Trending Videos

Takeaways

- Shares of Southwest fell after the airline raised its fourth-quarter fuel cost estimate and cut its capacity outlook after 2024.

- The carrier projects fuel prices to be 0 $.10 higher per gallon in the fourth quarter than before. expected.

- Southwest indicated that it had modified its capacity outlook beyond 2024 to support its long-term financial objective.

Shares of Southwest Airlines (LUV) fell more than 4% in intraday trading Wednesday after the airline raised its fuel cost outlook for the current quarter. and scaled back plans to increase capacity after 2024.

The carrier now forecasts fourth-quarter fuel prices will be $3.00 to $3.10 per gallon, up from the previous estimate of $2.90 to $3.00 per gallon, 00 $. It cut its forecast revenue per available seat mile (RASM) to a decline of 9% to 10%, from a decline of 9% to 11%.

Southwest said its growth target Annual seat miles (ASM) capacity beyond 2024 is in the low to mid-single digit percentage range. That's down from its earlier forecast of a single-digit percentage increase. The airline expects low-single-digit percentage travel growth.

Southwest explained that the change in planned capacity was “to support the Company's long-term financial objective of generating an after-tax return on invested capital (“ROIC”) well in excess of the weighted average cost of capital (“WACC”).

In its securities filing, the airline noted that “travel demand and yields continue to be healthy” and that it set a revenue record during the Thanksgiving holiday period. He added that close bookings have been higher than expected in November and December so far. Southwest expects current quarter unit revenue to “improve to the high end of its previous guidance range.” It also said it expects record operating revenues and passengers for the fourth quarter.

