Dow component The Home Depot, Inc. (HD) the reports of the first quarter of 2020 earnings on Tuesday, May 19, with analysts looking for earnings per share (EPS) of $2.26 on $27.5 billion dollars in revenue. The stock sold after you have tested the bull market high in response to February for the fourth quarter of 2019 report with the shareholders of hitting the exits after the company has lowered the annual forecast. The low has dropped to less than two weeks later, with a 42% decline in mid-March.

The home improvement giant has reduced the hours to restock shelves, and perform cleaning services for the coronavirus pandemic. He has received two Wall Street upgrades and a downgrade since the last earnings report, with bullish analysts were expecting a quick recovery. However, the loss of more than 20 million jobs has generated a moment of crisis of the housing, with furloughed workers forced to cut back on plans to buy a house or renovate an existing property.

The stock has rebounded sharply off the March lows, retracing more than 90% of the distance back to 2020 of the high, with investors viewing the company as a potential winner during a period of recession. The Accumulation almost matched the positive price action, configuration of favourable conditions for a possible break above the resistance. However, he has not posted a single lower in the last two months, the anticipation of a multi-week decline before an upward trend is sustained.

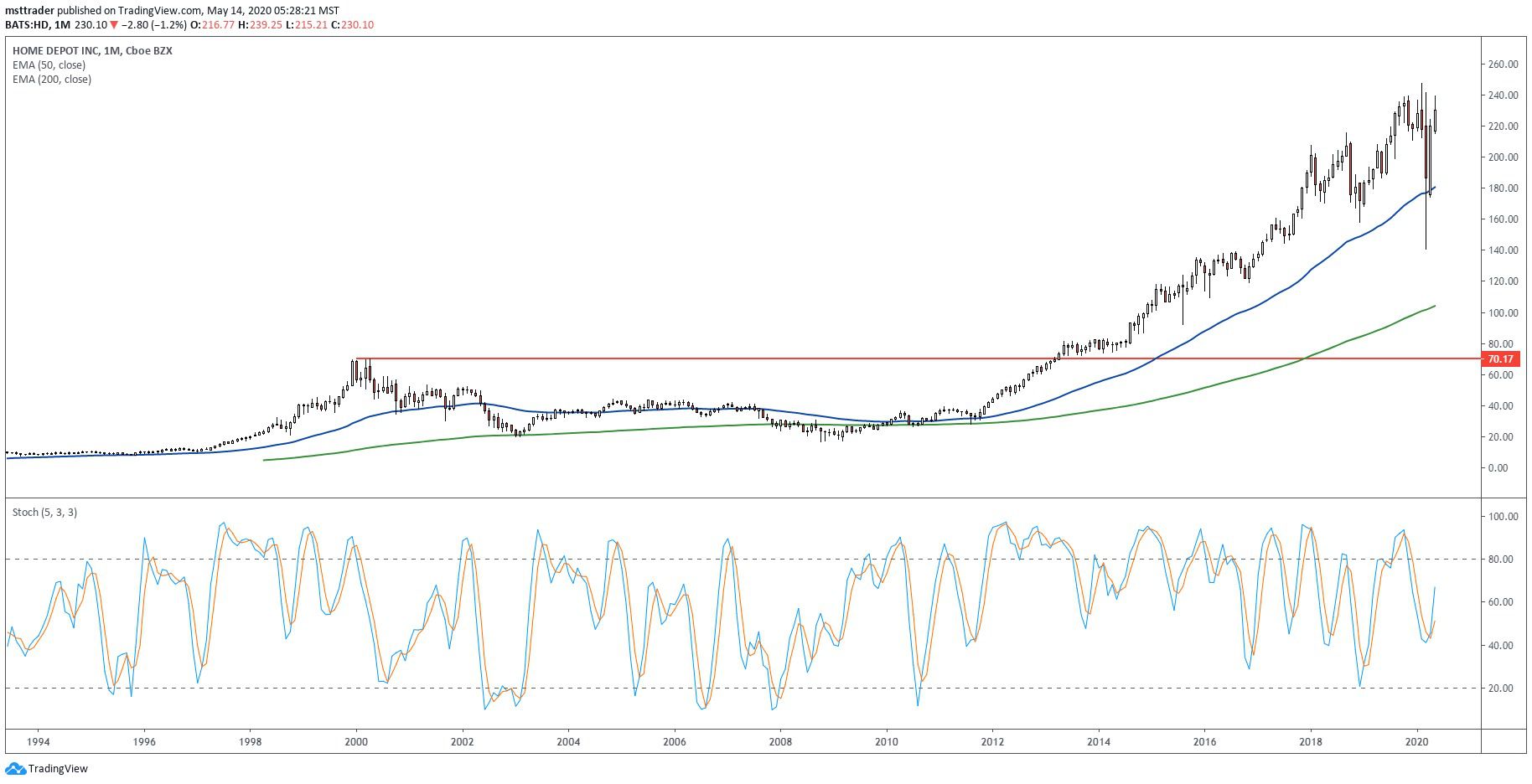

HD Long-Term Graph (2000 – 2020)

TradingView.com

A powerful up trend posted an incredible nine stock splits between 1987 and 1999, with a rapid growth, supported by the paradigm shift away from small equipment in the big box stores, home improvement centers. Advance finally the summit, to $70.00 in April 2000, to mark the high for the next 13 years, to the front of the complex of the decline that has carved a series of lower highs and lower lows in February 2003 of a five-year low of $20.10.

A modest recovery of the wave blocked near 50% sell-off of the retracement level in 2004, while three small attempts in 2007 failed, giving renewed decline which has accelerated during the economic collapse of 2008. The fall is vertical below the 2003 low by three points before finding support, the display of an 11-year low ahead of a choppy rise which has taken over three years to achieve a return in front-top.

A 2012 breakout ended in the low $80 in 2013, which gives a triangular based model, followed by a second escape in the third quarter of 2014. The stock posted gains stable in January 2018 and has stalled once more, with the trade of the war of the headwinds affecting broad sense. He finally cleared the resistance in August 2019, carving a small increase of which has posted a record high of $247.36 in February 2020, just three days before the results of the fourth quarter report.

HD in the Short-Term Chart (2017 – 2020)

TradingView.com

The decline in March breached strong support at the 50-month exponential moving average (EMA) before rising to the level at the end of the month. This constructive price action established a monthly stochastic buy of the cycle, which is the acceleration of less than a week before the report of the first quarter. The increase was also installed as the .786 Fibonacci sell-off of the retracement level, the marking, the last obstacle to the advance of the return to the bull market high. However, closely aligned to the 50 and 200-day EMAs look like magnet target for a certain distance, which suggests that the sum of 210 to 215 $of the area will offer a low-risk buying opportunity.

The balance volume (OBV), the accumulation-distribution indicator posted a new record high in January 2018 and is entered in a distribution phase, in advance of the failure of escape attempts in June and September. OBV finally allowed the barrier in December 2019 and a new one support through the first quarter of decline. It has not reached the state of high in the rebound in mid-May, but it is well placed to withstand a multi-week downturn before turning higher with price increases.

The Bottom Line

Home Depot stock has almost recovered from the first quarter of the rout and could get out of a bull market high in the coming months.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com