Take-Two Interactive (TTWO) is the best performing stock in the S&P 500 as the video game developer reported better-than-expected sales and said it expects demand to skyrocket in coming years.

Fourth fiscal quarter of Take- Two net bookings, a form of adjusted revenue, jumped 64.8% to $1.39 billion, above analyst forecasts. It was boosted by sales of legacy games such as Grand Theft Auto and NBA 2K.

The company faces a “challenging consumer backdrop,” CEO Strauss Zelnick explained, adding that inflation has made gamers wiser about their entertainment spending. He said this is driving demand for bargain titles and blockbuster games. Zelnick said Take-Two's scale and profit margin will grow as the company executes its strategy and releases what it believes will be “a lineup of successful titles.”

New Grand Theft Auto speculation

Take-Two noted its forecast for year-to-date adjusted revenue would be between $5.45 billion and $5.55 billion, below estimates. Despite this, the company said it plans to ship 36 video game titles by 2025 and 2026, with $8 billion in net bookings in 2025 and more than $1 billion in operating cash flow. This has fueled speculation that Take-Two will release a new version of Grand Theft Auto next year, adding to investor excitement.

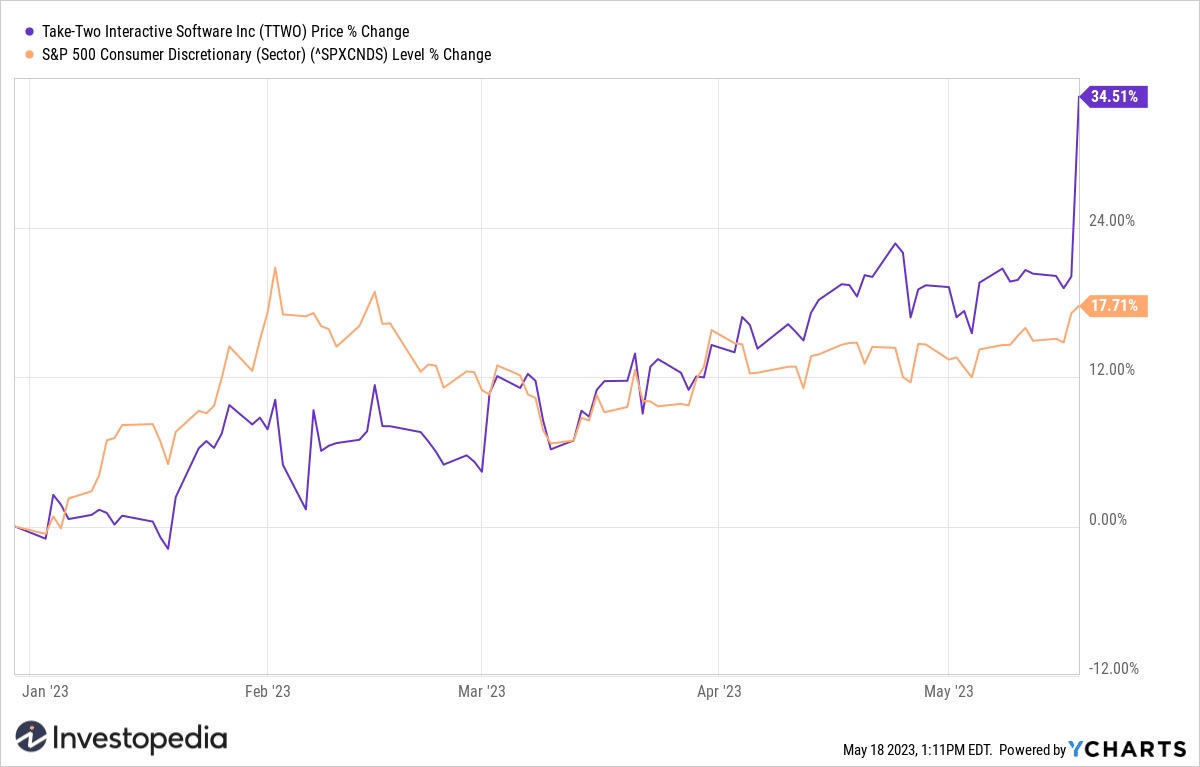

Video Game Maker Actions jumped 12% today to their highest level in over a year. They are up nearly 35% year-to-date, double an average gain of 17% among S&P 500 consumer discretionary stocks over the same period.

Y-Graphs

Source: investopedia.com