Key Takeaways

- Analysts estimate adjusted EPS of$0.07 against -1,12$T2-2019

- Vehicle deliveries fell year-on-year.

- Analysts expect a GAAP EPS loss due to COVID-19, threatening to Tesla, the inclusion in the S&P 500 index.

Tesla Inc. (TSLA)’s stock climbed nearly fourfold this year, boosting its market value to more than $ 300 billion. That has made Tesla, the electric car manufacturer run by CEO Elon Musk, eight times larger than the UNITED states rival General Motors Co. (GM) and 70% greater than that of Toyota Motor Corp (TM), making Tesla the world’s most valuable manufacturer. This strong performance has been driven by a string of three consecutive quarters of profits.

Investors will be watching to see if Tesla can expand its earnings streak of four consecutive quarters, and to maintain its high market value, when it publishes its results on July 22, 2020 for the 2nd quarter of the FISCAL year 2020. Analysts are skeptical. Currently, they believe that Tesla will lose money in Q2, as measured by the adjusted earnings per share (EPS), as income decreases.

During this quarter, investors will be closely watching for more details on the two key indicators to Tesla. The first is vehicle deliveries, Tesla is the most monitored metric and a key gauge of success, Tesla has already reported earlier this month that the deliveries of the vehicle for the 2nd quarter of the FISCAL year 2020 fell year on year (yoy), as the coronavirus pandemic hurt production and sales.

The second key metric is GAAP, which Tesla has yet to report. The recent explosion in Tesla’s share price is in part explained by the expectations that the stock can be added to the S&P 500 Index. To be eligible for inclusion, Tesla must report its fourth consecutive quarter of GAAP profits, and not the adjusted income, in the 2nd quarter of the FISCAL year 2020. Tesla has reported profits GAAP for the three consecutive quarters, but analysts believe that the company will post a GAAP loss in the 2nd quarter.

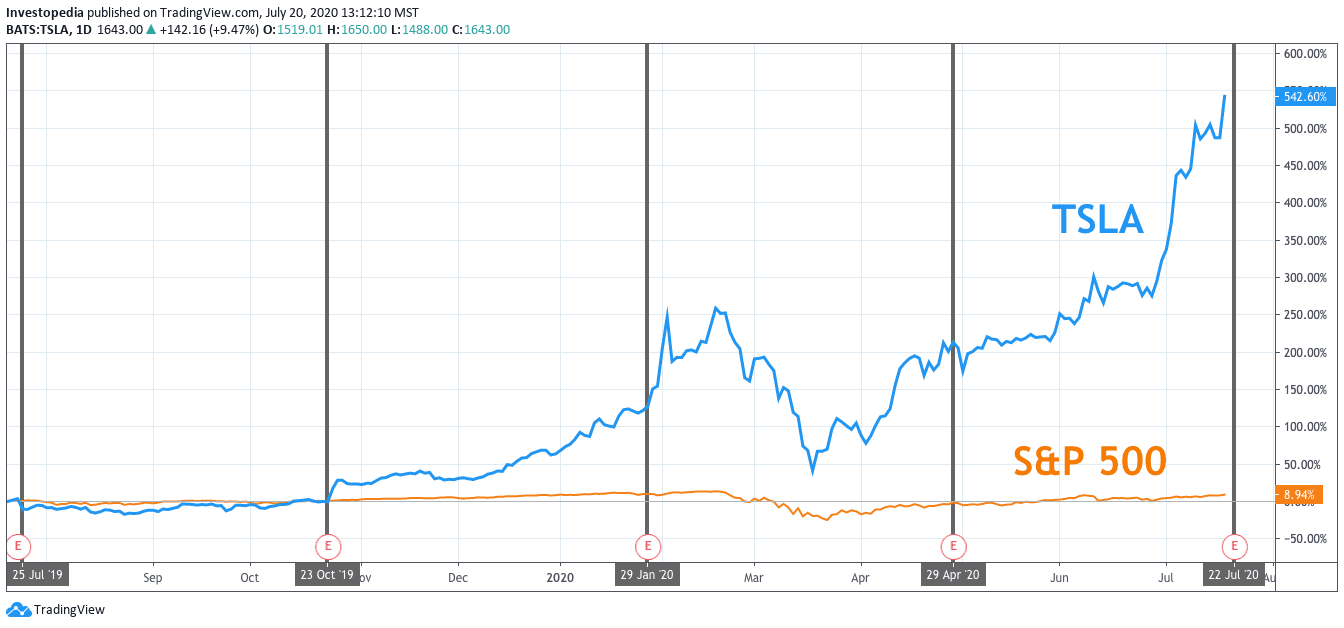

Tesla shares reflect investor exuberance on the stock. They have provided a total return of 542.6% over the last 12 months, over 60 times more than the S&P 500 total return of 8.9%. All figures are as of July 20, 2020.

