Key takeaways

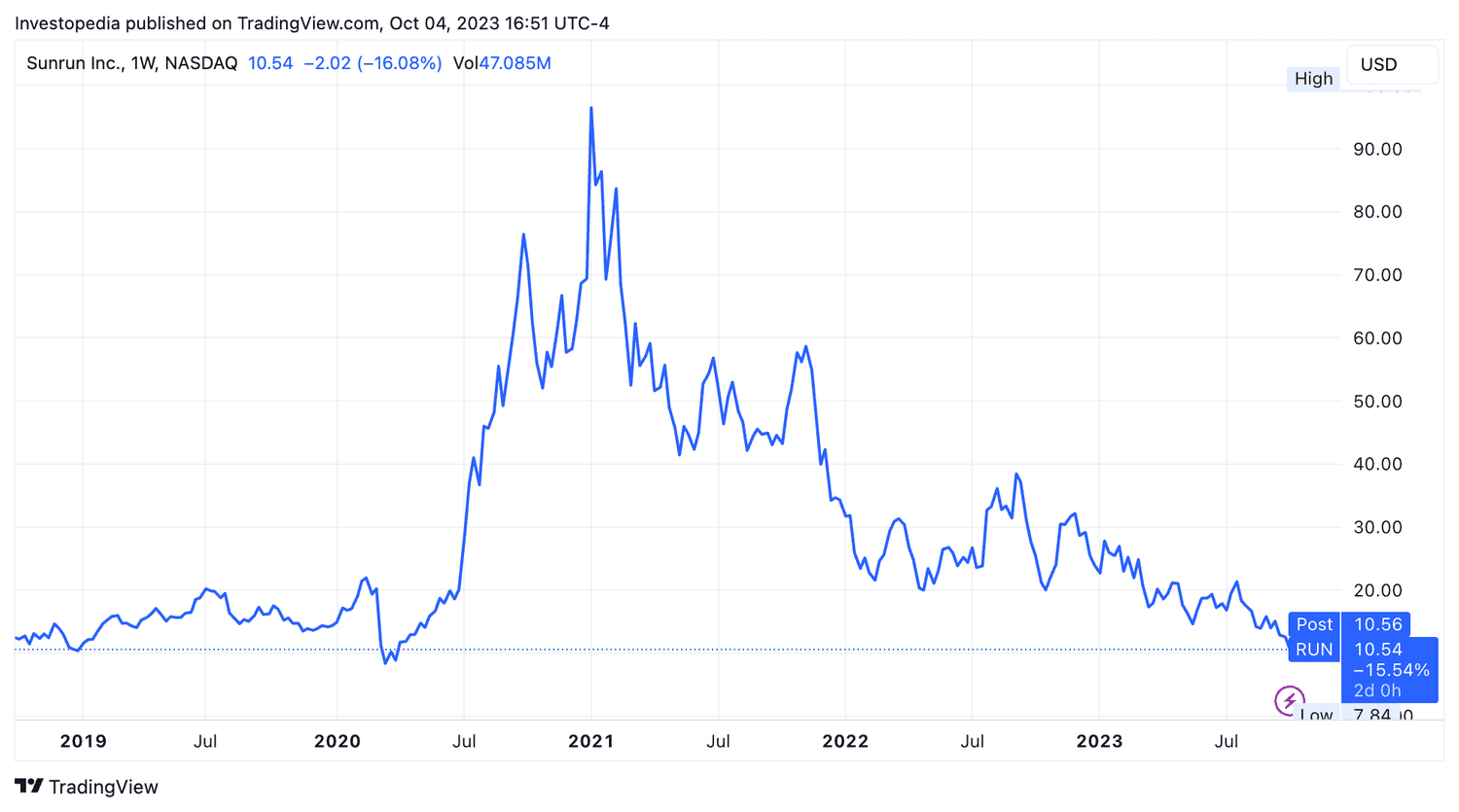

- Sunrun shares fell to their lowest level in more than three years before paring some losses after a Truist rating downgrade.

- Truist's Jordan Levy warned that interest rates are falling. High interest rates would continue to impact the solar panel installation market.

- Levy said the recent sell-off in so-called sustainable stocks was linked to fears that rising borrowing costs would continue for a longer period.

ul>

Shares of Sunrun (RUN) fell to their lowest level since April 2020 in intraday trading on Wednesday before paring some losses after a Truist Securities analyst warned that high interest rates would continue to hurt home installers. residential solar panels.

Jordan Levy of Truist degraded Sunrun as well as Sunnova Energy (NOVA) from “Hold” to “Buy” and reduced the price target on each.

Levy noted that so-called sustainability stocks have seen a widespread sell-off recently as investors fear borrowing costs will remain high for longer. He said analysts were re-evaluating the trade-off between short-term headwinds and long-term value creation.

Levy added that investors are paying more attention to stable profitability and margin improvement, which he said is difficult in the current economic environment.

He explained that the increase Costs associated with high interest rates could not only reduce customer demand for solar panels, but also make it more difficult for companies to generate cash.

Sunrun shares closed down 1% on Wednesday, while Sunnova stock posted a 2% gain.

TradingView

Do you have a news tip for news journalists? Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com