Solar stocks are holding up well in spite of the pandemic, which has slowed the residential and commercial construction to a crawl, especially in places such as California, which has imposed a virtual contracting stops. The state is now underlying constant of the offer of the sector, with a new law that requires solar energy for all new construction. Solar tariffs against China have also increased sales and installations by local operators, which include Arizona’s First Solar, Inc. (FSLR) and Utah is Living Solar, Inc. (VSLR).

High oil prices have been required in support of the sector of the uptrends in the past few years, so April crude oil the collapse in the negative numbers must have undermined the interest of buyers. This has not happened because of the political pressure has taken control of the band, with more and more asked for by millennial and Gen-Z environmental groups to end the use of fossil fuels. While their long-term success is not assured, the centre-left and centre voters have been lining up at a rapid pace to support this objective.

The funding costs now provide a strong tailwind for growth in the sector, with the collapse of yields for main contractors and small consumers to draw from clean solar energy without breaking the bank. On the other side of the coin, the Federal government is now winding up of health subsidies directly to consumers, with 26% of the maximum tax credit to drop to zero by 2022. However, this could change if a Democrat wins the White House in November.

TradingView.com

First Solar came public at $24.50 in November 2006, and is entered in a momentum rally which has posted a record high of $317 in the second quarter of 2008. He then collapsed with the global markets, cutting through the $100 and depositing $85 in November. As the level of support in 2011 breakdown that pierced the POPE opening print before returning in the all-time low in the lower part of the adolescence in 2012. The increase subsequent failed within 10 points of the new organization of the resistance in 2014, while 2016 breakout attempt also failed to clear the barrier.

The stock sold to a four-year low in April 2017, and has failed in another attempt to escape in the first half of 2018. He then entered a large falling channel carved a series of lower highs and lower lows, culminating in March 2020 three-year low of $28.47. The second quarter rebound has now risen to within 10 points of channel resistance, which should be mounted on healthy volume to trigger a buy signal.

A rising channel has contained the price action since 2012, setting a long-term target to $ 90 if the stock can rise to more small-scale, the channel of the resistance. As you can see from the blue line, the increase of the channel align with the 2011 triple-top breakdown in about three years, lowering the probability that the stock will trade in the three figures in 2021 or 2022. However, the target would still provide gains-of-trade, price levels.

TradingView.com

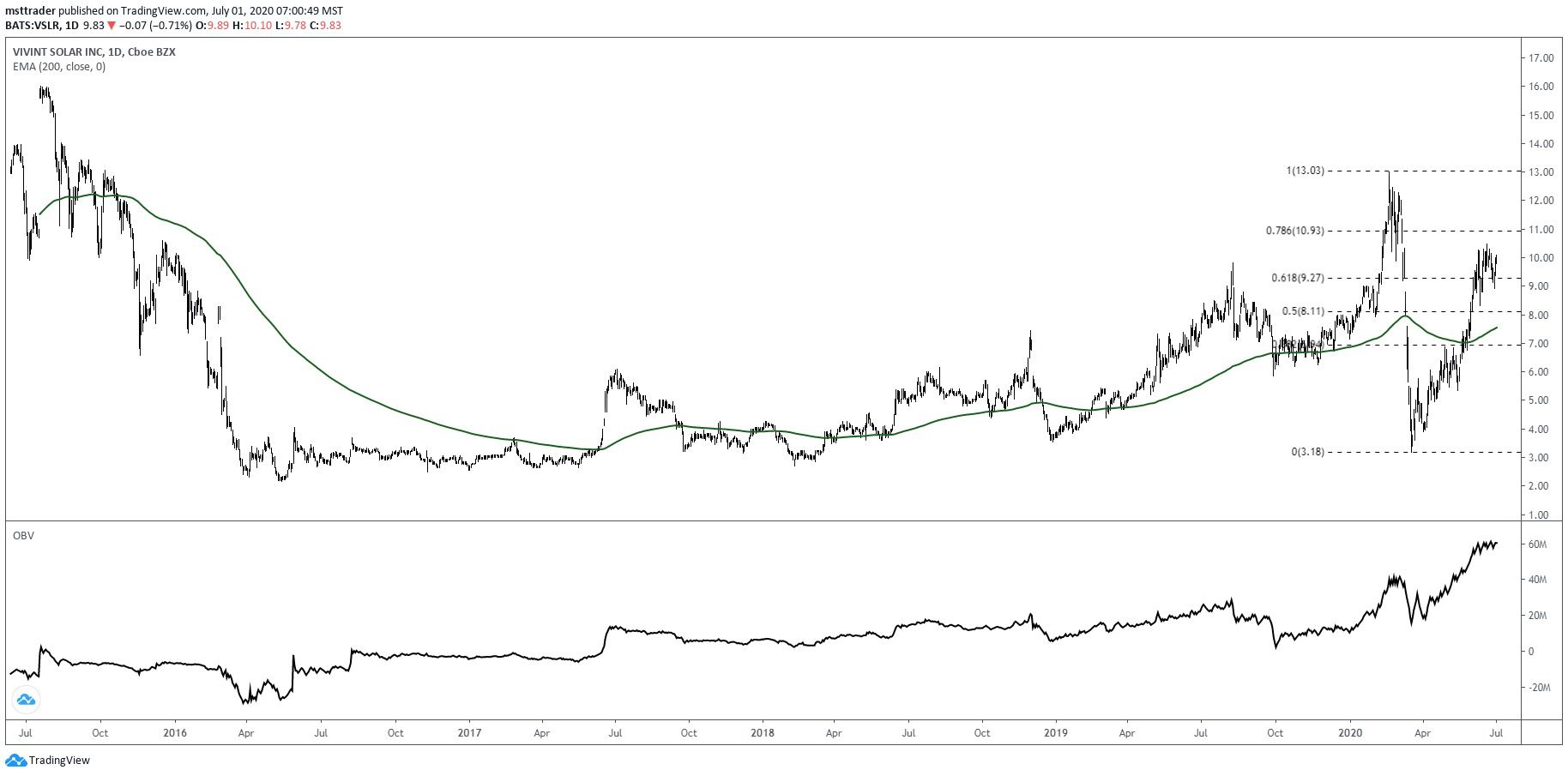

Living Solar is a small-cap installer who is well placed to benefit from California’s construction solar mandate. The stock posted a record high of $18.71 in the first public meeting in October 2014 and drove in a brutal downward trend that has hit a low of $2.16 in 2016. The price action since that time has alternated between the months of apathy, to the vertical of the rally of the waves, and bone-shattering drops.

The 200-day exponential moving average (EMA) reveals an upward trend steadily under the surface, lifting from $3.50 in 2017 to $7.50 this year. The stock displayed a high level in four years in February 2020 and has dropped to a two-year low a few weeks later, while the second-quarter rebound has recovered almost 70% of the losses. The balance volume (OBV), the accumulation-distribution indicator has held up remarkably well through the volatility of the share price and are currently trading at an all-time high, the anticipation that the price will soon test the 2020 high.

The Bottom Line

Solar stocks are back, with macro tailwinds likely to grow in the years to come.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com