Takeaways

- Snowflake said an overall stabilizing macroeconomic environment helped the company post better-than-expected profits and sales.

- The data warehousing software maker in the cloud also exceeded estimates in product revenue.

- Snowflake' Sales forecasts for the current quarter were higher than analysts' forecasts. estimates.

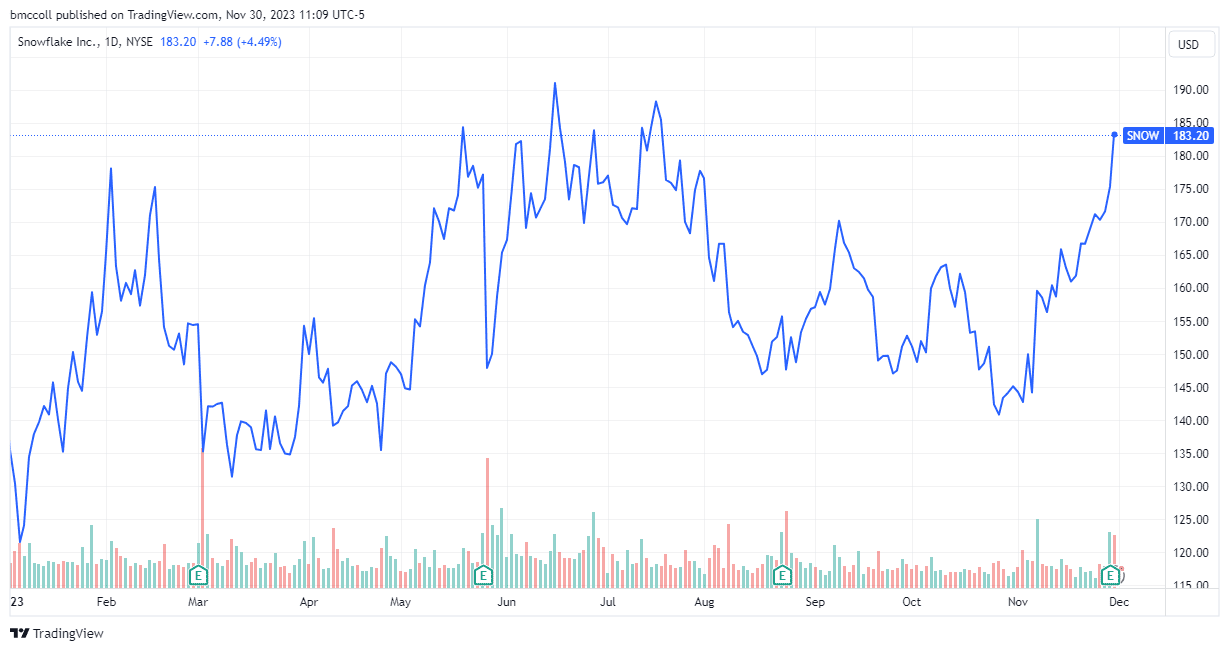

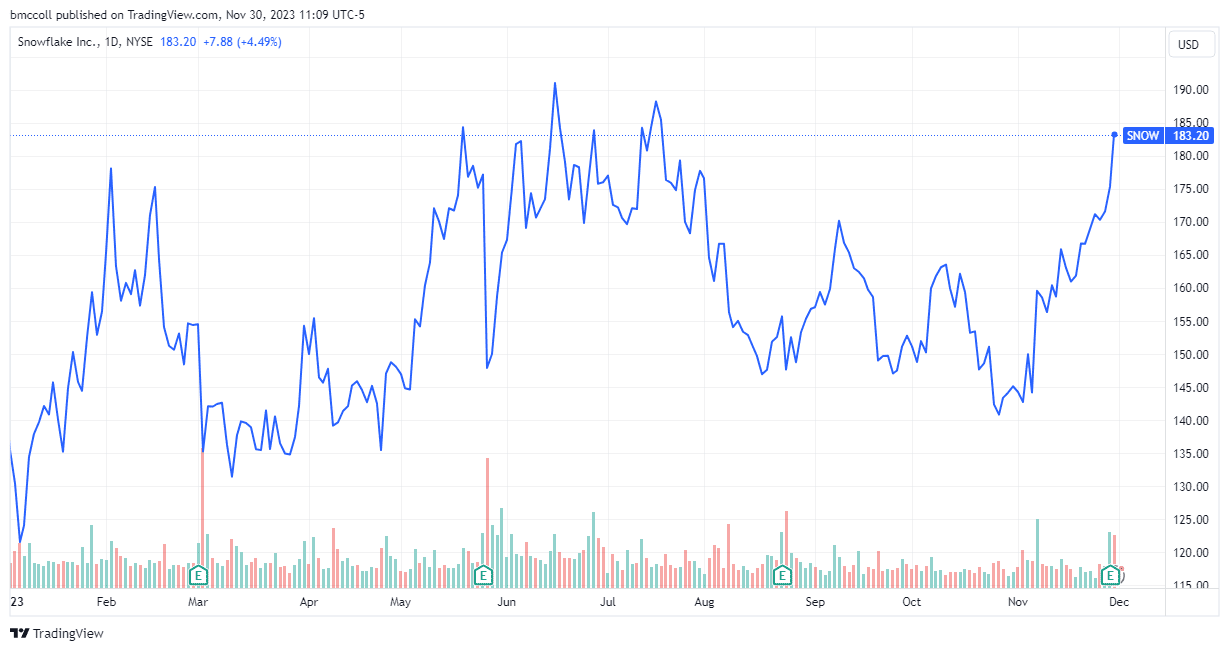

Shares of Snowflake (SNOW) rose nearly 5% in early trading Thursday after reporting better-than-expected quarterly results and guidance as the market for its cloud data warehousing services soars. was improving.

The company reported third-quarter fiscal 2024 earnings of $0.25 per share, up $0.11 from 2022 and well above estimates. Revenue rose 31.8% to $734.2 million and product revenue jumped 34% to $698.5 million. They also exceeded forecasts.

Snowflake indicated that It had 436 customers with product revenue over the last 12 months of over $1 million and a net retention rate of 135%. The company added that its performance obligations for the quarter were $3.7 billion, 23% higher than in 2022.

CEO Frank Slootman said the quarterly performance reflects “strong execution in a broadly stabilizing macro environment.”

Snowflake forecasts product sales in the for the current quarter will be between 716 and 721 million dollars, which is more than expected.

Snowflake shares traded at their highest level since July following the news.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com