Steven Madden Ltd. (SHOO) shares fell more than 8% during the session on Thursday after Wells Fargo downgraded the stock to Underweight from Equal Weight and lowered its price target from $26.00 to $18.00 per share. Analyst Tom Nikic believes that Steven Madden brands have under-performed relative to their peers as Deckers Outdoor Corporation (DECK) and Skechers U. S. A., Inc. (SKX).

Nikic added that Steve Madden, “very dependent” on the UNITED states of big channels, and the sub-performance relative to the sell-through this year is likely to lead to disappointing sales next year. The analyst believes that COVID-19 has affected all comfort” brands”, but maintains Overweight ratings of Steven Madden, peers, Deckers, and Skechers.

The movement follows the Loop of the Capital downward revision in the beginning of the week, from Buy to Hold with a $23.00 price target. Analyst Laura Champine believes that the weakness of big channels can remain problematic even after the stores re-open, such as job losses and health problems that will weaken the attendance of the store. Many retailers have begun to open their doors as the have lifted some COVID-19 restrictions, but the store traffic is likely to remain the light and the consumption has been reduced by a massive increase in unemployment.

TrendSpider

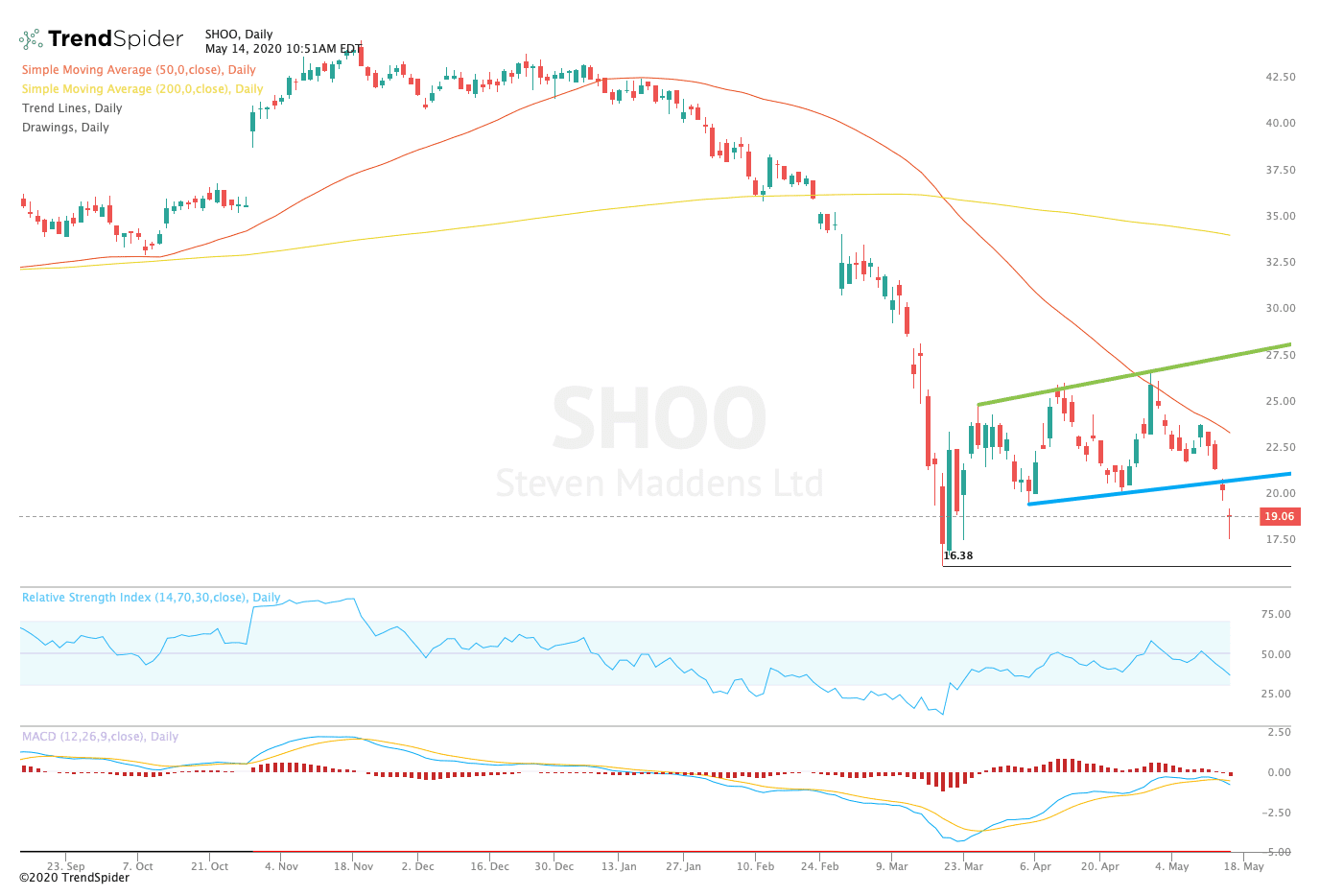

From a technical point of view, the stock is declining to retest prior lows of around $16.00 from mid-March. The relative strength index (RSI) has been moved to the oversold territory, with a reading of 35.95, but the moving average convergence divergence (MACD) in histogram MACD has experienced a bearish cross. These indicators suggest that the stock could see some short-term relief, but in the medium term, the trend remains bearish.

Traders should watch for consolidation above trend line support at $16.00 and below the reaction low of $21.00 in the coming sessions. If the stock breaks out from these levels, traders could see a move to test the reaction of high and trendline resistance at around $27.00. If the stock breaks lower after a period of consolidation, traders could see a fresh low.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com