In recent months, the communications sector has gained in importance in the portfolios of investors around the world. Due to the number of people suddenly work and stay at home because of the COVID-19 pandemic, the demand for products and services in this sector is expected to remain strong for many months to come. In this article, well take a look at several chart patterns in the sector as a whole and try to determine how the followers of the technical analysis will be in position to take advantage of the increased demand.

iShares Global Communication Services ETF (IXP)

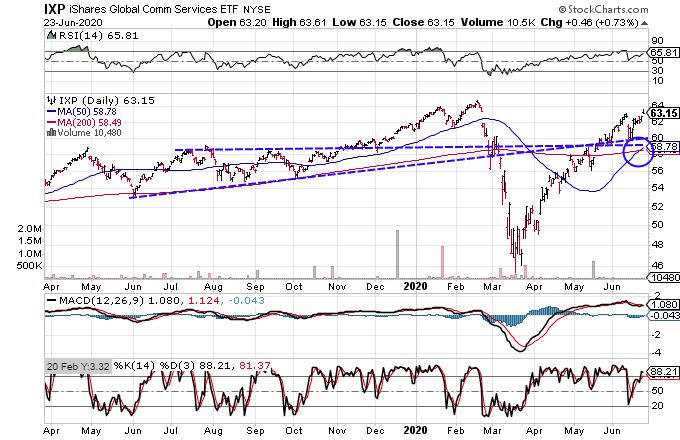

Active traders who are interested in the niche sectors such as communication services often turn to exchange-traded products such as the iShares Global Communication Services ETF (IXP). Taking a look at the chart below, you can see that the bounce from the March lows has resulted in the price of the fund back above its 200-day moving average.

Traders to take note of how the 200-day moving average has acted as a strong level of support in the past and how it has supported the price again earlier this month, suggesting that the bulls are in control of the amount of movement. The recent upward movement has also triggered a bullish crossover between the 50-day and 200-day moving averages, which could be used by followers of the technical analysis to mark the beginning of a new long-term uptrend. From a risk management perspective, most traders will likely set their stop-loss orders below $58.49 in the case of a sudden change in market sentiment.

StockCharts.com

Facebook, Inc. (FB)

Usurping for many, the top of the holding of the PE of the ETF is Facebook, Inc. (FB). Because of the competitive advantage of the company to facilitate the connections between people from all over the world, traders often see Facebook as a macro bet on the global communication services.

Take a look on the table, you can see that the strong movement since the March lows has triggered a bullish crossover between the 50-day and 200-day moving averages. The said moving average crossover combined with the recent break beyond the January highs puts the short-term momentum clearly in favor of the bulls. Stop-loss will probably be placed below $213.78 or $197.61, depending on the risk tolerance and investment horizon.

StockCharts.com

Alphabet Inc. – Class C (GOOG)

Another top holding of the PE of the ETF, which will be likely to capture the attention of active traders in the course of the coming weeks is the Alphabet Inc. – Class C (GOOG). As you can see on the chart below, the share price has increased above the resistance of the 200-day moving average and triggered a bullish crossover between the long-term moving averages in a manner similar to tables discussed earlier.

However, traders will also want to note that, in the case of the Alphabet Class C shares, the price still has to pass over the proximity of an influential trend curve. Bullish traders will likely want to keep an eye on the dashed-line curve, because several consecutive close above this level could be the catalyst for a major flood of buying pressure. Once again, from a risk management perspective, stop-loss orders will probably be placed below the 200-day moving average at $1321.80 in the case of a sudden change in market sentiment.

StockCharts.com

The Bottom Line

The volume of Stocks in the communication services sector have been the subject of attention of many traders because of the key role these companies play in the daily lives of millions of people, but also because of the break beyond the key resistance levels. As shown in the graphs above, close to the support levels, the risk/reward at current levels in favour of the bulls, and many will be likely to place stop loss orders below the respective 200-day moving averages in the case of a sudden sale.

At the time of writing, Casey Murphy did not own a position in any of the assets mentioned.

Source: investopedia.com