Trending Videos

Takeaways

- Steel Dynamics' current quarterly forecasts were higher than analysts' forecasts. estimates, and its shares rose.

- The steel producer and scrap metal recycler said order activity “remains strong”; through 2024.

- The company said it repurchased nearly 8% of its shares this year.

Steel Dynamics shares ( STLD) rose after the steel producer and scrap metal recycler gave guidance for the current quarter that beat expectations for strong orders.

The company said it expects fourth-quarter earnings per share (EPS) in the range of $2.60 to $2.64. Analysts expected $2.40. Earnings were $3.47 per share in the third quarter and $3.61 per share a year ago.

Steel Dynamics explained that steel ordering activity “remains strong, as evidenced by extended order lead times and recent price increases heading into the first quarter of 2024.”

However, the company noted that profit from its steel operations would be lower than in the third quarter due to a steady decline in shipments and a contraction in metal spreads, with prices lower than expected for flat rolled steel. The steel producer added that it had benefited from lower scrap costs.

Regarding its recycling operations metals, Steel Dynamics said expanding metals spreads helped offset lower volumes caused by lower demand as domestic steel mills experienced maintenance outages.

The company said steelmaking profits were affected by lower shipments and sales values, as well as higher costs.

In addition to the outlook, Steel Dynamics said it has repurchased $1.4 billion, or nearly 8 percent, of its shares so far this year.

