Key Points

- SoFi Tech could benefit from a provision in the government debt ceiling agreement restoring student loan repayments.

- The agreement reached between House Speaker Kevin McCarthy and Chairman Joe Biden are calling for an end to the payment freeze by August 29.

- SoFi shares soared following the tentative debt ceiling agreement.

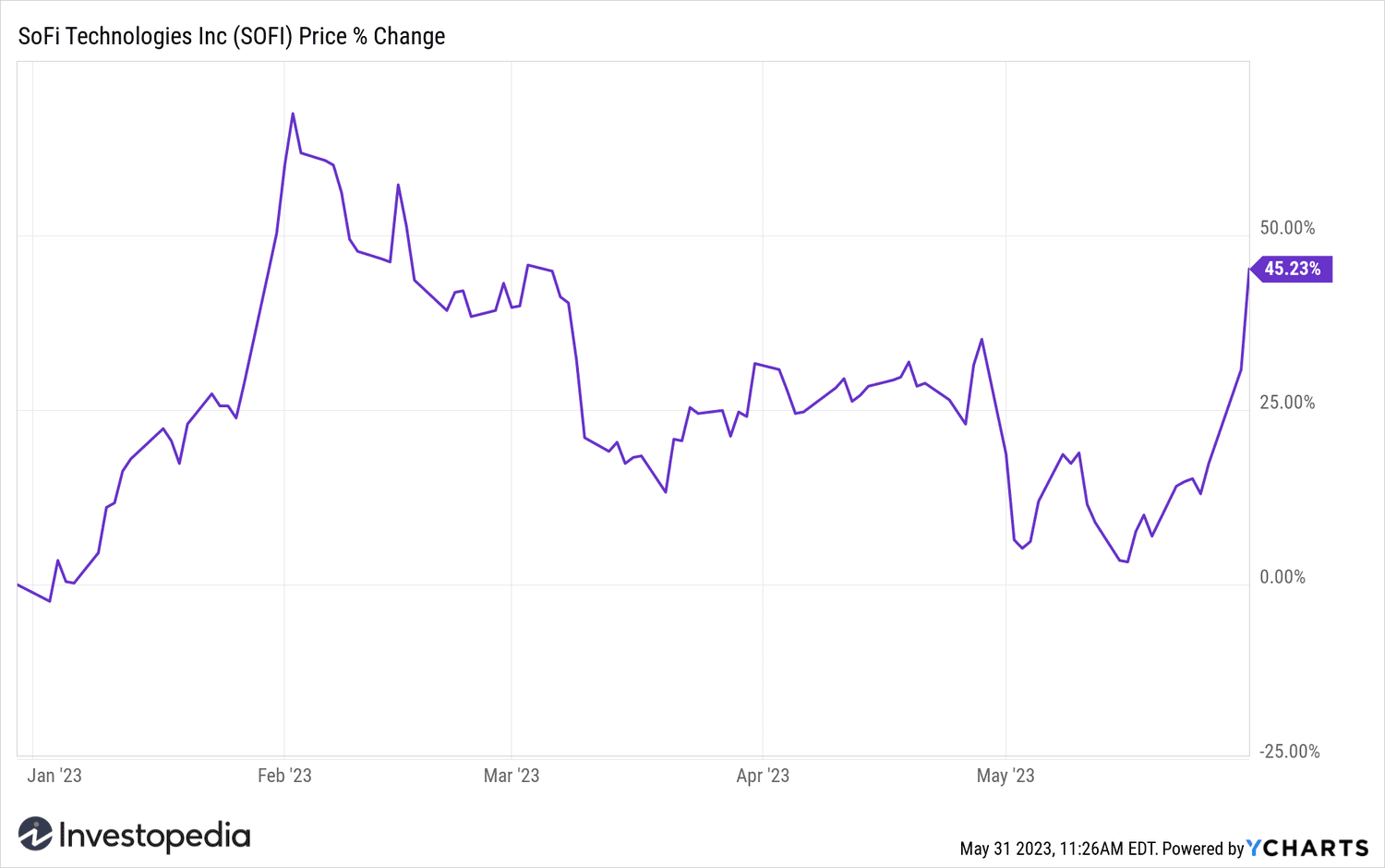

SoFi Technologies (SOFI) shares rose in early trading Wednesday amid optimism that the online financial company could benefit from a provision of the government debt ceiling agreement restoring student loan repayments.

The agreement reached between the president of House Kevin McCarthy and President Joe Biden are calling for an end to the payment freeze by August 29. This freeze was enacted three years ago in response to financial pressures caused by the COVID-19 pandemic, giving more than 40 million borrowers a break. The moratorium has been extended several times since then.

The pause hurt SoFi because it eliminated a key appeal of refinancing private student loans: lower interest rates over longer pay periods. As a result, SoFi's student loan volume fell to $525 million in the first quarter of this year, more than 50% below the pre-pandemic average.

The debt ceiling compromise still has some hurdles to overcome before it becomes law. The House is due to vote on the proposal tonight, and it faces opposition from some Republicans who argue it does not cut federal spending enough. If passed, it will need to be approved by the Senate.

Treasury Secretary Janet Yellen warned that the United States could run out of money to pay its bills next week if the borrowing limit is not increased.

SoFi Technologies shares have increased 11% from 11:30 a.m. ET on Wednesdays.

YCharts

Source: investopedia.com