Key takeaways

- Southwest Airlines (LUV) posted a worse-than-expected loss of $0.27 per share for the first quarter of 2023.

- The negative results reflect the continued impact of operational disruptions experienced by the airline in December 2022.

- The disappointing results sent shares of Southwest down 3% on April 27.

Southwest Airlines (LUV) posted a bigger-than-expected loss in the first quarter as the fallout from the carrier's vacation slump extends into the new year. Stocks fell.

Southwest reported a net loss of $159 million, or $0.27 per share, $0.04 lower than expected. Sales rose 21.6% to $5.71 billion, also below estimates.

CEO Bob Jordan said the negative results were linked to operational disruptions in December 2022, when Southwest was forced to cancel more than 16,000 flights during the busy holiday travel season because the airline could not not adapt to schedule changes caused by winter storms. Jordan added that these disruptions resulted in a $325 million negative impact on revenue in the first quarter due to the cancellation of customer return trips and lower bookings in January and February. However, he said demand and sales rebounded in March.

Revenue drop

Yet Southwest predicts that revenue per seat -mile (RASM) in the current quarter will be down 8% to 11%, although Jordan has indicated that the airline expects “strong earnings” in the quarter and for the #39; set of the year. He argued that despite an uncertain economic environment, demand for domestic air travel remains strong and that Southwest's goal is to “manage inflationary cost increases and maintain our competitive cost advantage.”