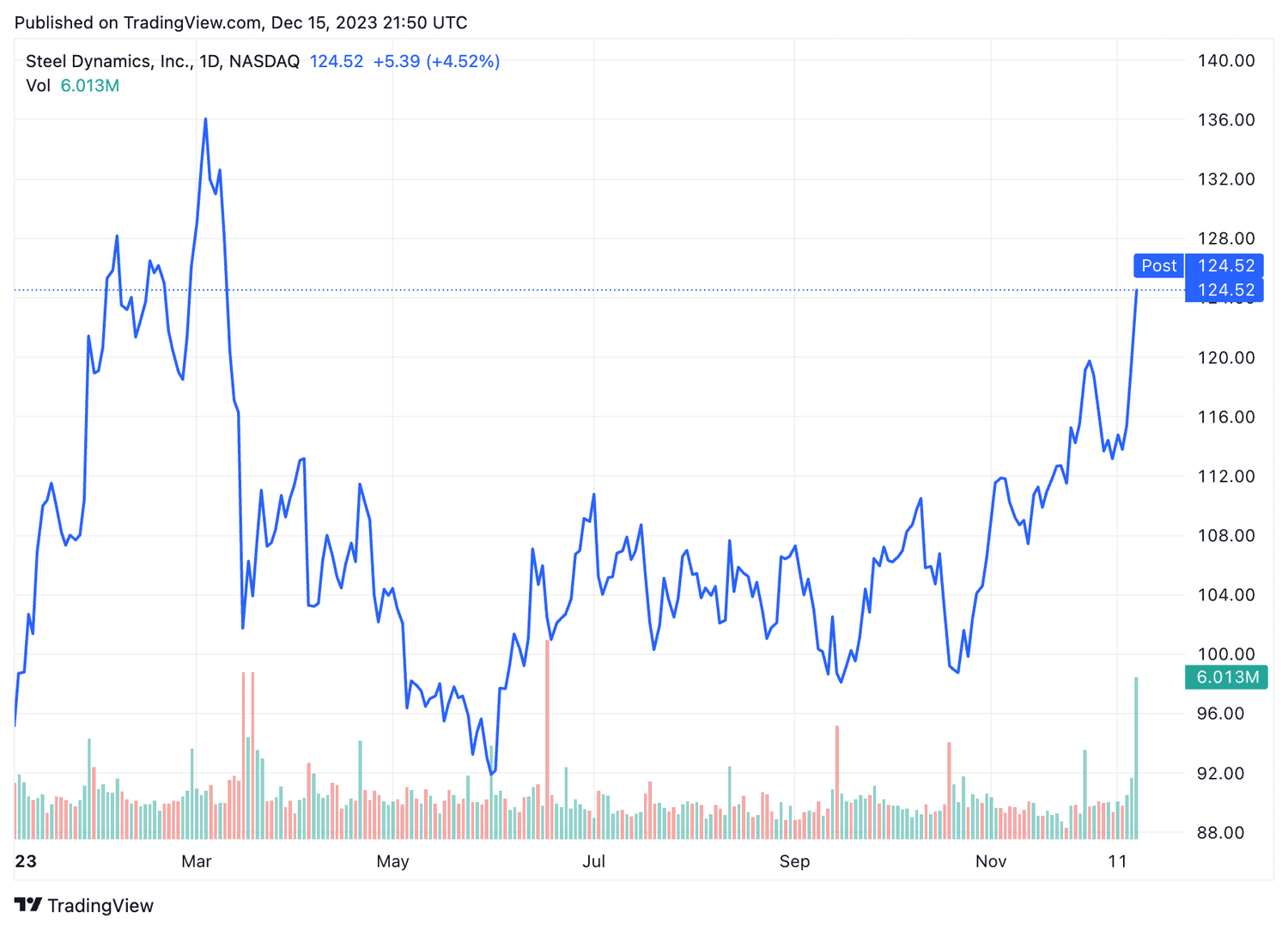

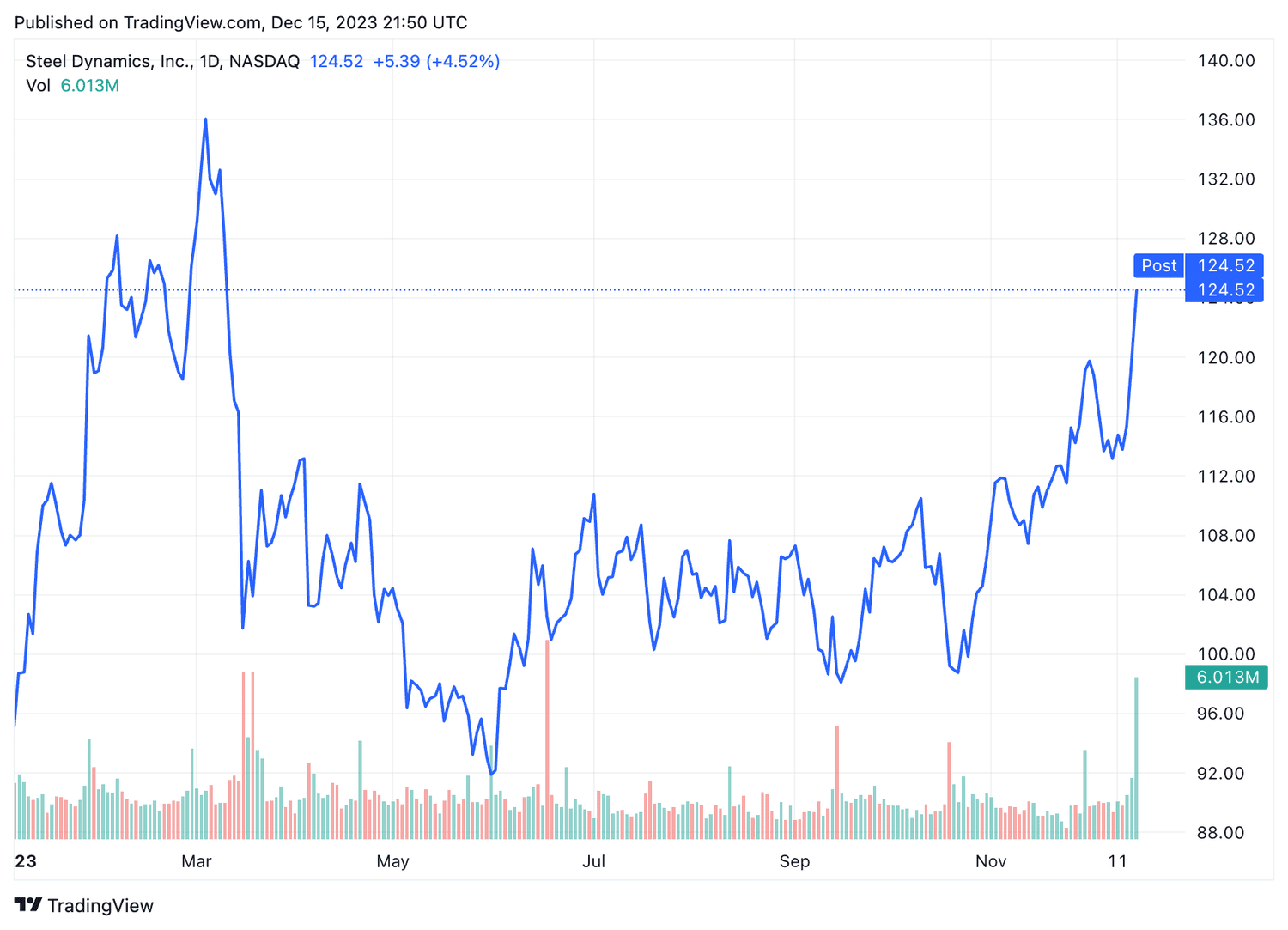

Steel Dynamics shares have rose 4.5% to close Friday's session at $124.52. The stock is up 31% for the year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com