Starbucks Corporation (SBUX) stock is trading higher by nearly 6% in Wednesday pre-market after the company beat top and bottom line fiscal third quarter to 2020, the estimates of gains. The coffee giant recorded a loss of $0.46 per share on $4.22 billion in revenue, which marked a 38.1% year-to-year decline. World and american comparative sales shared equal pain during the course of the quarter, with each segment falling around 40%. Higher average ticket sales offset the bearish metrics to a certain extent, but it was not enough to put wins in the win column.

Key Takeaways

- Starbucks quarterly revenue has fallen by 40% or more in key markets.

- Short-covering could be the cause of this morning’s buy-the-news reaction.

- The $80 to $82 range of prices of brands of strong resistance that may not get mounted at this time.

The strong “buy-the-news” reaction seems inappropriate, given the terrible quarter, but investors are apparently looking ahead to better times. Assessment has become a major issue in 2021 and beyond if the “new normal” after the pandemic of the course is below the long string of impressive results at the horizon 2020. Even more worrying is that, many actions are already priced for perfection in an imperfect world that may have to suffer through a deadly second wave of the pandemic this winter.

Starbucks has raised fourth quarter and fiscal year profit estimates, while waiting for a consolidated sales decline of 10% to 15%. The company has declared a $ 0.41 dividend, hoping to hang on to the shareholders through the end of the crisis. Similarly, in the projections of the end of the year take on a rosier path than the first half of the year is 2020, and the next pandemic surge, particularly in the overseas markets, which have seen the return to life, could be devastating for the share price.

A news trader takes decisions based on news announcements. The latest news, economic reports, and other reported events may be short-lived effect on the price action of stocks, bonds, and other securities. New traders trying to make profits by taking advantage of the market trend leading to the release of important news and/or to trading on the market response to the announcement after the fact.