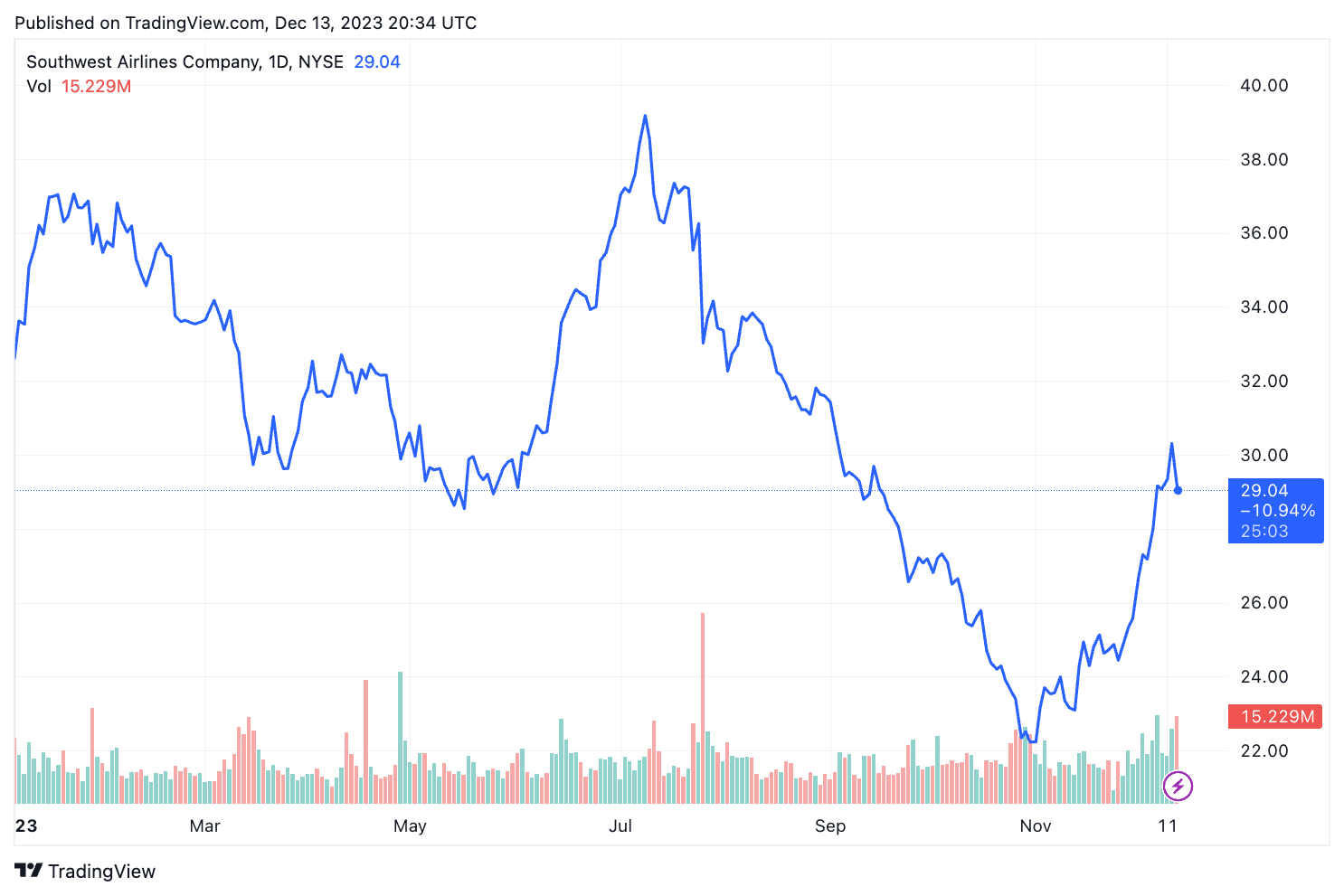

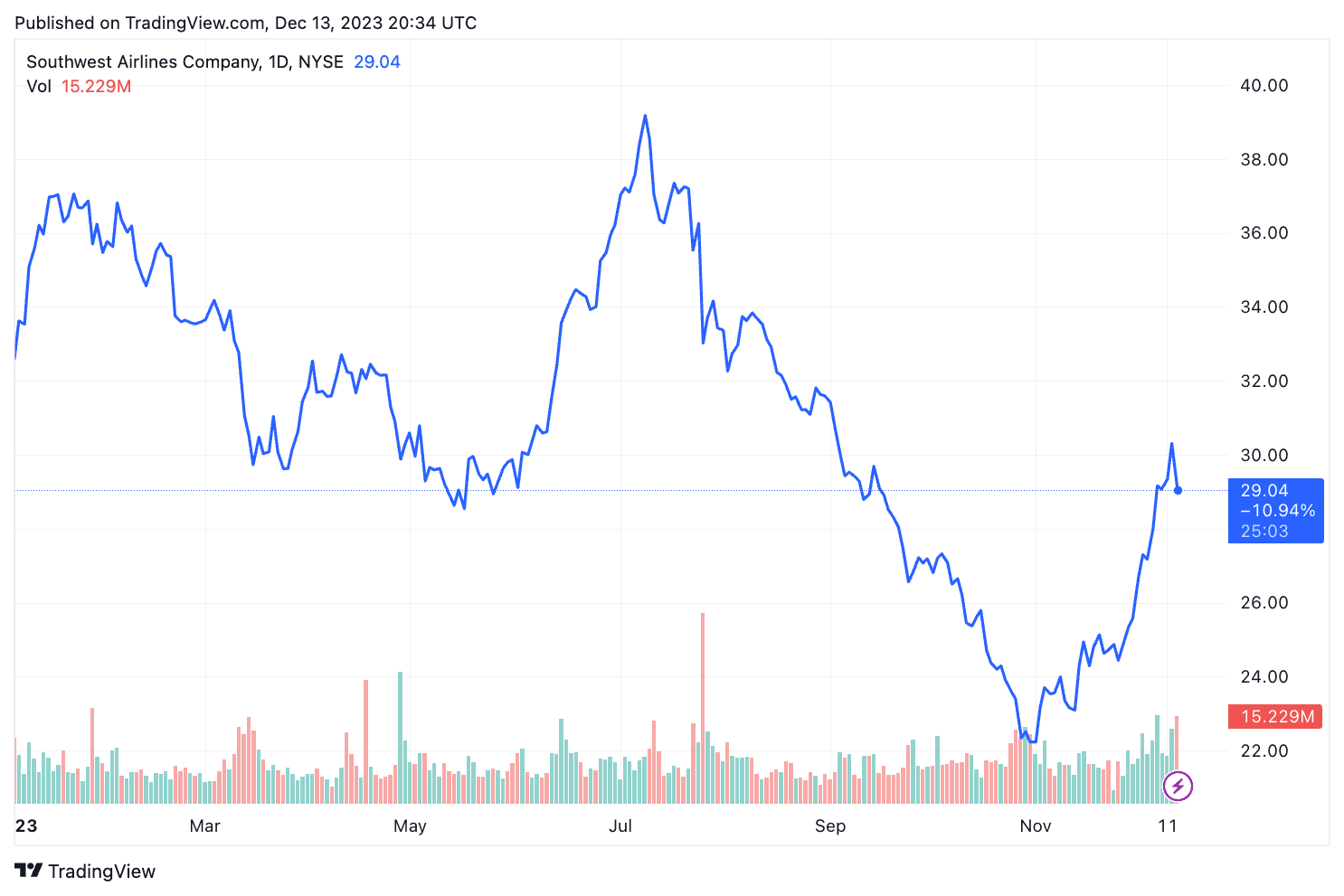

Southwest Airlines shares were down 4.3% to $29.01 per share around 3:30 p.m. ET on Wednesday and have lost about 11% of their value this year.

TradingView

Source: investopedia.com