase is expected to be completed in the 4th quarter of 2020.

The Rebate Negotiation

Two brokers, which is again, proposing to share the revenues that they will generate payment for order flow with their clients.

SogoTrade has introduced a new pricing structure as well as a program called “Paid For the Trade” which launches Friday, June 5, 2020. Commissions on equity limits, the orders are cut from $4.88 to$ 0, more orders to add liquidity earn $0.001 per share on a minimum order of ten shares. It is a unique program structure.

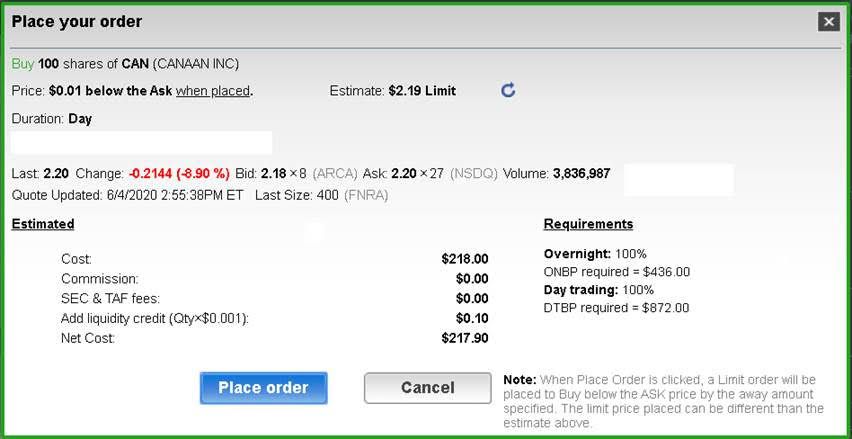

In the framework of this program, SogoTrade introduces a new type of command which appears on the order entry screen as GP2T (Limit). This type of order puts in place a limit order by default for a penny away from the market, the customer can modify up to $0.05 of the contract price. If the order is deemed to add liquidity to the market, you will see the credit of your purchase will generate once it is running. The order status page has a new column with the header “GP2T” which is highlighted in green if you have work orders if a credit is being.

SogoTrade GP2T Verification of the Order.

It can be difficult for a beginner or intermediate trader, to know in advance if an order is to make or take liquidity, but SogoTrade control of the registration process, you will be notified immediately if your order is eligible for the credit. Kristopher Wallace, chief executive of Asset Management at SogoTrade said, “We’ll make less money by revenue sharing, but we think we’re going to be attracting new business and volume.” Wallace said that SogoTrade wants to be competitive in a zero commission world and that it is a simple way to get a discount compared to some other brokers that share a discount.

We all, a San Francisco-based firm that opened its virtual doors at the end of May 2020, offers to share the income generated by their financial relationships with market makers with customers, and also automatically everyone enrolled in a fully paid securities lending program. We all commitments to extend credit of customer accounts with $0.0001 per share traded (minimum price of $1 per share) in the aftermath of the execution of a transaction. Customers who have shares that gets loaned out to short sellers will be credited once per month with 30% of the turnover of the brokerage is paid by its clearing firm, Apex Clearing. Stock trades are without commission and interest margin was 5.75%, which is below the average.

All of us has a website as well as on iOS and Android mobile platforms. At launch, only stocks and Etfs can be traded, but the company says its roadmap includes the addition of retirement accounts, mutual funds, options on shares and bonds over the next two years. The order can vary depending of the interest of the clients. All of us, it is registered in 47 U.S. states and the District of Columbia, but is not yet recorded in Illinois, Massachusetts, or Missouri.

Of these two offers, SogoTrade is ten times more generous with the discount.

A New stock Exchange for Futures contracts

The Small stock Exchange, a futures exchange offering smaller, simpler products to retail customers, which was launched on 1 June. This exchange has been in the works for a couple of years that developers have refined the process of construction, pricing and trading of products.

At launch, there are three Smalls stocks, the US Dollar, and precious metals. The Small Inventory of 75 Index is composed of 5 equally weighted sectors, each sector contains 15 tracks. These sectors include information technology, industrial, energy, financial services and materials. Small US Dollar is priced directly on the dollar, and it spreads USD exposure through the Euro, the Chinese yuan, Japanese Yen, british Pound, Canadian Dollar, Australian Dollar, canadian Dollar and the Mexican Peso. Small Precious Metals combines and weights the most popular of the precious metals in the world production, and u.s. consumption, and the volume of trade. Then, in the product of the queue are Smalls, which cover 10-year treasury bonds and the global oil market.

The contracts are designed to be homogeneous, and to move in increments of 0.01 that is equal to $1, which expire on the third Friday of each month. The Little Exchange is the result of the work of financial network tastytrade, and the products are available for the trade now tastyworks, Tradovate, and Gain Capital, among others. Interactive Brokers, which has recently made an investment in The Small stock Exchange, offers the Smalls in the near future. Tastytrade has a free course that describes what the products are, and offers practical examples of the negotiation.

