First Republic Bank (FRC) is about to collapse as stocks fell to new all-time lows on reports that the federal government and the nation's biggest banks are reluctant to mount a bailout.

Beleaguered lender reported Deposit outflows of more than $100 billion in the first quarter, or 40% of the total. That figure would have topped 50% had it not been for a $30 billion injection of uninsured deposits from 11 of the country's largest banks in March.

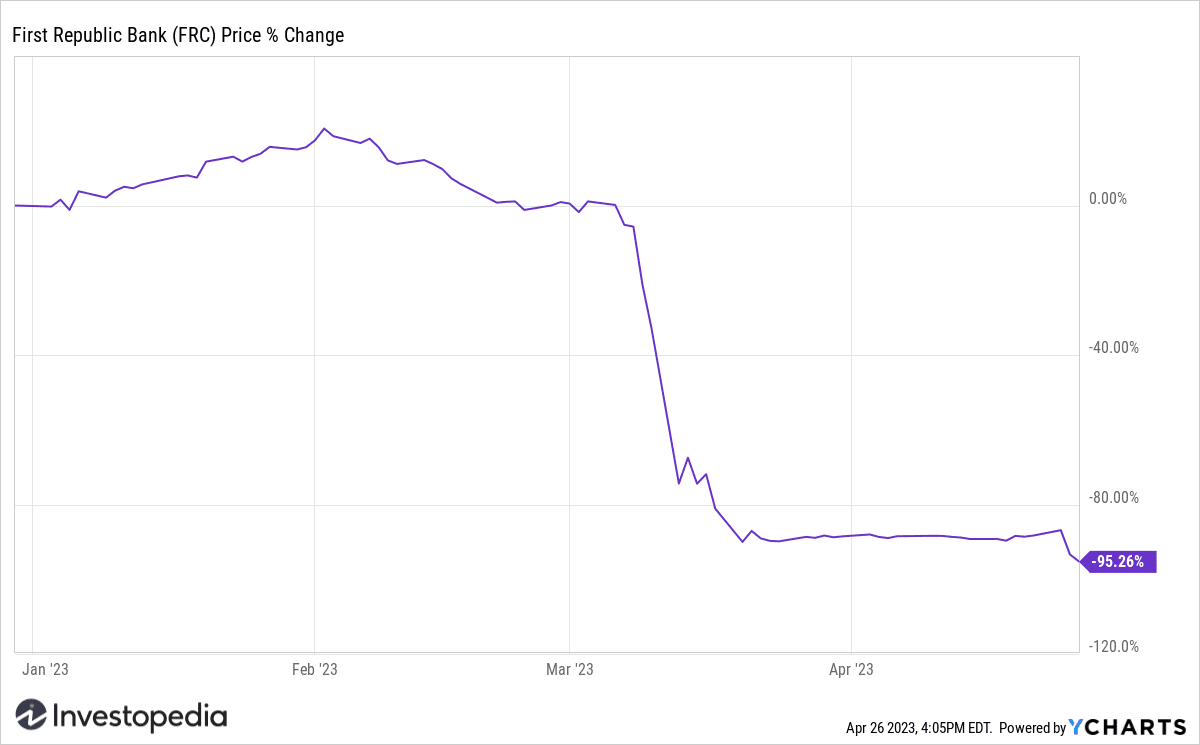

In response, FRC shares plunged almost 50% yesterday and are still down 30% today. The bank's market capitalization fell below $1 billion in intraday trading, a small fraction of its peak of $40 billion in November 2021. Its price-to-earnings (P/E) ratio fell to 0, 7. The stock's volatility prompted the New York Stock Exchange (NYSE) to suspend trading in the FRC 12 times on Wednesday.

To make matters worse, first Republic faces the prospect of losing access to Fed lending facilities if a private deal is not struck quickly, Bloomberg reported. US regulators prefer a private rescue that would not involve federal authorities seizing the bank, which could further deplete the FDIC's insurance fund.

Management is scrambling to convince regulators and the heads of bigger banks to provide one more financial lifeline. The leaders are engaged in a last-ditch effort to improve the bank's financial situation.

His options include transferring troubled assets to a “bad bank” or selling assets at above-market rates. However, other banks may be reluctant to step in for fear of losing their uninsured deposits and would prefer the FDIC to take control of some of the First Republic's assets.

First Republic Bank met financial trouble shortly after the collapse of Silicon Valley Bank (SVB) and Signature Bank in March, as it held the third highest share (behind the two collapsed lenders) of uninsured deposits that exceeded the FDIC's $250,000 limit.

The FRC action fell 60% in the first trading session after the collapse of SVB and Signature Bank. They have since extended their decline and are down over 95% year-to-date.

Y-Graphs

Source: investopedia.com