Target (TGT) posted its first quarterly decline in sales in six on Wednesday amid falling discretionary spending, backlash against the company's Pride collection and increased retail theft, prompting the big-box retailer to revise down its outlook for the business. whole year.

Key Takeaways

- Target reported its first quarterly sales decline in six years on Wednesday, with net sales down 4.9% from the same quarter last year.

- Even so, profit jumped 356% from a year earlier to $835 million. , reflecting higher than normal inventory reduction and lower margins in the prior year quarter.

- Sales were negatively impacted by a combination of lower discretionary spending, a backlash to the company's Pride collection and an increase in retail theft.

Net sales fell 4.9% from the same quarter last year to $24.77 billion, below consensus estimate of $24.96 billion. Same-store sales fell 4.3%, while digital sales fell 10.5%. Despite this, profit jumped 356% year-over-year to $835 million, reflecting higher-than-normal inventory reduction and lower margins in the year-to-date quarter. former. Earnings per share (EPS) came in at $1.80, well above estimates of $1.40.

Stocks fell 17% due to a lower inventory of discretionary goods, mainly clothing and household items. However, the decline was less than expected, with analysts expecting a 25% decline.

Sales were dragged down by a triple whammy of discretionary spending, a backlash from some customers over the company's Pride collection, and losses associated with organized retail crime and theft.

Discretionary selling stalled as the combination of rising interest rates, persistently high inflation and uncertainty surrounding the broader economy pushed cost-conscious buyers to reduce their expenses. It's a sharp reversal from the early days of the pandemic, when stimulus checks and excessive savings prompted consumers to splurge on discretionary items, boosting Target sales.

In contrast, today's high inflation and rising interest rates have led consumers to focus on their needs rather than their wants, while the excess savings are increasingly being spent on experiences, like vacations and concerts, rather than possessions.

A backlash from some customers on the company's Pride deals, which Target unveiled ahead of Pride month, also weighed on sales. Target eventually withdrew some of its offers due to employee concerns. security.

The retailer is also dealing with rising crime and theft. Target warned in its first quarter earnings report that it could lose another $500 million in inventory losses to organized crime.

The National Retail Federation (NRF ) defines organized crime as the large-scale theft of goods with the intent to resell the items for profit. It's a growing problem for US retailers, which lost an estimated $94.5 billion due to inventory “shrinking” in 2021.

Because of these headwinds, Target lowered its full-year EPS forecast of $7-$8, $7.75-$8.75, and now expects comparable sales to decline by percentages mid single digits this year.