Paste Adds The Options Trading

The dough, a commission-free on iOS and Android app focused on the online broker which was launched last summer, has recently put online option trading to its clients. To be eligible, you must have at least $2,000 to the balance.

The brokerage is led by Victor Jones, who had a 12-year tenure at TD Ameritrade and thinkorswim, and was TD the director of operations and exploitation. The dough itself is part of the tastytrade family. Jones is enthusiastic about the training of new investors and traders, the platform is loaded with short videos to explain the recent evolution of the market and investment concepts. The order entry ticket by default is a limit order, which Jones encourages. Jones, a millennial himself, says his generation wants to develop a deeper understanding of the markets, and describes the dough as, “a long-term relationship for a generation of investors to help understand the risks and the strategy through a new business model.”

You can open an account in the dough without making a deposit, and access to all of the platform’s content at any time. New unfunded accounts have 15 days of free real-time quotes; if even the capitalization, quotations of return to delay.

New Application for the Baby-Boomers Approaching Retirement

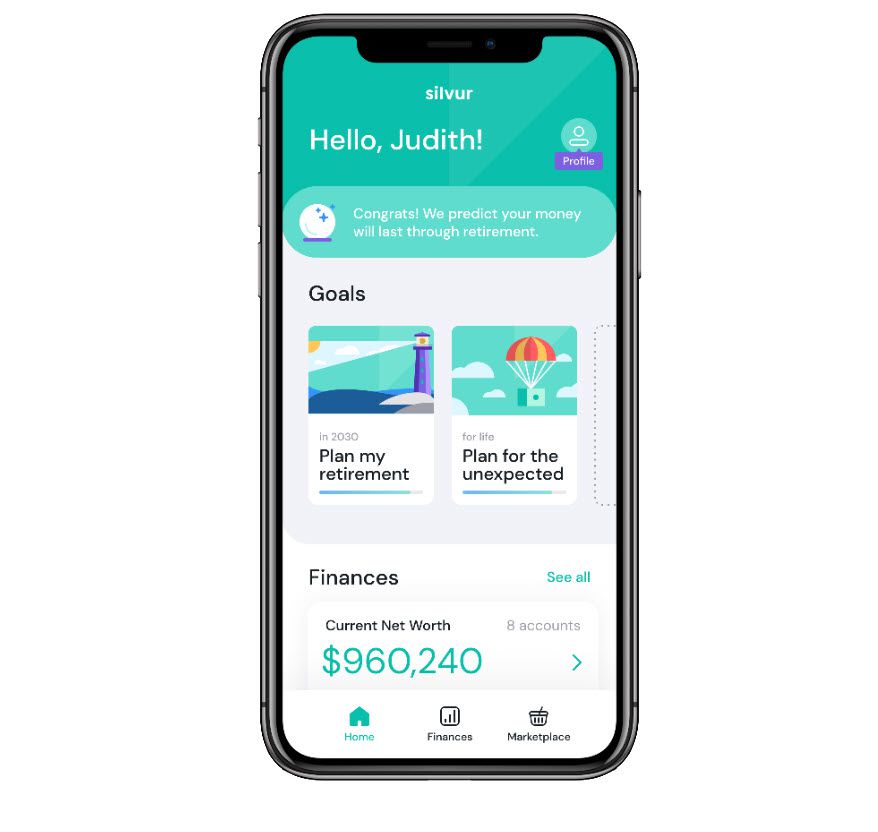

Kindur, an SEC-registered investment advisor dedicated to helping retirees feel ready to move in retirement, has recently published the Silvur application, designed to help baby boomers and others to avoid wasting their money. At launch, it is a iOS-apps, but there will be an Android version available soon. Silvur operates another Kindur-developed piece of technology, SmartDraw, to estimate baby boomers ‘ financial situation during retirement with the objective of providing the awareness of the potential financial pitfalls.

The Silvur dashboard lets you know how you are progressing towards retirement.

The application is free to download and use, the generation of income through partnerships of affiliation, that users can take advantage of if they wish. Silvur has established a partnership with a variety of consumer brands, including Uber Eats, Hulu, wine.com and others offer rebates that are deposited into users’ bank accounts. Silvur is adding new partners every week, including the financial services, such as home refinancing, credit cards, auto and home insurance, wills preparation and income tax filing.

Silvur calculates the required minimum distributions (rmds) from traditional Ira, which is changing all the time, especially through the various relief packages that have been adopted by the Congress in the course of the pandemic. The interface is designed to create a guidedexperience. Each step is carefully laid out and to the practice of the test, I have not run in places where I had to figure it out on my own. If you are over 55 years of age, this application is very useful and does a good job of walking users through the process of retirement planning.

Source: investopedia.com