Key Takeaways

- Analysts estimate adjusted EPS of$0.49 vs $0.78 in Q3 of FISCAL year 2019.

- Same store sales should not.

- COVID-19 may cause large decrease of the scale of the company’s revenue.

Starbucks Corp (SBUX) revenues, earnings and stock price have plummeted this year as the sars coronavirus pandemic has forced the coffee house chain to close many of its stores and limited dinner service to others. The company has recently been slowly re-opening its stores in some parts of the UNITED states, strictly following the directives of the government.

Investors want to know if Starbucks can reverse its plunging sales and other measures in its reports profit for the Q3 from the YEAR 2020 on the 28th of July, after the close of the market. Analysts estimate that Starbucks will report a sharp decline in sales and a net loss. They expect the company to post adjusted earnings per share (EPS)- or$0.49 per share. The company’s fiscal year ends in September.

Investors will also be likely to be watching closely as a key indicator to measure the Starbucks growth: same-store sales. Analysts expect the news to be extremely negative. In the 3rd quarter of FISCAL 2020, analysts estimate same-store sales were down 41.1%, by far the worst of the year-on-year (yoy) decline in at least 18 quarters.

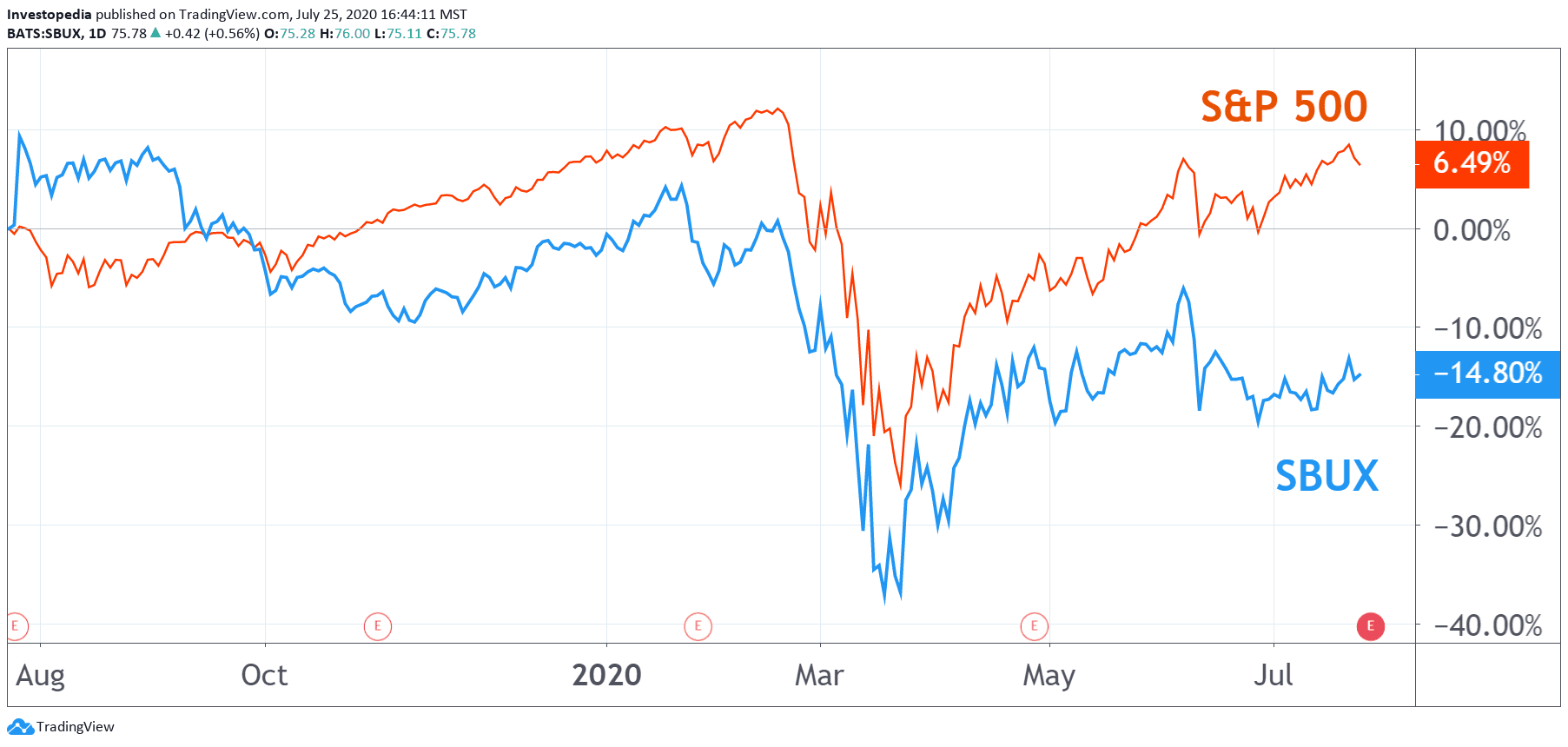

Starbucks shares initially took a steep dive on news of the pandemic. But despite the rebound of nearly 50% since their March lows, Starbucks shares still badly lag the overall market by 2020. In the last 12 months, Starbucks has posted a total return of -14.8% compared to 6.5% for the S&P 500.

Source: TradingView.

Prior to its Q2 of FISCAL year 2020 the results, Starbucks had posted positive year-over-year revenue and adjusted earnings growth every quarter since the 1st quarter of FISCAL year 2018. Most of the time, the year-on-year gains in adjusted EPS was strong. They increased by two digits in almost every quarter, including a 25.8% jump in adjusted EPS in Q3 of FISCAL 2019. The Hot streak started to cool in the Q1 of FISCAL 2020, when Starbucks reported a sharp slowdown in EPS growth, the increase of 5.1%. It was followed by a serious year-on-year profit drop of 48.0% in the Q2 of FISCAL 2020 ending March, when the pandemic began to affect Starbucks.