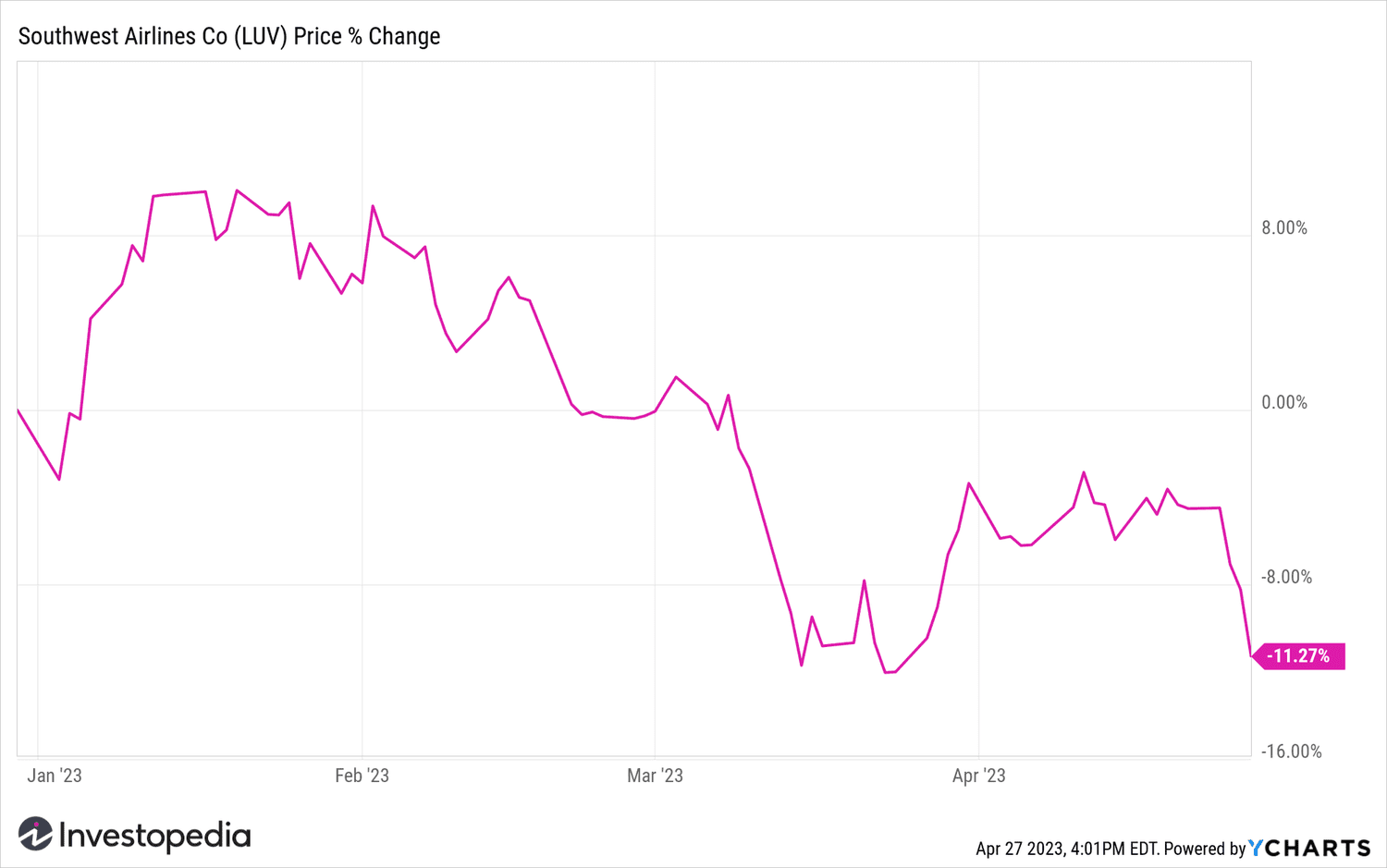

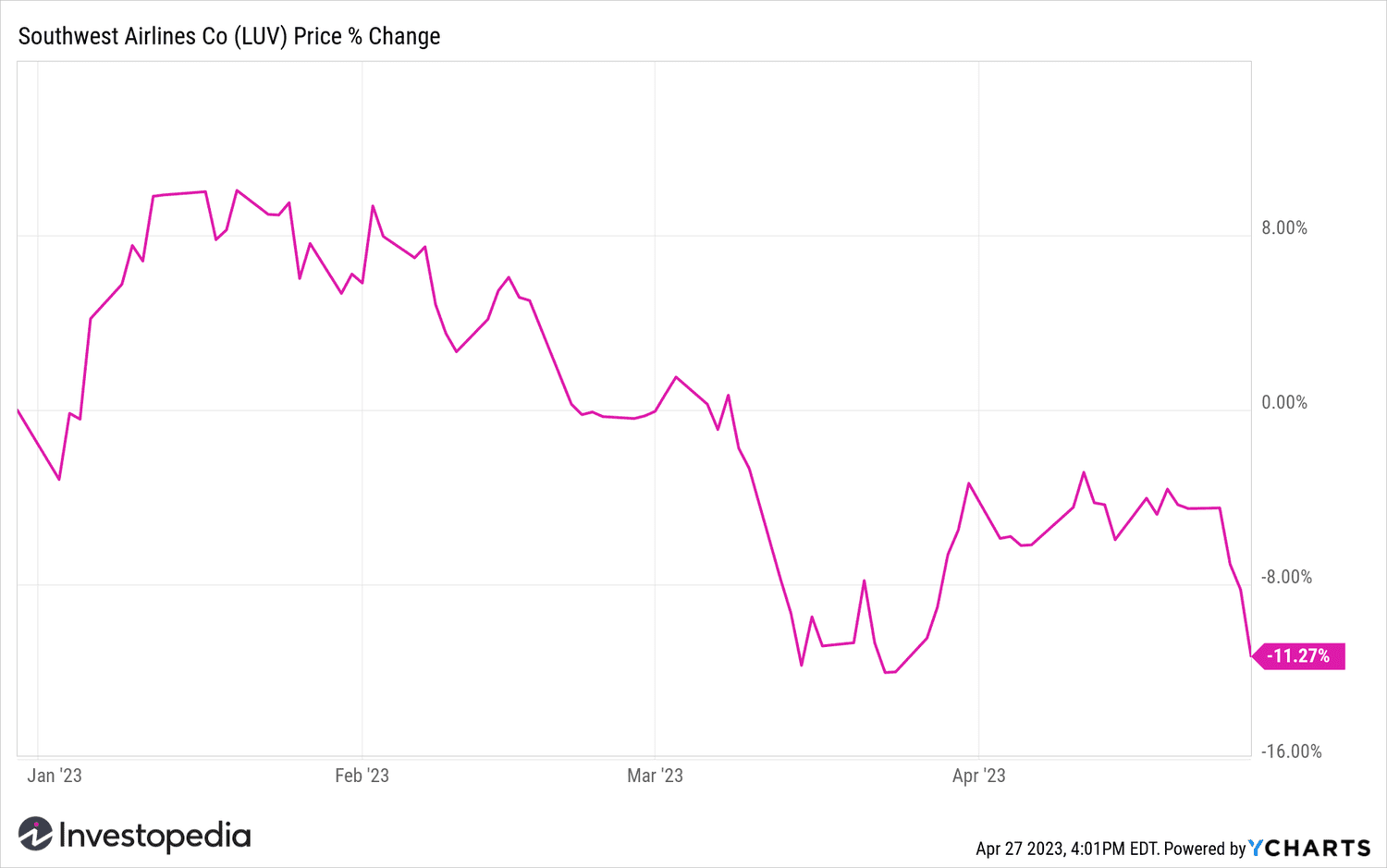

Southwest Airlines shares have lost 3% on April 27 and are 11% lower this year.

YCharts.

YCharts.

Source: investopedia.com