Tesla's Aggressive Price Reduction Strategy (TSLA) hurt the company's profitability in the second quarter of the year, despite record sales and shipments. Tesla shares fell about 4% in extended trading as Elon Musk reiterated his stance of “sacrificing margins” to boost sales volume.

Key Points to Remember

- Tesla's second-quarter operating margins shrank 9.6% due to aggressive price cuts.

- The electric vehicle maker posted record revenue of $25 billion, even as its margins and cash flow were disappointing.

- Tesla could spend more than a year billion dollars in the Dojo supercomputer to train its driverless cars.

Price cuts eat away at Tesla profits but Musk unfazed

Tesla's second-quarter operating margins were 9.6% lower than the same period last year due to the company's price reduction strategy. And Musk remains unfazed.

“It makes sense to sacrifice margins in favor of making more vehicles because we believe that in the not too distant future they will see a dramatic increase in valuation,” he said during the talk. 39;call for results Thursday.

Some analysts agree “Tesla is seeing steady demand after price declines in the US and China, with margins now in stabilization mode expected to bottom out over the next 1-2 quarters.” he added, Wedbush Securities analysts wrote in their post-earnings note.

Following the company's record deliveries, powered by an increase in sales in China, Tesla was able to report auto revenue $275 million higher than the prior quarter, but 46% higher year-over-year.

An increase in services revenue of around $300 million helped push the overall figure higher. However, free cash flow of $1.01 billion is below estimates of $2.18 billion. Despite the drop in cash flow, the company still added $700 million to its $23 billion cash position.

Billion Dollar AI Investment

Musk plans to spend more than $1 billion by the end of next year on Tesla's Dojo supercomputers that will be used to power his driverless cars.

Real World Data, Network Neural training, vehicle hardware and software are the four pillars of self-driving technology, according to Tesla, which is currently working with an Nvidia supercomputer (NVDA) for the training aspect.

Musk said Tesla will continue to work with Nvidia , while the Dojo supercomputer that will focus on video training helps reduce training costs.

The way to go can be bumpy

However, some analysts are worried about the company's performance for the rest of the year. The latest results pointed to higher operating costs as the company continues deliveries of Cybertrucks, which it says are on track for this year. There was also a sharp decline in regulatory credits which came to $282 million from $521 million in the first quarter.

The bank of investment Goldman Sachs downgraded Tesla stock at the end of the second quarter, with analyst John Delaney citing the stock's rally and a difficult price environment.

“Overall, we believe Tesla is well positioned for long-term growth, given its leadership position in the electric vehicle and clean energy markets (which we attribute in part to its ability to offer complete solutions including charging, storage, software/FSD and services with a direct sales model), is now better reflected in stock," Delaney said.

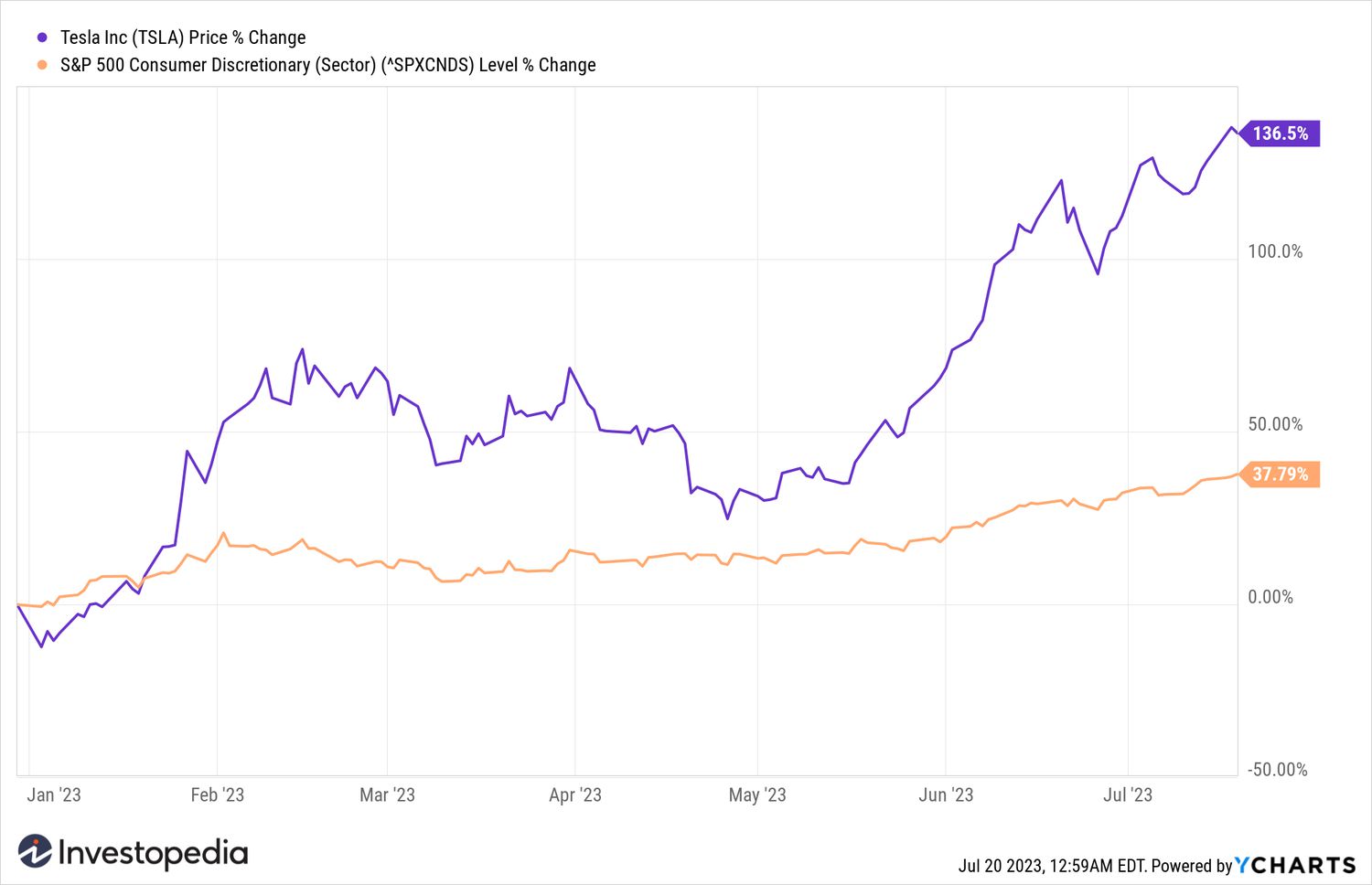

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com