Key Takeaways

- The adjusted EPS of$ 0.02 vs $0.13 analysts were expecting.

- Gross payment volume in below expectations.

- Slowdown in gross payment volume was driven by a sharp fall in March due to COVID-19.

What Happened

Square reported a$0.02 adjusted EPS loss, significantly below the $0.13 gain expected by analysts. While revenue modestly exceeded expectations, the gross remuneration in volume (GPV) disappointed. GPV has increased by 25% or more year-over-year each quarter of the last year, but increased by only 14% in the 1st quarter of 2020. This has been driven by a huge drop in payments at the end of the month of March. As GPV has been a 29% increase year-on-year in January and February, it was down 39% for the last two weeks of March. Place of the stock has been down sharply in after-hours trading.

(Below, Investopedia’s original earnings preview, published 5/5/20.)

What to Look for

Square Inc. (SQ), the financial services company co-founded by Twitter Inc. (TWTR) chief executive officer Jack Dorsey, has recorded impressive growth in revenues and earnings since its ipo in 2015. But COVID-19 has changed the situation. The pandemic has significantly reduced in financial transactions by consumers and businesses, pushing Up the stock up to 55% earlier this year. Since then, it has recovered only a portion of its losses. Investors are essentially focused on how much COVID-19 has wrong Place and its business customers when the company releases its results for the 1st quarter of FISCAL year 2020, after the market close on 6 May. For the quarter, analysts expect Square to announce a slowdown drastic in adjusted earnings per share (EPS) growth, revenue growth slows down.

Investors will also be watching closely to another key Square tons, gross payment volume (GPV), as an indicator of performance. GPV measures the total volume of payments the company processes. While the analysts expect solid GPV growth, it will be at the slowest pace in at least 3 years.