Source: TradingView.

Tesla performance gain was very irregular during the past three years. It was first posted a long string of quarterly losses until 2017 at the end of the first half of 2018. But since then, he has posted more than quarterly profits than losses.

After crashing with the rest of the market earlier this year amid fears about the global pandemic, Tesla shares have rebounded strongly. But in spite of the T1 return for the YEAR 2020 adjusted earnings at the end of the month of April, which beat the forecasts of analysts, the stock moved the most side for the next month. Analysts expected a loss, but Tesla reported adjusted EPS increased 140.0% from Q1 of FISCAL year 2019. Revenue has also increased significantly, an increase of 31.8%.

Tesla also beat the adjusted earnings estimates in the last quarter of 2019. The adjusted EPS has increased 7.1% year-on-year, a considerable improvement from the loss posted in the previous quarter. But the net income has increased much more slowly than they had in the course of each quarter from Q3 2018 Q2 2019. The turnover increased slightly by 2.2%, and outside of the decline registered in the 3rd quarter of the YEAR 2019, it marked the slowest growth Tesla has stated in at least 12 quarters. The shares of the company increased during the following week, but the gains were quickly wiped out by the coronavirus-induced market collapse that started at the end of February.

Since bottoming around the middle of March, Tesla shares sped ahead of the market. Analysts expect an adjusted loss per share of$0.07 and a decrease in turnover of 13.4% for the 2nd quarter of the FISCAL year 2020. For two successive quarters, the analysts, however, expect Tesla to report its first annual profit for the entire FISCAL year 2020.

Q2 2020 (AF)

Q2 2019 (AF)

Q2 2018 (AF)

Adjusted Earnings Per Share ($)

-0.07 (estimated)

-1.12

-3.06

Revenue ($B)

5.5 (estimate)

6.3

4.0

The Vehicles Are Delivered To

90,650 (real)

95,200

40,740

Source: Visible Alpha; Tesla Inc.

As mentioned, one of Tesla’s key indicators of the delivery vehicles, which represent the most concrete measure of whether Tesla is able to increase their incomes. Both deliveries and production, reported earlier, beat analysts ‘ expectations for the 2nd quarter of the FISCAL year 2020. Since Tesla has done in the face of recurring struggles with profitability, the vehicle deliveries remains an important driver of its stock price. As the demand for the cars Tesla has remained generally strong despite the past production bottlenecks, factory closures caused by the pandemic have contributed to the decline in deliveries and production of vehicles. For the 2nd quarter of the FISCAL year 2020, the number of vehicles delivered decreased 4.8% compared to the same quarter a year ago. The number of vehicles produced fell 5.5%.

The strong Q2 of FISCAL year 2020 deliveries are fueling expectations of some investors that Tesla could also beat another key measure – GAAP earnings estimates and meet the eligibility criteria for inclusion in the S&P 500 index. The stock is already consistent with the market valuation and liquidity requirements to be eligible for inclusion. But as mentioned above, Tesla has also need to report positive GAAP earnings for the 2nd quarter of FISCAL 2020, which would be the fourth consecutive quarter of profitability. Tesla adjusted EPS, which is expected to be -0.07, could easily be beaten in the Q2 report. But in order to meet the eligibility criteria, Tesla should report positive results on a GAAP basis. Now, analysts estimate of the GAAP loss amounting to$0.72 per share, for the quarter, which is 10 times greater than the adjusted loss per share. The stakes are high for Tesla and its investors. Tesla’s acceptance in the broad market index could push the stock higher than the passive index funds that follow the S&P 500 would be necessary to load up on the newcomer’s actions.

Source: investopedia.com