Key Points

- Point Fixed stocks soared on Wednesday after reporting quarterly results that beat estimates.

- EBITDA exceeded company guidance due to "strict cost control" and the company said it has other cost-cutting plans.

- Stitch Fix is closing one fulfillment center and letting the lease expire on another.

Stitch Fix Actions (SFIX ) soared after the online personal styling service reported better-than-expected quarterly results and announced new cost-cutting measures.

Stitch Fix posted a loss of $0.19 per share in the third quarter of fiscal 2023, well below estimates. Sales fell 19.9% to $394.9 million, although that was also better than expected. The company said it continued to benefit from “tight cost control,” which produced earnings before interest, taxes, depreciation and amortization (EBITDA) of $10.1 million, beating its forecast range.

Interim CEO Katrina Lake said Stitch Fix continues to “focus on ways to improve the efficiency of our business, while investing in the core capabilities that have set Stitch Fix apart from the start. “. She also credited artificial intelligence (AI), saying the company's success came from “personalization powered by our industry-leading data science and AI.”

Stitch Fix has announced that 39; it will close its Dallas distribution center next year and will not renew the lease at Bethlehem, Penna. place of dissemination. He added that because “the macro environment and our business has changed” he must consider exiting the UK market in FY24.

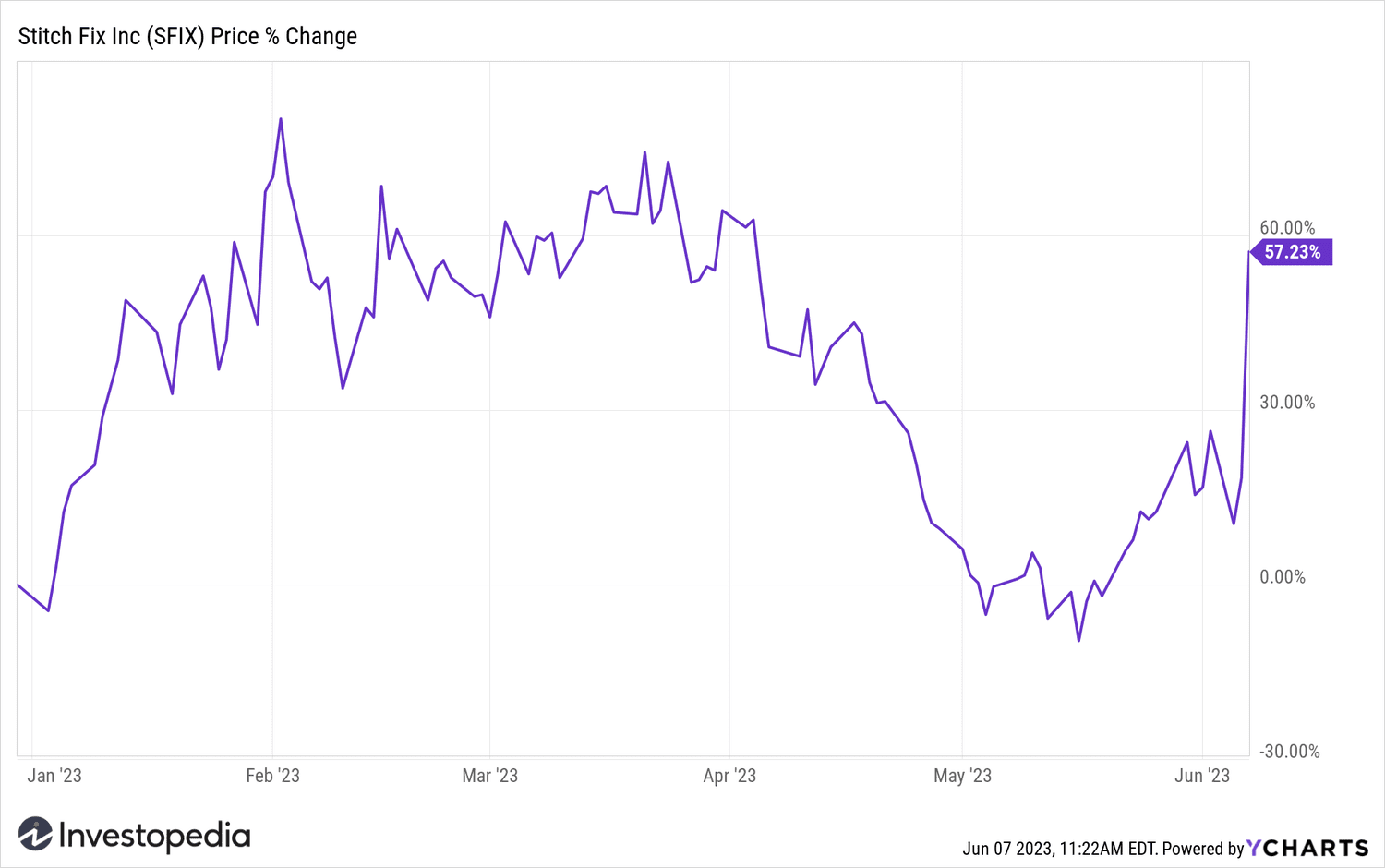

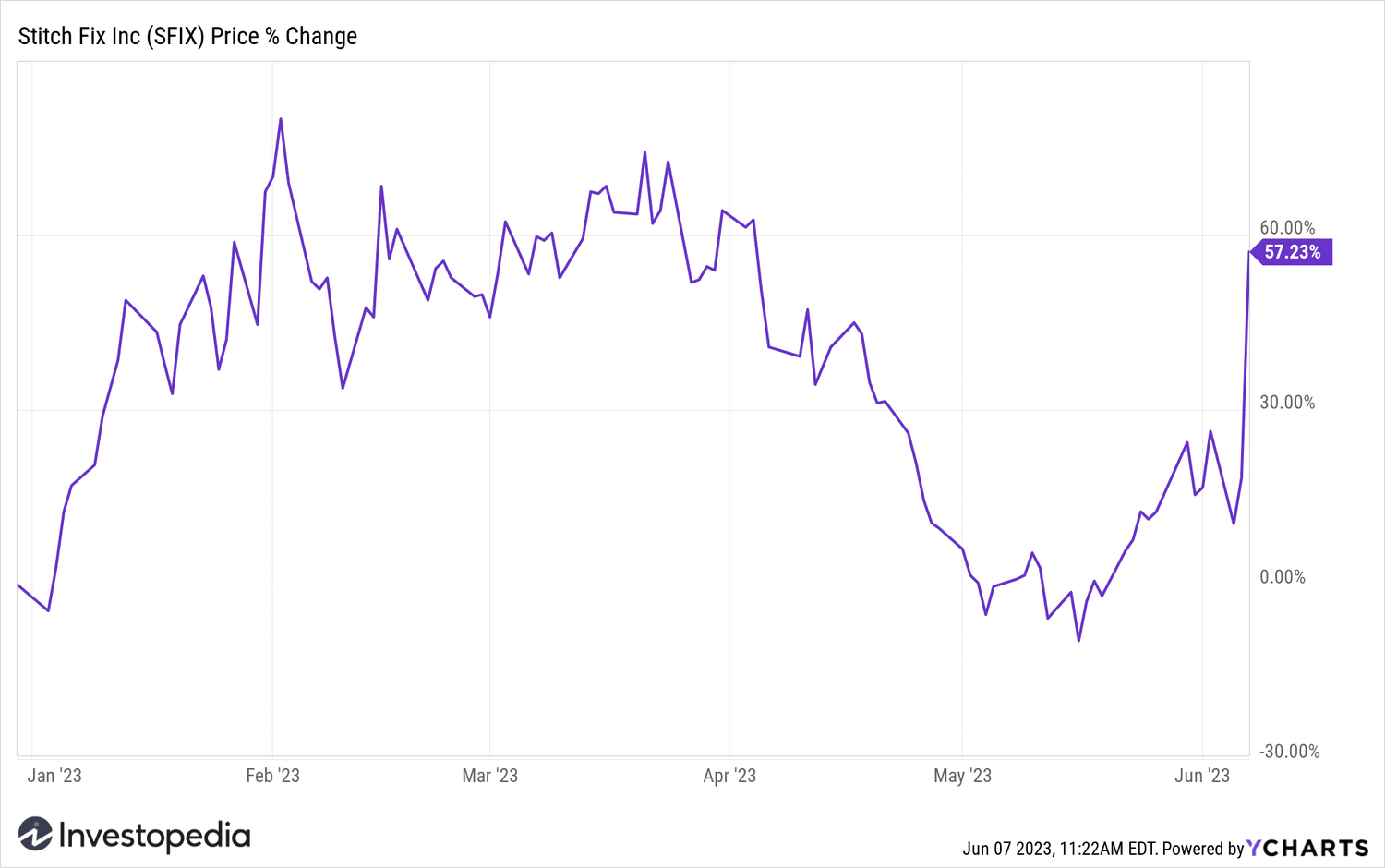

Stitch Fix shares rose 33% Wednesday morning at 11:20 a.m. EST , after the news.

ChartsY

Source: investopedia.com