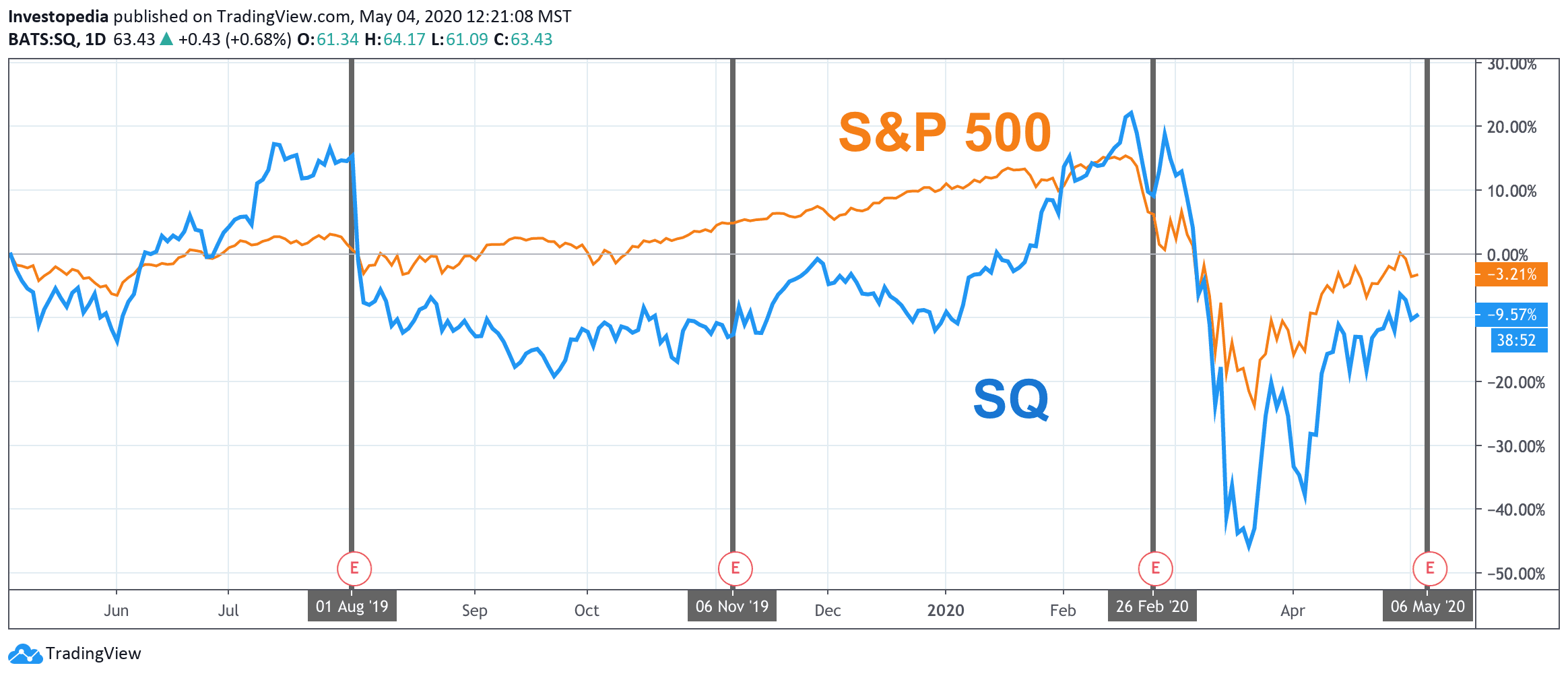

In the last 12 months, Square of the stock has underperformed the S&P 500 by a significant margin, providing a total return of -9.6% compared to -3.2% for the market as a whole.

Source: TradingView.

For the Q1 periods in recent years, the Site has posted dramatic growth in adjusted EPS annually and quarterly. That growth, however, has often varied widely on a quarterly basis, which often comes with the rapid growth of the business. The adjusted EPS has increased 199.4% year-on-year in the 1st quarter of FISCAL year 2017, up 26.3% in Q1 of FISCAL 2018 and by 93.2% in Q1 of FISCAL 2019. But for the 1st quarter of FISCAL year 2020, the analysts expect adjusted EPS to rise only 8.5% to$ 0.13, which would be the slowest year-on-year quarterly growth rate of almost 4 years.

Square’s revenue growth appears to be holding up better than earnings. In the prior eight quarters, revenues have increased by between 40.9% and 51.4% year-on-year. For the 1st quarter of FISCAL year 2020, the analysts expect revenues to increase at a slower pace, but still strong, 34.7% year-on-year to $1.3 billion.

Square of the performance may worsen as the year goes on, because the pandemic has not had a great impact on most companies until the end in the calendar of the first quarter. Place of analysts, for example, currently, the estimate for the full year to 2020, the revenue growth will slow to 7.3% adjusted earnings per share plunged by 28.5%.

Place Key Indicators

The estimate for the Q1 2020

Real for the 1st quarter of 2019

Actual for Q1 2018

The earnings per share

$0.13

$0.12

$0.06

Turnover (in millions of dollars)

$1,292.5

$959.4

$668.6

The gross remuneration (in terms of volume (in billions of dollars)

$26.1

$22.6

$17.8

Source: Visible Alpha

As mentioned, many investors will look at gross Square of the volume of payments, which is a key measure of Square success in an increasingly crowded payments industry. This figure has increased considerably on an annual basis, each quarter, for the past three years. If analysts ‘ expectations come to pass, Square’s gross payment volume for the 1st quarter of the YEAR 2020 will be approximately two times the same figure in the 1st quarter of FISCAL year 2017, reflecting the company’s rapid growth. During this period, Square established itself as a leader in the payments and financial services, with its popular Cash Application beacon mobile payments offering. Square has maintained its growth rate in the face of competition from larger rivals such as PayPal Holdings Inc. (PYPL), and the credit card providers such as Mastercard Inc. (MA). But the industry is particularly vulnerable to the COVID-19 pandemic, which has had an impact on small business clients are particularly important. Investors should look for gross payments volume to determine if Square was able to continue its growth in this sector in 2020.

Analysts predict that Square gross payment volume will rise by 15.7% year-on-year to $ 26.1 billion in Q1 of FISCAL 2020. Even if this growth is strong, it represents a slowdown compared to previous quarters. The 15.7% growth estimate is half the rate of growth of the same quarter three years ago. Place of the year-on-year growth in Q1, gross payments volume has already been moderately deceleration over the past three years. It has slowed from 32.6% growth in the 1st quarter of FISCAL year 2017 to 30.6% in Q1 of FISCAL year 2018, and then to 26.7% in Q1 of FISCAL 2019. While there was no consensus estimate gross volume of payments in 2020, it can slow down even more. A sign is analysts bearish consensus estimates for the Square of the growth by 2020, which is expected to slow sharply.

Source: investopedia.com