Revenue, meanwhile, has generally risen at a stable pace in recent years, but with significant variations from one quarter to the other. Since the 2nd quarter of the FISCAL year 2016, the year-on-year revenue growth has varied from one to 16.2% in the 4th quarter of the FISCAL year 2016 to a decline of 4.9% in the 2nd quarter of FISCAL 2020. Until then, the only other area in which Starbucks has reported the fall of the revenue growth was in Q4 of FISCAL 2017, when the sales dropped a little by 0.2%, essentially flat.

For the Q3 of FISCAL 2020, however, analysts expect recent declines to increase, with quarterly revenue of $3.2 billion, compared to $ 5.5 billion in Q3 of FISCAL year 2019, a decline in year-on-year -39.2%.

Starbucks Key Measures

Estimate of Q3 2020 (AF)

Actual for Q3 2019 (AF)

Real to Q3 2018 (AF)

Adjusted Earnings Per Share ($)

-0.49

0.78

0.62

Revenue ($B)

3.2

5.5

5.1

Sales at comparable stores (%)

-41.1

6.0

1.0

Source: Visible Alpha

As mentioned, investors will be particularly focused on Starbucks ‘ same-store sales, also known as comparable-store sales. Same-store sales is a key indicator for investors which provides a comparison of the performance of stores that have been in business for at least a year. Review of same-store sales allows investors to determine what portion of the chain of sales of existing stores and the part that comes from the opening of new stores. Investors and analysts also use the metric to determine the management has managed to generate revenue growth from existing assets.

Until 2020, Starbucks’ comparable store sales have shown steady growth by posting a year-on-year growth for 16 consecutive quarters. The performance was particularly striking during each quarter between Q4 of FISCAL 2018 and Q1 of FISCAL 2020, when the pace of sales growth in each quarter was faster than the same quarter a year earlier. For example, Starbucks ‘ same store sales increased 5% in the 4th quarter of FISCAL year 2019, much faster than the Q4 of FISCAL year 2018, when sales rose 3%.

This trend is reversed quickly, with same-store sales slip 10% in Q2 of FISCAL year 2020, the pandemic began to take steam. That T2 decrease was mainly caused by the plunging of the business outside of the UNITED states, But analysts see a very different picture for the Q3 of FISCAL 2020. They believe the 41.1% decline in comparable store sales in Q3 came from a 42.9% plunge in the company’s sales in the Americas segment, which is most of the time in the UNITED states, and from a 39.9% international same stores sales. Since Starbucks has started closing many of its stores during the last 10 days of March, its financial results are likely to show the full effect of these closures in Q3.

Source: investopedia.com