Tesla, Inc. (TSLA) stock opened Friday’s session, less than 100 points below February all-time high at $969, following a spectacular recovery of over 500 points in March, the pandemic is low, setting the stage for a potential escape, which raises the electric vehicle manufacturer in the quadruple digits. Who is going to mark a historic achievement in the traditionally cyclical automotive sector, in particular with the combustion engine rivals to cut production, due to the high rate of unemployment.

Similarly, a break-up would be speculative, because the company had to close in California, in March, the cut in the first half of the sales. The company is also dropping the North American prices of 6%, in an attempt to sell more vehicles, but that also means that he will earn a lower profit on each sale at a time, tens of millions of people are without work. Given these developments, a second wave could be devastating to the bottom line, may be the trapping of the shareholders in a second significant decline.

The manufacturers hope that demand for personal vehicles will be on the rise because of a growing aversion to public transport, but it will be difficult for Tesla to achieve profits and sales targets, at least as the employment figures increase sharply in the coming months. Rapid re-openings around the world have increased the optimism for this bullish result, but few analysts now expect a V-shape of the economic recovery before 2021 at the earliest.

Reasons to Be Optimistic

However, there are reasons to believe that Tesla is going to thrive in the middle of the decade. First, earnings and revenue for the first quarter of 2020 beat estimates, highlighting the continued demand in spite of the pandemic. The margin and the free cash flow has also increased in the first quarter, despite the stiff headwinds. Secondly, the order book has held the highest ever order backlog at the end of the month of March, with deliveries delayed due to production stoppages. Third, in California, has thrown in the towel quickly and leave the factory in Fremont to reopen when the CEO Elon Musk has threatened to stop operations and move them to the Midwest.

Technically speaking, there are now few barriers to a breakout above$ 1,000. The jump in March turned on a dime to a new support generated by the December 2019 breakout above 30 months of resistance, confirming the new floor. The purchasing power increased during the rebound, the lifting of the accumulation of measures to February peaks. Finally, the relative strength of the indicators cooperate with the effort, the monthly stochastic oscillator engaged in a buy cycle which has not reached the level of overbought.

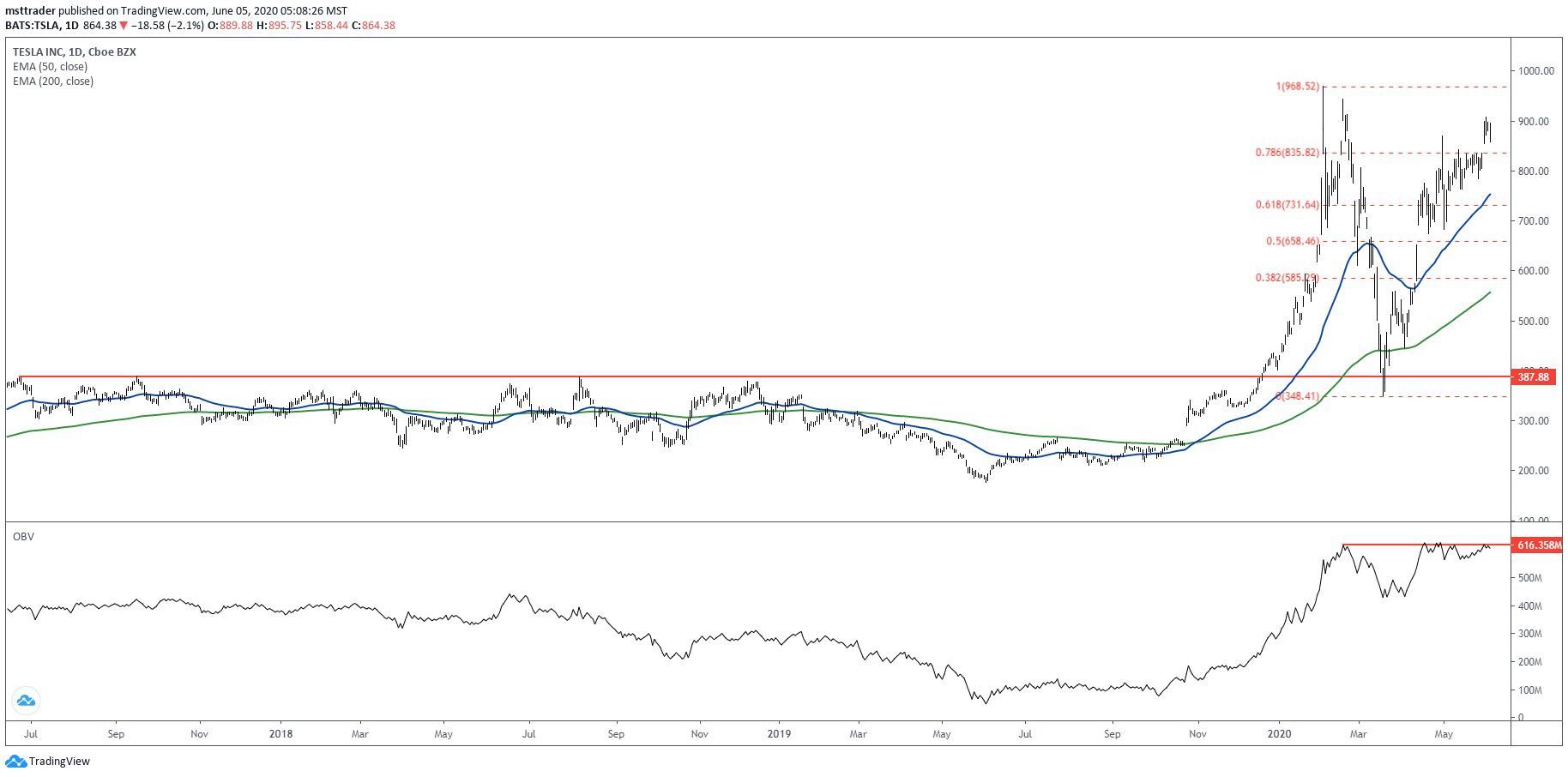

TSLA in the Short-Term Chart (2017 – 2020)

TradingView.com

The stock topped out at $387 in the second quarter of 2017, leaving the place in a trading range with support below$ 250. It broke down in May of 2019, entering a downward trend which has posted a two-year low a month later. The share price has completed a selling climax, before a recovery wave that the reassembly of the broken support in October. The increase in subsequent reaches range resistance in December, which gives an immediate escape, which has generated an intense dynamic the interest of buyers.

The short sellers crashed after the escape, with the increase in the addition of nearly 600 points in seven weeks before topping $968.99 on Feb. 4. The failure of a breakout attempt later in the month completed a small double top, before a sharp drop which gave 100% of the increase before rebounding strongly to $350 in March. The subsequent impulse purchase carved on the rise, Elliott five-wave advance, stalling at $870 and it is the triangular consolidation that has persisted for the past five weeks.

The model for the month of February has carved the outline of an inverse head and shoulders breakout pattern, although the right shoulder is not quite up to the first quarter of high. However, bullish expectations remain the same, with a rally in the quadruple digits of targeting a measured move up to$ 1,500. While this increase may not correspond to the trajectory of the current rebound, it would still reward shareholders with windfall profits.

The Bottom Line

Tesla stock has confirmed the month of December escape and be able to trade well above $1,000 in the coming months.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com