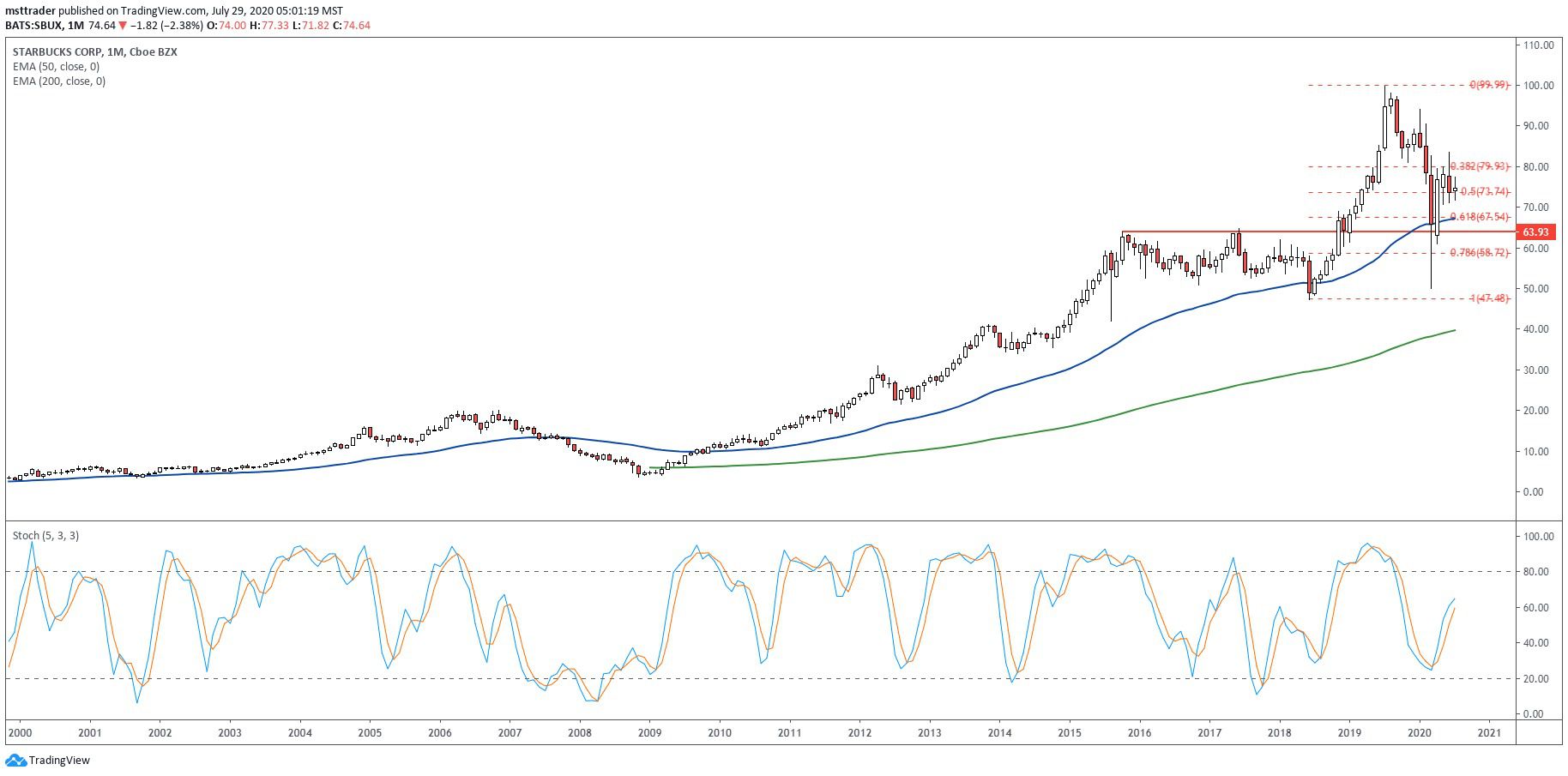

Starbucks Long-Term Graph (2000 – 2020)

TradingView.com

A long-term bullish close at $6.41 in 2001, giving way to a bear market decline that reached a low after the Sept. 11 attacks. The stock posted a new record in the third quarter of 2003, and book spectacular gains during the mid-decade bull market, with nearly $20 in the second quarter of 2006. It broke down from a double top pattern in 2007, entering a steep decline which has accelerated during the economic collapse of 2008. The sell-off found support in November in a time of 16 cents from the 2003 low, which gives a strong bounce that has reached the state of the high in 2011.

An escape carved a well-defined Elliot five-wave pattern in the fourth quarter of 2015, when the stock topped once more. 2017 rally attempt has failed, before the success of the 2018 efforts that have posted impressive gains in July 2019 all-time high of $99.72. The stock displayed a lower high in February 2020 and collapsed with the global markets, in the absence of the session before hitting a 20-month low in March. The increase in subsequent restored the escape, the strengthening of support in the low $60.

Elliott Wave theory was developed by Ralph Nelson Elliott to describe the movements of prices on financial markets, in which it was observed and identified recurring, fractal wave patterns. The waves can be identified in stock price movements and in consumer behavior. Investors try to take advantage of a market trend could be described as “riding a wave.”

Starbucks Short-Term Chart (2018 – 2020)

TradingView.com

The stock is trading just above the 200-day exponential moving average (EMA) near $79 after result, marking the first climb above this critical level since the month of June. However, a strong resistance during the month of February double top breakdown between $80 and $82 argues for caution at this time. Given bearish settings in-game before the benefits, it is likely that short covering is food on the rise this morning, rather than fresh buying interest. This force of nature may be insufficient to significantly improve the technical outlook.

The balance volume (OBV), the accumulation-distribution of the indicator follows this cautionary theme, the entry of a holding company in April, after a brief burst of buying power. OBV is placed quite high in the tendency to act as a gathering platform, but the lower part of the red line is not likely to get mounted to the front of the upper part of the red line. In turn, the bulls should take a look at the $80 to $82 range of prices for directional clues.

The Bottom Line

Starbucks stock is starting to gain ground in a “buy-the-news” reaction after a horrible quarter, but short-term upside may be limited.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com