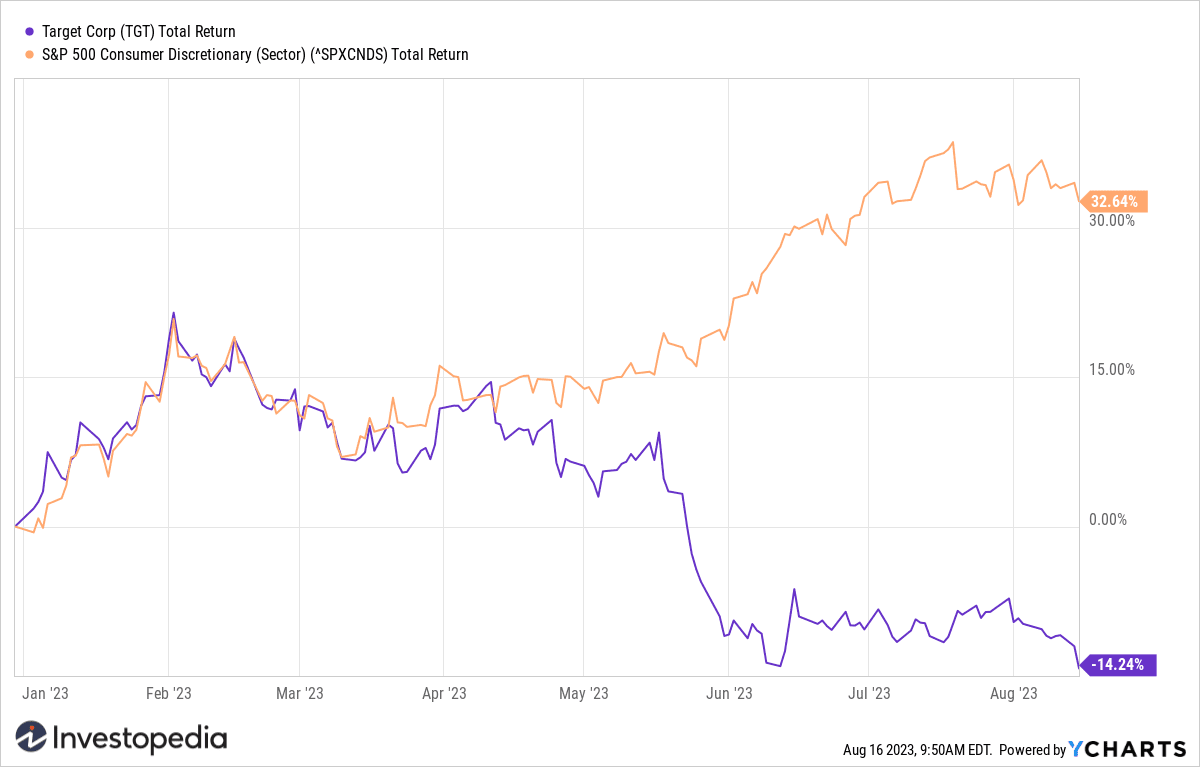

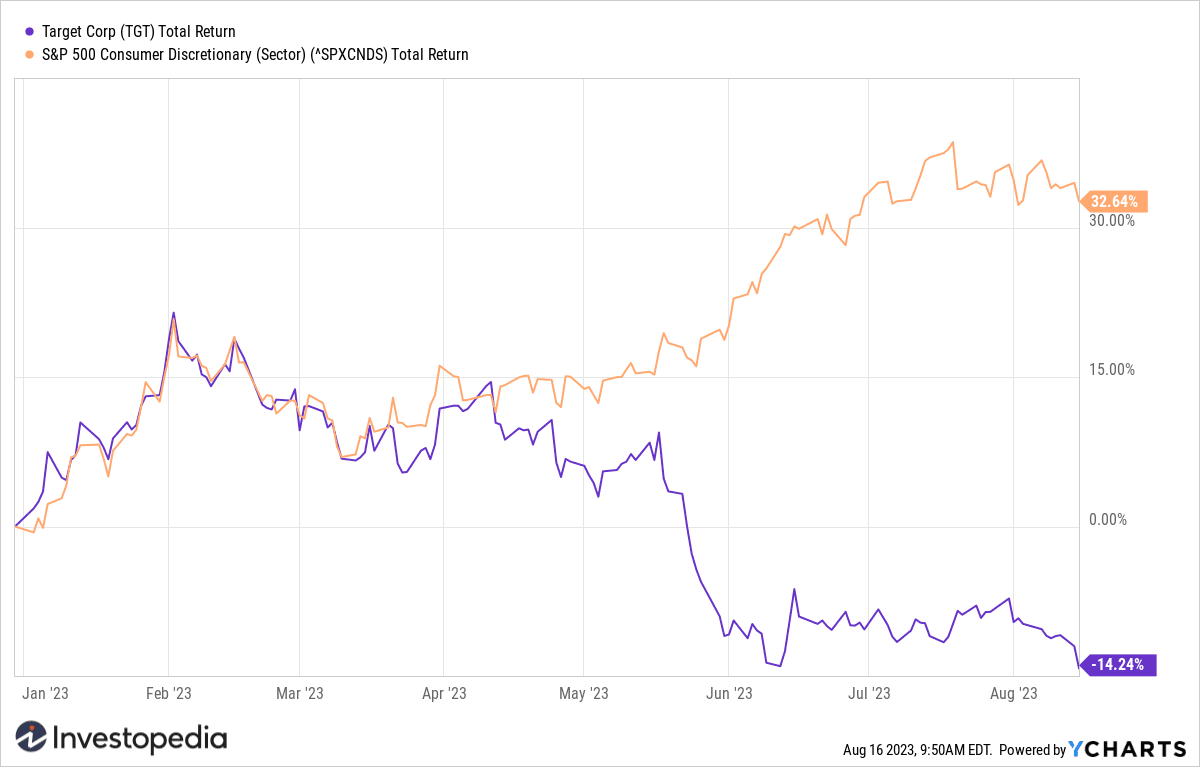

Target shares jumped up to #39;at 8% at the start of Wednesday's session before giving back some gains. They are down 14% so far this year, far underperforming the broader S&P 500 consumer discretionary sector's 33% gain over the same period.

Y Charts

Do you have a tip for investing opedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com