Key Points

- Target posted better-than-expected quarterly results, although inflation led consumers to change their shopping habits.

- The company noted strong demand for its “frequency business “, which include beauty, food and drink, and household essentials.

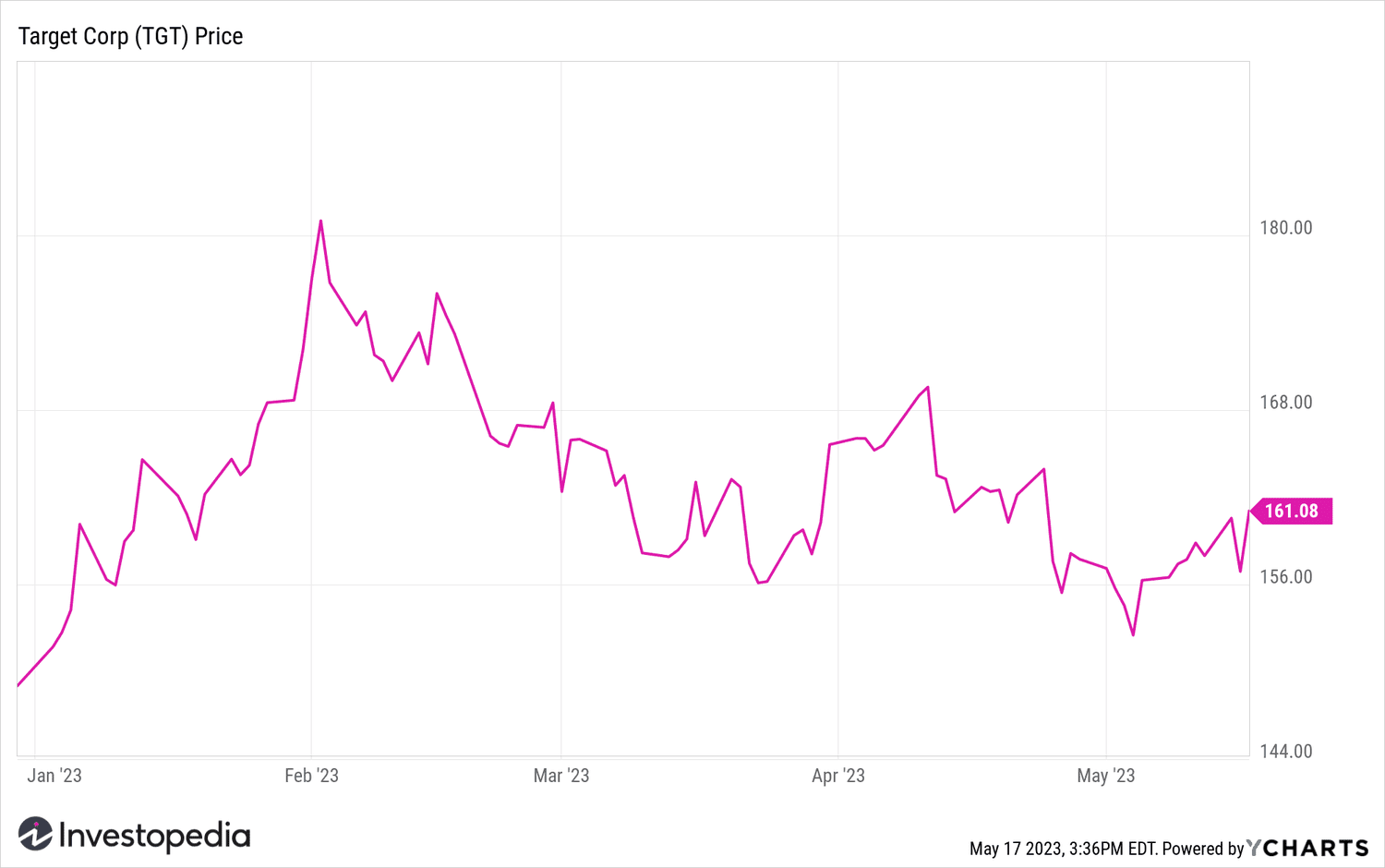

- Earnings news sent Target shares up 2.6% on Wednesday.

Target (TGT) posted better-than-expected quarterly results, even as inflation led consumers to shift their buying habits from higher-priced discretionary products to lower-priced ones.

The retailer reported earnings per share (EPS) of $2.05, well above analysts' forecasts. Revenue rose 0.6% to $25.32 billion, slightly above estimates. Same-store sales, which include both in-store and online purchases, were unchanged from a year ago, with physical store sales increasing (+0.7%) while digital sales increased. decreased (-3.4%).

The company noted strong demand for its “frequency activities,” which include beauty, food and drink, and household essentials. It also reduced its inventory, which was down 16% from 2022.

CEO Brian Cornell says Target entered in 2023 “with clear eyes on the challenges consumers face” and responded by looking at “the value and product categories our customers need most right now”.

Target locked in with its annual comparable store sales guidance between low-single-digit percentage decline and low-single-digit percentage increase, and EPS of $7.75 to $8.75.

Cornell noted that the company will be significantly impacted by theft, anticipating “shrinkage” will reduce profits by more than half a billion dollars this year. He added that Target is making “significant investments in strategies” to prevent losses and protect employees and customers.

Earnings news has sent shares of Target 2.6% higher on Wednesday.

Y-Graphs

Source: investopedia.com