Key Takeaways

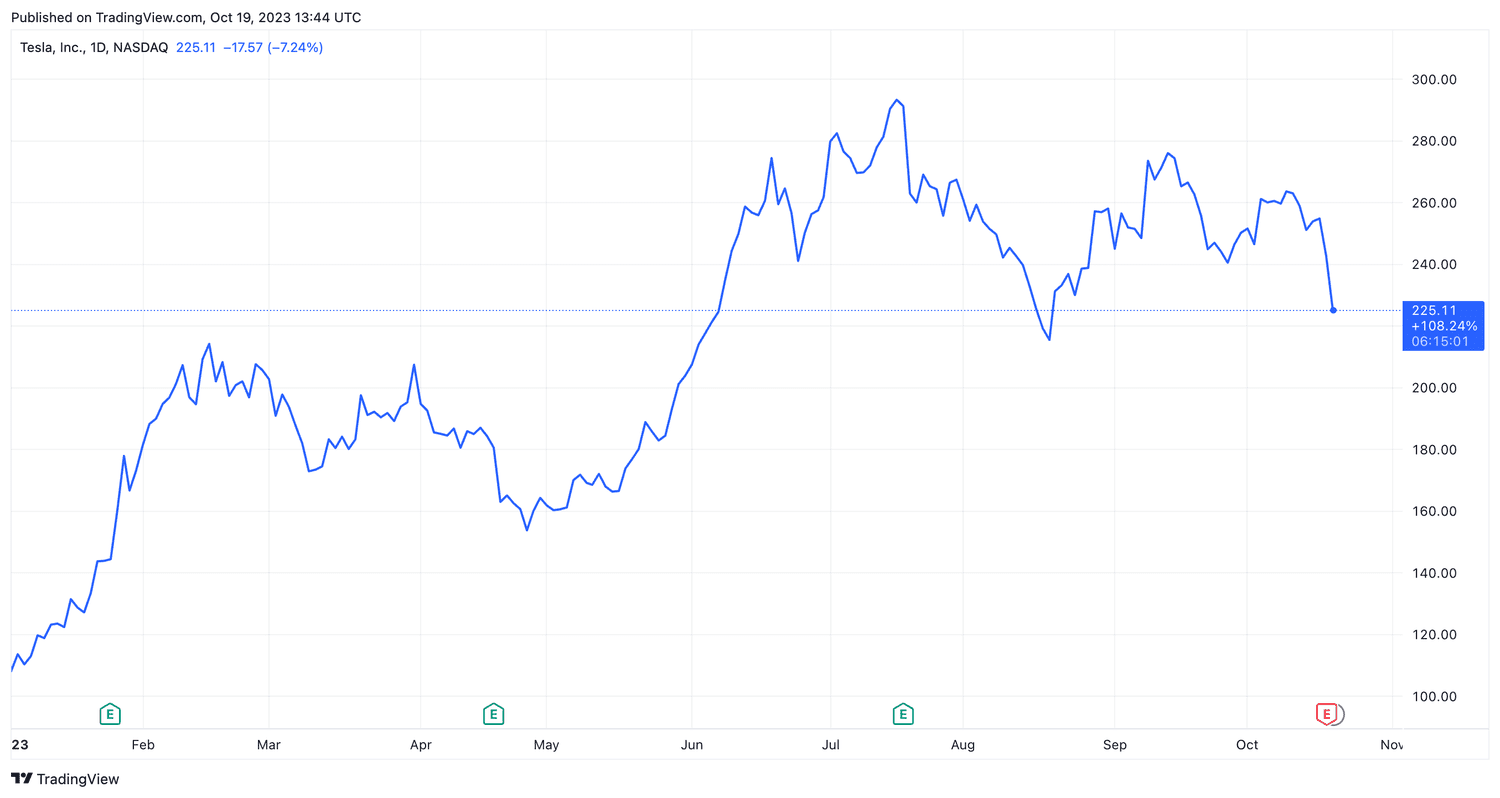

- Tesla shares fell more than 9% Thursday afternoon after the electric car maker's lackluster third-quarter earnings report.

- CEO Elon Musk said the rise interest rates canceled out the impact of Tesla. Price cuts have made it more difficult for consumers to buy cars.

- Rising interest rates and global economic concerns have also weighed on Tesla's Mexico factory expansion.

Tesla (TSLA) shares fell more than 9% Thursday afternoon, after the electric car maker's lackluster third-quarter earnings report the day before showed that price cuts ate into profit margins. However, CEO Elon Musk blamed high interest rates for making price cuts ineffective in boosting sales volume and warned that “stormy” macroeconomic conditions could prove difficult for the company. ;business.

Higher rates resulted in Tesla price cuts ;t Effective

Tesla is not immune to broader economic challenges, including rising interest rates and persistent high inflation, which are affecting the auto industry and consumers.

Since many buyers Many cars take out loans to pay for their vehicles, rising interest rates have made it more difficult for consumers to finance these purchases.

"If interest rates remain high or if they rise further, it makes it that much harder for people to buy a car. They just can’t afford it,” he said. Musk said during the company's earnings call.

This prompted Tesla to reduce sales prices of its vehicles in an effort to boost sales growth, which hurt the company's profit margins last quarter. But interest rates rose more quickly, limiting the impact lower prices could have had on helping customers buy Tesla cars.

“When you look at the cost or the price reductions that we've made on, say, the Model Y, and you compare that to the increase in people's monthly payment due to interest rates, the “The price of the Model Y is almost unchanged,” Musk said on the call, referring to an internal cost analysis done by the company.

Interest rates, economic concerns weigh on plant expansion

Higher interest rates and a difficult global economic context also prompted Tesla to delay the construction of a new gigafactory in Mexico. However, Musk reiterated that construction is a matter of when, not if, and depends on the trajectory of interest rates.

“The question is really only a question of timing, and there is going to be a record broken on the interest front. It's just that interest rates need to come down, he says. » Musk said. "I think we want to get a feel for the global economy before we go all in on the Mexico plant."

Cybertruck Production Challenges

Deliveries of Tesla's highly anticipated Cybertruck are scheduled to begin November 30. During the company's earnings conference call, Musk said there could be “tremendous challenges” in achieving volume production and positive cash flow, but reiterated that such production challenges are “normal” when it comes to products as different and advanced as the Cybertruck.

“If you want to do something “Something radical and innovative and something really special like the Cybertruck, it's extremely difficult because there's nothing to copy,” he said. Musk said.

Analysts Reaction to Tesla Earnings

In a research note, analysts at Wedbush Securities called Tesla's third-quarter earnings release a “mini-disaster.” as Musk and other executives focused on rising interest rates and Cybertruck-related production challenges, while Wall Street expected more clarity on falling margins and Tesla's price cuts.

Despite this, analysts of Wedbush remain bullish on Tesla and maintained their “outperform” rating on the automaker's shares. Analysts lowered their price target on TSLA from $310 to $350, reflecting increased caution from Musk and other executives.

Bank of America analysts were slightly more pessimistic and assigned a “neutral” rating to the stock, citing macroeconomic risks, price cuts and increased competition in the electric vehicle (EV) market. Analysts cut their profit estimates for the end of the year, but said Tesla's gross margin could recover slightly in coming quarters.

Despite Thursday's decline, Tesla shares have more than doubled since the start of 2023.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com